Municipal bond issuers in the Southwest region sold $42.3 billion of debt in the first half of 2020, according to the data collection firm Refinitiv.

The volume from all Southwest issuers, up 42% from the first half of 2019, was the highest since 2016 with first-quarter growth of 45% and a 39% increase in the second.

The first-half boom came amid the backdrop of the COVID-19 pandemic, which was a gut-punch for the U.S. economy.

“This period will be remembered as one of the most favorable issuing environments the market has ever seen at a time when municipal issuers needed it most,“ said Chad Runnels, head of underwriting for the Southwest region at Raymond James.

“The first half of 2020 was marred by a period of brief but extreme illiquidity and uncertainty, followed by a surge of issuance due to municipal issuers taking advantage of historically low interest rates and increased investor demand in the wake of the pandemic,” Runnels said.

Of The Bond Buyer’s five regions, the Southwest’s volume ranked second behind the Northeast’s $55.4 billion and first in percentage increase.

With rates falling to record lows, taxable refundings of tax-exempt debt easily penciled out, mitigating the loss of tax-exempt advance refunding in 2018. With new money issues down 5%, refunding grew 177%. Refunding and new money combined issues rose 86%.

Taxable issuance more than septupled, compared to a modest 8% gain for tax-exempt volume.

“The increase in taxable debt seems to speak to the absolute low level of rates, such that a refunding, despite being taxable, makes economic sense for many issuers,” said Douglas Benton, senior municipal credit manager and vice president of Cavanal Hill.

From a buyside perspective, “March-April was certainly an unusual market with good buying opportunities in the secondary,” Benton said.

“New deals seemed to stay on the shelf much longer than typical and volumes during that period reflect that,” he said. “However, fund flows for munis turned positive in May-June and continue to remain in that mode. For many, including us, high quality new issues are in high demand and the spread widening from earlier this year seems to have stalled. It appears that issuers are seeing this and taking advantage of this strong market for issuance.”

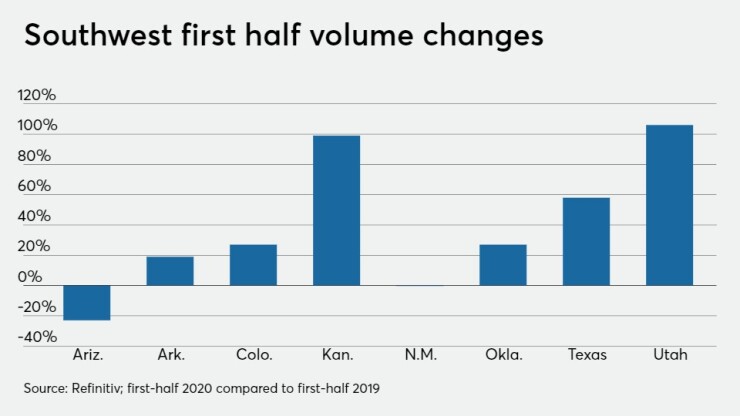

Texas, which accounts for more than half of the eight-state region’s volume saw a 58% increase to $26.68 billion, the highest first-half total since 2016.

Drew Masterson, founder of Texas’ fifth-ranked financial advisory firm, Masterson Advisors in Houston, said the first half represented growth over the same period last year, with an even stronger second half expected.

“For various reasons, the second half is our busy season,” Masterson said. “While we have slightly more transactions in the pipeline for the second half than we closed in the first half, the size is almost double.”

“We are expecting periods of market volatility through the fall despite the stability that we have seen this summer,” he said. “Some of our transactions are focusing on getting done before the election if possible.”

Masterson said the abrupt illiquidity in March was reminiscent of other downturns.

“We did have quite a few refundings postponed in the early stages of the pandemic,” he said. “Interestingly, we saw competitive MUD [Municipal Utility District] sales in Texas occur every week of March. Deals were postponed because interest rates were unattractive, not because they couldn’t be sold, in our experience. We were fortunate that we were issuing general obligation bonds at that time and we weren’t doing any revenue bonds in the pandemic affected industries.”

