Asked to highlight the

“A lot of time, we as treasurers deal with arcane and lofty issues, but we also need to focus on people and quality of life,” Magaziner said in an interview. “What I’m most proud of is advocating strong financial management that has a real impact on the local economy that make people’s lives better.”

Passage of a $250 million school construction bond in last November’s referendum, on which Magaziner and Gov. Gina Raimondo ran point, was a major achievement, Magaziner said. Roughly 77% of voters approved the bond, which will kick-start a $1 billion, 10-year plan to improve school infrastructure.

Consultants have estimated the cost to bring every school into good condition at $2.2 billion.

Under what Magaziner called “a robust financing plan,” Rhode Island intends to borrow $500 million over 10 years, continuing its practice of reimbursing cities and towns from $80 million and $100 million annually for repairs already undertaken. Communities would cover the balance.

Implementing the construction, Magaziner said, will be a priority for 2019.

He also cited the stabilization of the state pension fund.

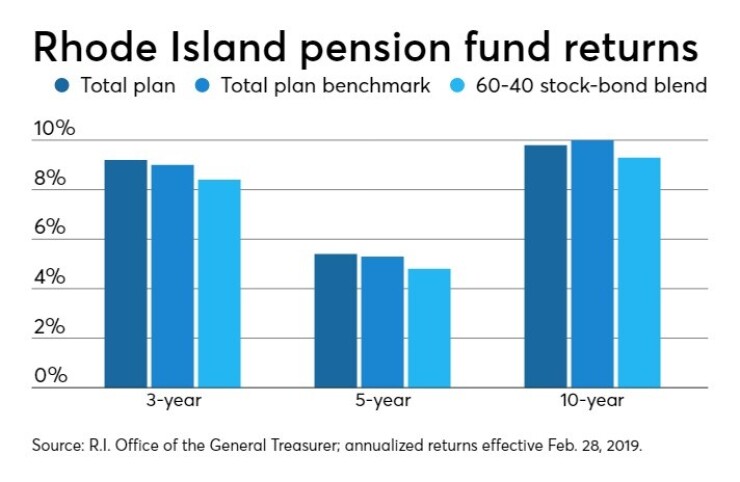

According to Magaziner, the fund, in the three-year period ending Feb. 28, outperformed benchmarks earning an annualized return of 9.21% versus the plan benchmark return of 8.98% and a traditional 60% stock-40% bonds portfolio, which would have earned 8.42%.

Magaziner’s “back to basics” initiative lessened reliance on hedge funds.

Treasury initiatives include college savings, victims' compensation and a new BankLocal program, aimed to help small businesses get financing necessary to expand and hire employees.

Debt-management workshops for municipalities have been highly successful, Magaziner said.

“We’ve had great turnout at all these sessions,” he said of the latter. More than 120 mayors, town administrators, finance directors, debt managers, accounting managers and municipal attorneys have attended.

“Municipal finance officers from smaller communities often don’t have access to resources that a large city has,” he said. “We provide access to rating analysts and experts on national finance issues. If we can help save them money that means more funding for critical projects.”

Moody’s Investors Service rates Rhode Island’s general obligation bonds Aa2. Fitch Ratings and S&P Global Ratings rate them AA, all three with stable outlooks.

In neighboring states, finance officers have undertaken similar community-relations initiatives.

Connecticut’s new treasurer, Shawn Wooden, held a public finance outlook conference last Friday at the minor-league baseball Dunkin’ Donuts Park in downtown Hartford. It included discussions on a variety of fiscal matters.

In Massachusetts, Treasurer Deborah Goldberg has been conducting a women’s empowerment series.

Magaziner has championed a bill, now in the legislature, that would require all public school students to take a personal finance course.

“A strong foundation in school will benefit later in life,” he said. “You’ll see higher credit scores and less debt.”