Municipal bond buyers were rewarded with much-awaited supply on Wednesday, as deals from New York City and Intel hit the market.

Munis were trading stronger at midday while Treasuries weakened and equities declined.

Primary market

In the competitive arena on Wednesday, the New York City Municipal Water Finance Authority sold $390.415 million of Fiscal 2019 Series EE water and sewer system second general resolution revenue bonds in two offerings.

BofA Securities won the $275 million of Subseries EE-2 bonds while Morgan Stanley won the $115.415 million of Subseries EE-1 bonds.

The financial advisors are Lamont Financial Services and Drexel Hamilton. The bond counsel are Nixon Peabody and the Hardwick Law Firm.

The deals are rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

In the negotiated sector, BofA Securities priced the Oregon Business Development Commission’s $100 million of Series 250 economic development revenue bonds for Intel Corp.

RBC Capital Markets priced the Hayward Unified School District of Alameda County, Calif.’s $231.35 million of general obligation bonds. The deal is insured by Build America Mutual Assurance and rated AA by S&P and A-plus by Fitch.

Bond sales

Oregon

New York

California

Bond Buyer 30-day visible supply at $6.66B

The Bond Buyer's 30-day visible supply calendar decreased $387.2 million to $6.66 billion for Wednesday. The total is comprised of $2.93 billion of competitive sales and $3.73 billion of negotiated deals.

Secondary market

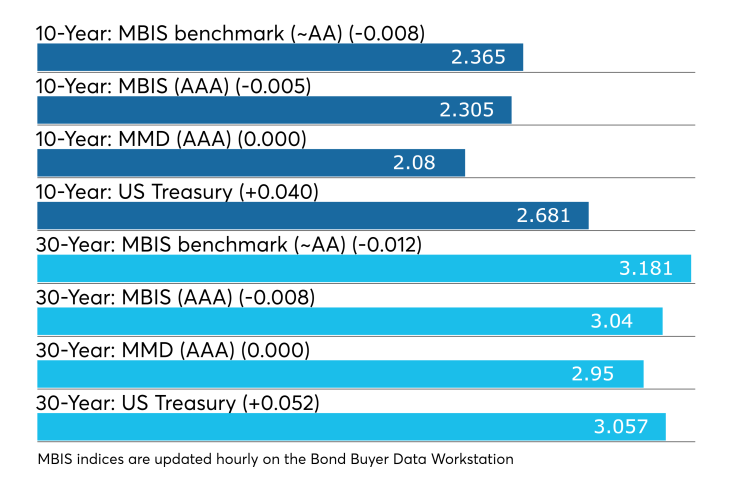

Municipal bonds were stronger Wednesday, according to a read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities. High-grade munis were also stronger, according to MBIS, with muni yields falling as much as four basis points across the curve.

Investment-grade municipals were steady on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stock prices traded lower.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 79.1% while the 30-year muni-to-Treasury ratio stood at 98.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasurys with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

COFINA bonds trading

Some of the restructured Puerto Rico Sales Tax Financing Corp. bonds were among the most actively traded bonds on Wednesday.

The COFINA restructured Series A1 5% bonds of July 1, 2058 (principal amount of issuance of $3.479 billion), were trading on Wednesday at a high price of 97.176 cents on the dollar and a low price of 93.337 cents, according to the Municipal Securities Rulemaking Board’s EMMA website. This compares with a high price of 97.659 cents and a low price of 90.676 cents on Tuesday. Trading volume totaled $9.486 million in 39 trades compared to $58.125 million in 209 trades on Tuesday.

The COFINA restructured Series capital appreciation bond zeroes of July 1, 2046, dated Aug. 8, 2018, (principal amount of issuance of $1.095 billion), were trading at a high of 20.19 cents and a low of 18.954 cents, compared to 19.835 and 17.10 cents on Tuesday. Trading volume totaled $15.439 million in 50 trades, compared with $26.391 million in 179 trades on Tuesday.

The COFINA restructured Series capital appreciation bond zeroes of July 1, 2051, (principal amount of issuance of $631.551 million), were trading at a high 14.51 and a low of 13.958, compared to 14.779 and 13.11 on Tuesday. Volume totaled $18.682 million in 40 trades versus $31.770 million in 155 trades on Tuesday.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,237 trades on Tuesday on volume of $12.61 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 12.57% of the market, the Empire State taking 12.455% and the Lone Star State taking 10.484%.

ICI: Muni funds see $2.47B inflow

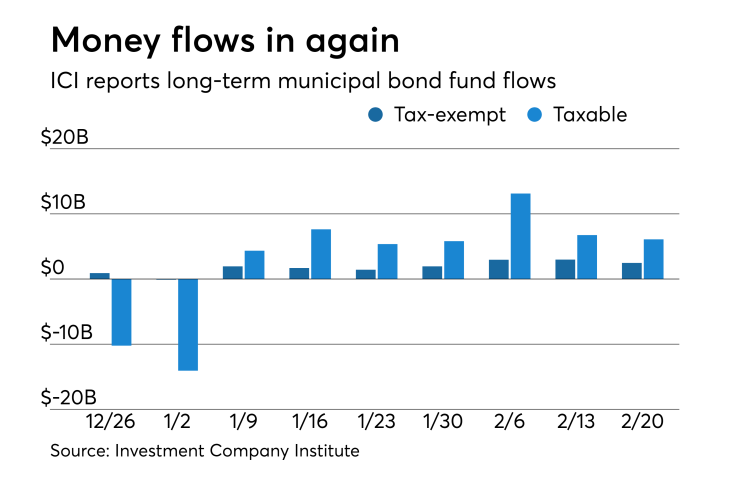

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.472 billion in the week ended Feb. 20, the Investment Company Institute reported on Wednesday.

This followed an inflow of $2.985 billion from the tax-exempt mutual funds in the week ended Feb. 13.

Long-term muni funds alone saw an inflow of $2.351 billion after an inflow of $1.928 billion in the previous week while ETF muni funds saw an inflow of $121 million after an inflow of $57 million in the prior week.

Taxable bond funds saw combined inflows of $6.096 billion in the latest reporting week after experiencing inflows of $6.753 billion in the previous week.

ICI said the total combined estimated inflows out of all long-term mutual funds and exchange-traded funds were $7.373 billion for the week ended Feb. 20 after inflows of $8.511 billion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.