Senior living’s COVID-19 struggles persist two years after the pandemic began to wreak havoc on a sector poorly positioned to fiscally manage such a crisis, Moody’s Investors Service says in a report.

Moody’s counted a total of 675 disclosures reporting a principal/interest payment delinquency and non-payment related defaults between April 2020 and March 2022 of which the senior-living sector accounted for 24%. All were unrated transactions. Puerto Rico-related defaults and local government special districts led in single categories at 27% and 26%, respectively.

While Puerto Rico and local taxing districts exceeded senior-living facilities, their fiscal pain had taken hold before the pandemic. Puerto Rico’s bankruptcy proceedings began in 2017 and most of the local government special districts that disclosed delinquencies over the two-year period began defaulting before the pandemic.

A total of 45 payment delinquencies were disclosed and Moody’s identified at least 29 senior-living financings had missed bond payments for the first time during the pandemic.

“With nearly 50 senior-

The 45 financings had a combined total of $2.48 billion of outstanding debt with Moody’s viewing defaults on financings totaling $1.46 million as directly linked to the pandemic’s impact and the stress on financings totaling another $365.1 million made worse by the pandemic and perhaps hastening a default.

“This is both because of the vulnerability that senior living has by nature to a health emergency that disproportionately affects the elderly, and because the inherent financial weakness of many borrowers left them with little margin to survive a disaster of any kind,” Moody’s said in the report published Monday.

The wounds lingered in the first quarter during which Moody’s examined 83 material credit events — which includes a broader range of fiscal difficulties beyond defaults — based on its own data and data drawn from the Municipal Securities Rulemaking Board’s EMMA website. The senior-living sector accounted for 35%. Puerto Rico-based credits and local government special districts followed with each accounting for 22% of notices.

Moody’s defines material credit events as

The senior sector stands out, since the ratings of most others sectors showed resilience during the pandemic, Moody's said.

State-imposed lockdowns began in March and that meant many facilities were unable to provide tours to prospective residents or allow new residents to move in. At the same time, seniors who were especially vulnerable to the worst effects of a COVID infection drove up mortality rates. Facilities grappled with additional costs to disinfect surfaces and isolate residents that contributed to revenue struggles.

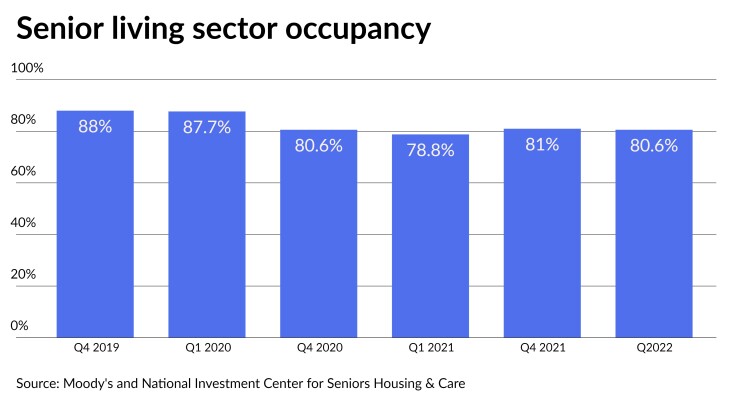

“Senior housing occupancy began to plunge rapidly in the second quarter of 2020 and ultimately sank to a record low a year later” of 78.7% for the second quarter of 2021, Moody’s found. That was down from a peak of 88% in the second half of 2019. Occupancy is rebounding and was at 80.6% for the last quarter.

About half of the financings examined by Moody’s for the report had supplied a feasibility study or financial forecast with breakeven rates of occupancy needed to cover debt service. The median breakeven point was 83%, so many continue to fall short.

Not all defaults looked the same. Of the 45 financings that reported delinquencies during the pandemic, Moody’s put 16 with a total of $1.46 billion of outstanding debt in the category of those experiencing new distress that analysts viewed as being directly related to the pandemic.

Another nine financings totaling $365.1 million of outstanding debt fell into the category of facilities that were experiencing distress with the pandemic possibly hastening an eventual default.

“We made this determination primarily depending on whether the trustee had been drawing on the debt service reserve fund, whether the event that catalyzed the default occurred prior to 2020, or whether debt service coverage had been well below 1.0x before the default began,” Moody’s said.

Another 16 fell into the category of those with pre-pandemic defaults with $590.9 million of outstanding debt. “This underscores that senior living is a risky sector to begin with,” Moody’s said.

Another four senior living projects with a total of $68.2 million of outstanding debt also disclosed missed payments for the first time during the pandemic, but public disclosure was inadequate to determine whether the pandemic was the cause, Moody’s said.