New York City and Los Angeles issuers came to market on Wednesday as municipal bond buyers looked ahead to next week’s mega-billion deal from California and a big sale from the Big Apple.

The Golden State has a $2.3 billion general obligation bond deal set for next week, which consists of $2.05 billion of various purpose refunding GOs and $250 million of various purpose new-money GOs.

Citigroup and BofA Securities are lead managers on the deal, with PRAG as the financial advisor and Orrick as bond counsel.

Also on tap is an almost $915 million GO offering from NYC. Siebert Cisneros Shank is set to price the bonds, which consist of $824.07 million of GOs and $90.175 million of refunding GOs.

BlackRock: Changing positions

After rates rallied lower at the end of 2018, BlackRock moved to favor a neutral duration stance for its Strategic Municipal Opportunities Fund to position for upcoming interest-rate movements, according to Peter Hayes, head of the firm’s municipal bonds group.

“We tactically use hedges to adjust overall duration and capitalize on interest-rate volatility,” Hayes said in a report released Tuesday. “We continue to maintain a barbell yield curve strategy with more concentrated exposures in maturities of three- to eight- and 20-years-plus. The fund’s underweight in the 10- to 15-year space was the biggest detractor from performance in January.”

Hayes, whose group oversees about $135 billion in municipal securities, said it has been reducing risk while increasing liquidity.

“We increased exposure to higher-quality credits rated AAA while decreasing exposure to A, AA and BBB,” he wrote. “As of month end, approximately 15% of the fund’s net assets were high-yield municipal bonds, which primarily include tobacco, corporate-backed, health care and education bonds.”

Transportation and healthcare credits aided fund performance in January, BlackRock said, while tobacco and housing bonds were negatives last month. And looking ahead, the firm sees reasons to be optimistic.

“The technical backdrop appears poised to further improve. We believe forward supply forecasts remain manageable, while recent strong performance should continue to support firm retail demand,” Hayes wrote.

Primary market

Municipal bond buyers were rewarded with much-awaited supply on Wednesday as deals from New York City and Intel hit the market.

In the competitive arena on Wednesday, the New York City Municipal Water Finance Authority (Aa1/AA+/AA+) sold $388.11 million of Fiscal 2019 Series EE water and sewer system second general resolution revenue bonds in two offerings.

BofA Securities won the $275 million of Subseries EE-2 bonds while Morgan Stanley won the $113.11 million of Subseries EE-1 bonds.

The financial advisors are Lamont Financial Services and Drexel Hamilton. The bond counsel are Nixon Peabody and the Hardwick Law Firm.

In the negotiated market, Ramirez & Co. priced the Los Angeles Department of Airports (Aa3/AA-/AA-) $438 million of revenue bonds. The issue consists of Series 2019A private activity subordinate revenue bonds subject to the alternative minimum tax, Series 2019B non-AMT governmental subordinate revenue bonds and Series 2019C private activity subordinate refunding non-AMT revenue bonds.

BofA Securities priced the Oregon Business Development Commission’s (A1/A+/NR) $138.165 million of AMT Series 250 economic development revenue bonds for Intel Corp.

RBC Capital Markets priced the Hayward Unified School District of Alameda County, Calif.’s (NR/AA/A+ Underlying A+/A+) $231.35 million of general obligation and GO green bonds, insured by Build America Mutual Assurance.

Bond sales

California

Oregon

New York

Bond Buyer 30-day visible supply at $6.66B

The Bond Buyer's 30-day visible supply calendar decreased $387.2 million to $6.66 billion for Wednesday. The total is composed of $2.93 billion of competitive sales and $3.73 billion of negotiated deals.

Secondary market

Municipal bonds were stronger Wednesday, according to the MBIS benchmark scale, with benchmark muni yields falling as much as two basis points in the one- to 30-year maturities. High-grade munis were also stronger with muni yields falling as much as four basis points across the curve.

Investment-grade municipals were mixed on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni remaining unchanged while the 30-year muni yield rose one basis point.

Treasury bonds were weaker as stock prices traded lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 77.3x% while the 30-year muni-to-Treasury ratio stood at 96.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasuries with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasuries; if it is below 100%, munis are yielding less.

COFINA bonds trading

Some of the restructured Puerto Rico Sales Tax Financing Corp. (COFINA) bonds were among some of the most actively traded bonds on Wednesday.

The COFINA restructured Series A1 5% bonds of 7/1/58 (principal amount of issuance of $3.479 billion), were trading on Wednesday at a high price of 97.176 cents on the dollar and a low price of 93.20 cents, according to the Municipal Securities Rulemaking Board’s EMMA website. This compares with a high price of 97.659 cents and a low price of 90.676 cents on Tuesday. Trading volume totaled $19.624 million in 187 trades compared to $58.125 million in 209 trades on Tuesday.

