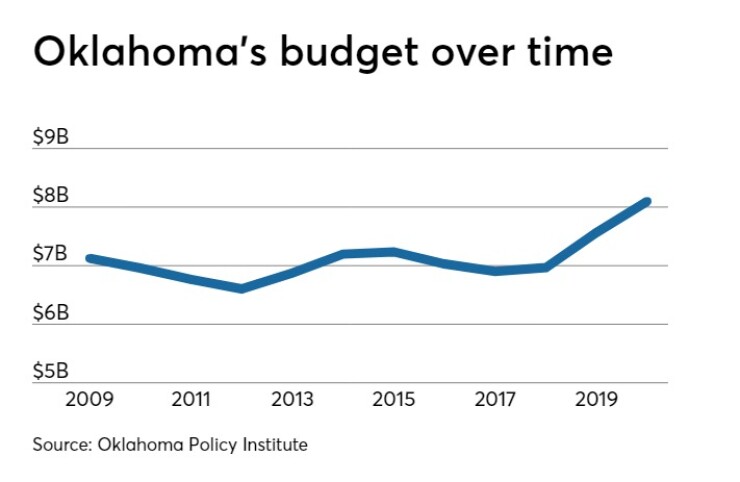

The $8.1 billion budget Oklahoma Gov. Kevin Stitt signed Friday is the largest in state history but treads a cautious path amid rising revenues while seeking to protect the oil-dependent state from future downturns, state officials said.

“Holding firm to my commitment of no new taxes, we will put away $200 million more in savings while also increasing the state’s investment in core services by more than 5%,” the first-year governor said.. “For the first time in state history, we will increase Oklahoma’s savings account, in order to protect core services in the future, without the law forcing it.”

Spending will increase about 7% under the plan that includes raises for teachers and state employees and builds on the common education funding increase the Legislature approved last year. With inclusion of $200 million set aside for the state’s depleted rainy day fund, the budget comes to $8.3 billion.

State employees get their second annual raise in a row at a cost of $37.7 million. Education gets $157.7 million in new appropriations, including $74 million in additional classroom funding and a teacher pay raise that begins on Sept. 1. Teacher raises average $1,200.

“We can make investments in core services, while still showing fiscal restraint to prepare and save for tougher economic times,” said state Senate President Pro Tem Greg Treat, R-Oklahoma City.

Rebuilding the state’s rainy day fund was a top priority for Stitt, who praised lawmakers for focusing on priority issues. The $200 million addition will lift the fund to $1 billion. Lawmakers depleted the fund to patch budget holes that appeared after oil prices fell from more than $100 per barrel in mid-2014 to a low of $40 a year later.

“For the first time in state history, we will give Oklahoma teachers a pay raise for a second year in a row,” he said. “For the first time in state history, we will fully fund our roads and bridges, and we will also make the largest deposit into the Quick Action closing fund, helping Oklahoma compete for new jobs.”

Minority Democrats sought more for public education and expressed disappointment that lawmakers had not addressed expansion of Medicaid to the working poor.

House Speaker Charles McCall, R-Atoka, said Medicaid expansion would be considered in next year’s session.

“This budget agreement moves Oklahoma forward by increasing funding for education, rural infrastructure, public safety and healthcare,” McCall said in a statement. “The Legislature has now increased the common education budget by more than 26% during the last two years. We are also prioritizing funding for county roads and bridges, nursing homes, concurrent enrollment programs for high school juniors and seniors and pay increases for corrections officers in our prisons and all other state employees.”

Amid funding shortages in previous years, some Oklahoma school districts cut back classes to four days per week. Under new legislation that will be forbidden.

At Stitt’s insistence, the Senate reconsidered and passed House Bill 1269, known as the “retroactivity bill” that will allow those serving time for crimes that no longer require prison sentences to seek relief through the Oklahoma Pardon and Parole Board.

HB 1269 follows passage of State Question 780 by voters in November 2016. The ballot measure downgraded several nonviolent offenses from felonies to misdemeanors and reduced the associated sentences. In the state with the highest incarceration rate in the nation, Stitt is following his predecessor Mary Fallin’s initiative to ease the burden of high jail and prison populations.

“We will reform district attorneys’ funding model so they are not reliant on high fines, fees and court costs that have created a debtor’s prison,” Stitt said.

“By any measure, Gov. Stitt can call this a successful session for his priorities,” former House Speaker Steve Lewis wrote in a commentary for the Oklahoma Policy Institute.

"The governor’s most notable budget victory was ‘saving’ $200 million that was available for appropriation,” Lewis said. “No doubt, knowledgeable legislators who have been starving state government for the past several years would have liked to appropriate that money to meet pent up needs.”

With a population of 3.94 million, Oklahoma has $2.2 billion of long-term obligations and carries ratings of AA from S&P Global Ratings and Aa2 from Moody’s Investors Service.

In a sign of continuing economic expansion, State Treasurer Randy McDaniel reported record state receipts of $1.6 billion in April, a nearly 13% increase over the same month last year.

“Reports on total state revenue collections in April and over the past 12 months show growth of more than 12%,” McDaniel said. “Monthly receipts have exceeded collections from the same month of the prior year for 25 consecutive months and cumulative 12-month receipts have now topped more than $13.4 billion.”

However, McDaniel cautioned that while lagging economic indicators such as gross receipts and unemployment reports show expansion has occurred, a few leading indicators point to a potential slowdown in economic activity.

“Oklahoma gross receipts are at record highs and state unemployment remains at historically low levels, all very positive news,” McDaniel said. “Nevertheless, some leading economic indicators bear a close watch.”

McDaniel cited the Oklahoma Business Conditions Index, compiled by the Creighton Economic Forecasting Group, and the Leading Index for Oklahoma, from the Federal Reserve Bank of Philadelphia. Both indexes are respected predictors of future economic activity.

The Creighton report for April dipped below growth neutral for the first time in 21 months, falling to 48.6 from 53.9 in March. Numbers below 50 show anticipated economic contraction and include measures of new orders, production and sales, delivery lead time, inventories and employment.

The Federal Reserve’s Oklahoma index for February dropped into negative territory for the first time in more than three years, but did rebound slightly in the latest report from March 2019. The index considers state-level housing permits, initial unemployment insurance claims, and delivery times from the Institute for Supply Management manufacturing survey, among other factors.

In addition, McDaniel reported that April gross receipts collections on oil and gas production, at $79.8 million, are the lowest monthly total since taxes on production were raised last year. The previous low was $96.2 million in March. Employment in the oil field has been relatively unchanged for about a year.

Revenue generated by increased tax rates approved in House Bill 1010 during special session last year added $47.2 million to monthly collections, 3% of all April gross receipts.

The largest amount, $26.3 million, came from the increase in the incentive tax rate on oil and natural gas gross production. Higher tax rates on gasoline and diesel fuel generated $7.5 million, and the $1 per pack hike in cigarette taxes added $13.3 million to the April total.