The municipal market will be staffed by skeleton crews as the calendar has no negotiated deals and only small competitives, which don't even total $3 million — and another long holiday weekend right around the corner.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was stronger in early trading on Tuesday.

The 10-year muni benchmark yield dipped to 2.348% from 2.373% Friday’s final read, according to

The MBIS benchmark index, which is comprised of investment-grade municipal securities, is updated hourly on the

Top-rated municipal bonds were stronger on Tuesday. The yield on the 10-year benchmark muni general obligation was as many as two basis points lower to from 2.10% on Friday, while the 30-year GO decreased by as many as two basis points from 2.68%, according to a read of MMD’s triple-A scale.

U.S. Treasuries were mostly stronger on Tuesday morning. The yield on the two-year Treasury nudged up to 1.91% from 1.89%, the 10-year Treasury yield decreased to 2.48% from 2.49% and the yield on the 30-year Treasury fell to 2.82% from 2.84%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 84.4% compared with 85.6% on Thursday, while the 30-year muni-to-Treasury ratio stood at 94.4% versus 95.3%, according to MMD.

Prior week's actively traded issues

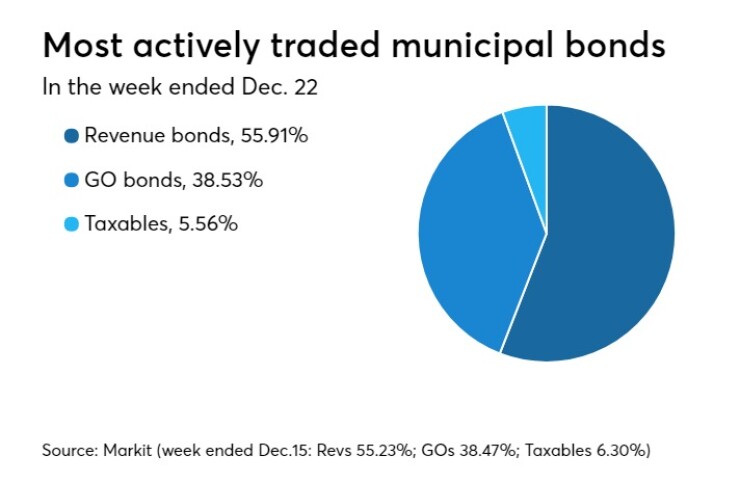

Revenue bonds comprised 55.91% of new issuance in the week ended Dec. 22, up from 55.23% in the previous week, according to

Some of the most actively traded bonds by type were from Puerto Rico, New Jersey and Texas issuers.

In the GO bond sector, the commonwealth of Puerto Rico 8s of 2035 were traded 54 times. In the revenue bond sector, the New Jersey Turnpike Authority 4s of 2043 were traded 87 times. And in the taxable bond sector, the Houston 3.961s of 2047 were traded 30 times.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 25,413 trades on Friday on volume of $11.285 billion.

Primary market

The market will see no large deals this week, with action expected to resume in 2018.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.