The COFINA restructured Series Capital Appreciation zeroes of 7/1/46 (principal amount of issuance of $1.095 billion), were trading at a high of 20.19 cents and a low of 17.454 cents, compared to 19.835 and 17.10 cents on Tuesday. Trading volume totaled $25.789 million in 188 trades, compared with $26.391 million in 179 trades on Tuesday.

The COFINA restructured Series Capital Appreciation zeros of 7/1/51 (principal amount of issuance of $631.551 million), were trading at a high 14.625 and a low of 12.239, compared to 14.779 and 13.11 on Tuesday. Volume totaled $34.094 million in 155 trades versus $31.770 million in 155 trades on Tuesday.

Previous session's activity

The MSRB reported 41,237 trades on Tuesday on $12.61 billion of volume.

California, New York and Texas were most traded, with the Golden State taking 12.57% of the market, the Empire State taking 12.455% and the Lone Star State taking 10.484%.

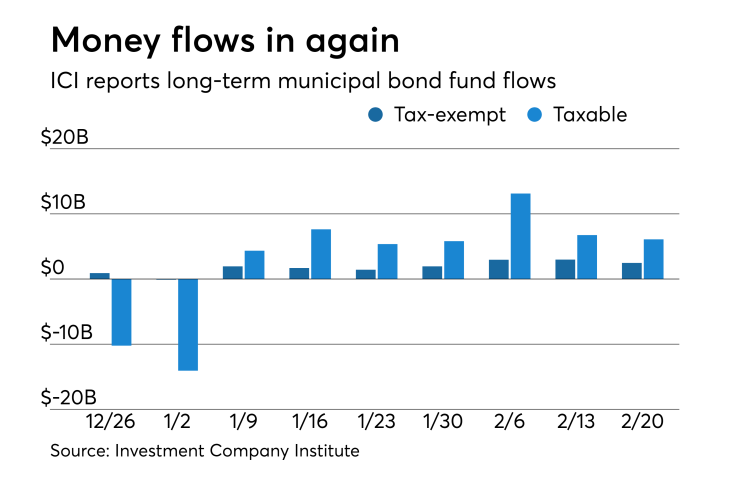

ICI: Muni funds see $2.47B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.472 billion in the week ended Feb. 20, the Investment Company Institute reported on Wednesday.

This followed an inflow of $2.985 billion from the tax-exempt mutual funds in the week ended Feb. 13.

Long-term muni funds alone saw an inflow of $2.351 billion after an inflow of $1.928 billion in the previous week while ETF muni funds saw an inflow of $121 million after an inflow of $57 million in the prior week.

Taxable bond funds saw combined inflows of $6.096 billion in the latest reporting week after experiencing inflows of $6.753 billion in the previous week.

ICI said the total combined estimated inflows out of all long-term mutual funds and ETFs were $7.373 billion for the week ended Feb. 20 after inflows of $8.511 billion in the prior week.

Oppenheimer optimistic on bonds

Jeffrey Lipton, Managing Director, Head of Municipal Research and Strategy at Oppenheimer said that while winter has some time left to go, he is quite optimistic that municipal bond prices will remain firm coming into springtime.

"Last week, tax-exempt bond prices traded within a narrow range, closely following U.S. Treasuries as fixed income participants avoided taking on any out-sized bets, choosing instead to await the docket of events for this week," Lipton wrote in his weekly report. "Thus far for the year, new-issue supply has been manageable and easily greeted by a hearty appetite."

He also noted that much of Oppenheimer's positive sentiment is illustrated by seven consecutive weeks of strong mutual fund inflows as reported by Lipper U.S. Fund Flows.

"Given generally supportive demand for munis, a less-threatening legislative environment, and a more market-friendly Fed, investors are now demonstrating a willingness to move further out along the yield curve," he said. "The short-end had become rich as concerns over monetary policy and thinner participation from certain institutional buyers on the longer end tempered duration psychology and kept the muni yield curve steep relative to the Treasury curve, which continues to remain flat."

Lipton added that thus far, he has been pleased with the overall recent market performance and he does not see challenges on the near-term horizon that would alter the course.

"Again, for our high net worth investors we advocate trading up in credit quality where appropriate and maintaining proper diversification should help to insulate the portfolio from the vagaries of economic, political and market behavior," he said. "Such diversification should take account of sector, individual credit, state of issuance and regional exposure. Portfolio construction (new and revised) should strike a good balance of general obligation and revenue bonds."

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.