Despite reports that a vaccine is close, the coronavirus pandemic overshadowed the news, with consumer sentiment falling and Federal Reserve Bank of St. Louis President James Bullard reiterating what the Fed has been saying: health issues will determine how the economy rebounds.

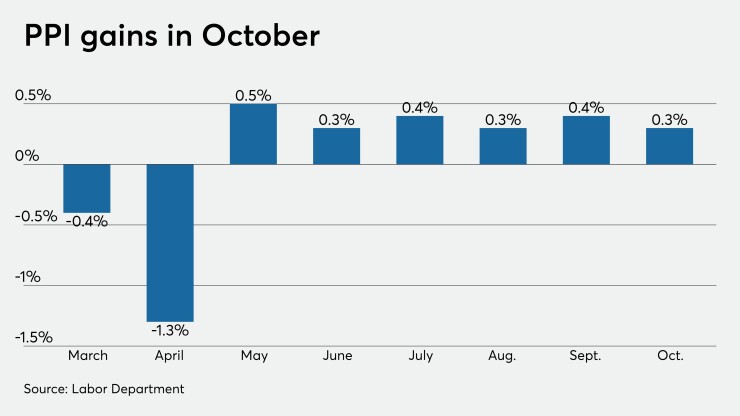

The producer price index rose 0.3% in October, after a 0.4% rise in September, while the core PPI, which excludes food and energy, rose just 0.1% in the month, after a 0.4% a month earlier, the Labor Department reported Friday.

Economists polled by IFR Markets expected both indexes to rise 0.2%.

Year-over-year, PPI was up 0.5% compared to 0.4% a month earlier, while the core gained 1.1%, down from 1.2% in September. Economists expected PPI to rise 0.4% from last October and the core to gain 1.2% year-over-year.

“Producer prices decelerated in October, as the economy suddenly became frail due to the recent surge of the COVID pandemic,” said Ed Moya, senior market analyst at

This follows Thursday’s consumer price index report which showed a flat read, compared with projections for a 0.2% rise. Inflation has failed to meet the Federal Reserve’s 2% target consistently in a decade, and many economists see the pandemic as disinflationary.

Also released Friday, the University of Michigan’s preliminary consumer sentiment index fell to 77.0 from the final October read of 81.8.

Economists had expected a slight bump to 82.0.

The current conditions index dipped to 85.8 in November from the final October 85.9 and the expectations index dropped to 71.3 from 79.2.

“The outcome of the presidential election as well as the resurgence in COVID infections and deaths were responsible for the early November decline,” the survey’s director Richard Curtin said in the report. “Interviews conducted following the election recorded a substantial negative shift in the expectations index among Republicans, but recorded no gain among Democrats.”

While the news on vaccines was positive, questions remain about how soon they will be deliverable and how many doses will be available. And the number of positive cases is increasing just about everywhere in the U.S.

“The psyche of the public is taking a protective turn as U.S. residents start to stay closer to home without a government mandate,” according to Marty Mitchell, author of the Mitchell Market Report. “This dynamic has combined with the elevated levels of restrictions that are being imposed to raise concerns that the economic recovery will be soon be heading into the infirmary too.”

Separately, St. Louis Fed's James Bullard told the Economic Club of Memphis via webinar on Friday businesses have quickly adjusted to the COVID-19 pandemic as “U.S. monetary and fiscal policies have been exceptionally effective and were designed for a larger shock than the one that has occurred.”

Despite the better-than-expected economic rebound, “downside risk remains substantial, and continued execution of a granular, risk-based health policy will be critical in the months ahead.”

Governments have yet to significantly ramp up restrictions on businesses, which he said need to keep patrons and employees safe to prevent a “major outbreak” that would have drastic implications for the businesses.