Facing a sharp downturn in revenues due to the COVID-19 pandemic, the Oklahoma Turnpike Authority will create some fiscal breathing room with $371 million of refunding bonds.

Upfront savings of $55.2 million will come in 2021, with $6.6 million available in 2022, according to the authority’s online presentation to investors.

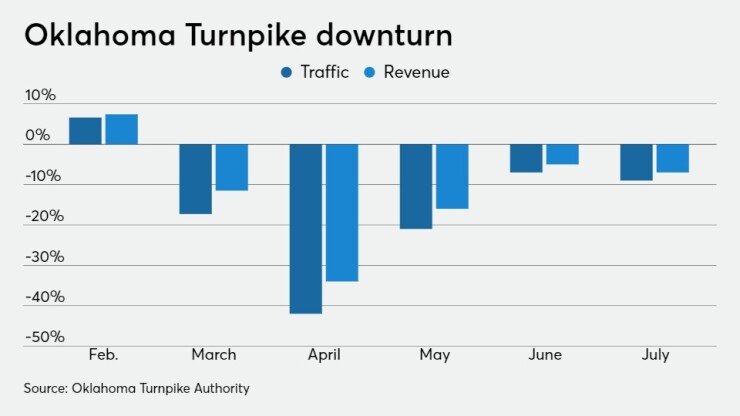

“Like many other toll roads across the nation, the authority’s traffic volumes were adversely affected in 2020 by the coronavirus pandemic,” officials said. “While the authority’s assets have demonstrated greater resiliency than comparable toll roads, the authority has structured this transaction to reduce its debt service burden in fiscal years 2020 and 2021 to provide additional flexibility given future uncertainty regarding COVID-19 impacted traffic volumes.”

The bonds are pricing in two series on Wednesday through negotiation with JP Morgan, led by Marshall Kittain, head of investor marketing, and executive directors Antti Suhonen and Rhett Bredy of JP Morgan Banking.

Hilltop Securities is financial advisor.

Series A will be about $191 million of tax-exempt toll revenue bonds reaching final maturity in 2033.

Series B will be about $180 million of taxable bonds with the same maturities. Both series are second senior lien debt refunding 2011 and 2017 bonds.

The new bonds are rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

“Although some negative effects are expected, the authority is well positioned to recover from coronavirus disruptions,” Moody’s analyst Julie Meyer wrote in a Sept. 25 report. “We expect the anticipated savings from the refunding will offset revenue declines driven by the coronavirus, and that revenues will continue recovering at a quicker pace compared with other Moody's rated toll road systems.”

With this issue, OTA will have about $1.75 billion of second senior revenue bonds outstanding, per Moody’s.

The authority operates the nation’s longest system of toll roads, with bonds secured by the net revenues of the toll road system and a share of state’s motor fuel tax.

The $46.9 million Turnpike Trust Fund can only be used to make debt service on outstanding bonds.

The Oklahoma Turnpike system includes 10 tollways across the state, intersecting with U.S. Interstates 35, 40, and 44.

“The lack of alternatives in Oklahoma for long-distance travel and essentiality of the system contribute to an established and stable traffic demand base,” according to Fitch. “The average toll rates of $0.07 per mile for passenger cars an $0.19 per mile for commercial vehicles remain competitive compared to Fitch's rated portfolio and demand has been relatively inelastic to past toll increases.”

At the end of the second quarter of 2020, year-to-date revenue fund operating expenses were 19.8% under the 2020 operating budget, according to OTA's report to bondholders. Senior and total debt service ratios remain in compliance with the minimum trust requirements, per the report. Total debt service coverage exceeds minimum trust requirements on a rolling twelve-month basis by approximately 27%.

The authority last month approved a $45 million contract to add more lanes to the Turner Turnpike in the Tulsa area, with work expected to start in January with completion expected in 2022.

More than a dozen capital plan projects are underway, several of which are part of the authority’s program to improve safety and pavement conditions in rural areas.