Masterson’s former employer Hilltop Securities retained its long-held place as top financial advisor in the state, credited by Refinitiv with $7.16 billion of deals, followed by Estrada Hinojosa & Co., with $6.18 billion and Specialized Public Finance with $1.68 billion. PFM Financial Advisors ranked fourth in Texas with $1.47 billion of deals.

Hilltop and Estrada Hinojosa also topped the regional FA table, followed by Stifel Nicolaus, credited with $2.48 billion of deals, RBC Capital Markets with $2.14 billion and PFM Financial Advisors with $1.97 billion.

Citi, which has led senior managers in the region for three years running, retained that position, credited with $4.43 billion of deals, followed by BofA Securities with $4.12 billion. Piper Sandler ranked third with $3.46 billion, followed by JP Morgan with $3.22 billion. RBC Capital rounded out the top five with $2.47 billion.

McCall Parkhurst & Horton maintained its perennial position atop bond counsel firms, credited with $11.24 billion of volume. Second-ranked Norton Rose Fulbright with $4.5 billion was followed by Bracewell with $2.8 billion, Gilmore Bell with $2.74 billion, and Orrick Herrington & Sutcliffe with $2.13 billion.

The Grand Parkway Transportation Corp.’s $2.3 billion refunding of debt for the Houston area’s outer beltway on Feb. 11, managed by BofA Securities and Goldman Sachs, dwarfed all other Southwest deals in the first half, and was the second-largest in the country, trailing only a $5.35 billion Buckeye Tobacco deal.

The Texas Transportation Commission’s $794 million refunding through Citigroup and Ramirez on June 17 ranked second in the Southwest.

Dallas’ $646 million through JP Morgan on June 10 was the third-largest deal, followed closely by Houston’s $611 million through Wells Fargo the next day.

The Arizona Transportation Board rounded out the top five with $510 million through JP Morgan on Jan. 9. All of the top five were refunding deals.

Colorado ranked second in the region behind Texas as a source of municipal bonds with $3.99 billion of deals, a 27% increase from the first half of 2019. The state government was Colorado’s largest issuer with $500 million, and the top senior manager was D.A. Davidson with $628 million. Stifel Nicolaus led financial advisors with $1 billion, and Kutak Rock led bond counsel with $1.4 billion.

Arizona’s $3.05 billion, a 23% drop year over year, ranked third in the eight-state region. The Arizona Transportation Board at $510 million was tops among issuers while Stifel Nicolaus led senior managers with $822 million. RBC Capital Markets was to financial advisor with $1 billion, and Squire Patton Boggs led bond counsel with $1.3 billion.

Utah volume more than doubled to $2.2 billion, led by $896 million sold by the state government. Wells Fargo was top senior manager with $665 million, and Zions Bank led financial advisors with $1.4 billion. Gilmore & Bell was top bond counsel with $1.65 billion.

Oklahoma’s $1.94 billion represented a 27% rise, lifting the Sooner State to fifth place. The Oklahoma Agricultural and Mechanical College was the largest issuer with $272 million of debt. Citi was the state’s top senior manager with $510 million. Stephen H. McDonald led financial advisors with $402 million of deals, and the Floyd Law Firm ranked first among bond counsel with $686 million.

Kansas saw a 98% increase to $1.89 billion, with the Kansas Development Finance Authority the largest issuer at $175 million. Piper Sandler led senior managers with $221 million, while Stifel Nicolaus’s $209 million topped financial advisors. Gilmore & Bell outdistanced all other bond counsel with $902 million.

Arkansas managed a 19% increase to volume of $1.4 billion, with the Arkansas Development Finance Authority’s $200 million deal as the largest issue. Stephens Inc. led senior managers with $279 million. Crews & Associates was number one among two active financial advisors with $546 million, and Friday Eldridge ranked first among bond counsel with $1.17 billion.

New Mexico registered the lowest volume among the eight states at $1.1 billion, flat compared to the first half of 2019. Albuquerque was the state’s largest issuer with $258 million, and Mesirow Financial was top senior manager with $135 million. RBC Capital Markets dominated financial advisors with $533 million, while Modrall Sperling Roehl ruled bond counsel ranks with $518 million.