The New York City Transitional Finance Authority Wednesday will competitively bid $300 million of building aid revenue bonds, including $100 million of taxable qualified school construction bonds.

Officials opted to sell the debt competitively after downsizing the transaction to $300 million from $600 million.

Original plans included structuring the borrowing as a negotiated issue.

Because the city only needs about $300 million of funding for school construction projects for the remainder of fiscal 2011, it cut the deal in half to better mirror its spending needs, according to Mark Kim, the city’s assistant comptroller for public finance.

The city’s fiscal year ends June 30.

“Given that the size of our borrowing needs was actually reduced to the $300 million level, we felt that we could more efficiently sell this deal competitively,” Kim said. “We felt we could get better rates and that the smaller size would allow a better bid.”

The transaction includes $200 million of Series 2011 S-2A building aid revenue bonds, with debt maturing annually from 2027 through 2040, according to the preliminary official statement. Another $100 million of Series 2011 S-2B QSCBs will mature as a term bond in 2026.

Fulbright & Jaworski LLP is bond counsel. Public Resources Advisory Group and A.C. Advisory Inc., are financial advisers.

The TFA has $4.4 billion of outstanding debt, according to Moody’s Investors Service.

Fitch Ratings assigns its AA-minus rating to the Series 2011 S-2 bonds with a positive outlook. Standard & Poor’s and Moody’s also rate the transaction double-A minus, both with stable outlooks.

The bonds are secured by payments the city receives from the state to fund the construction of new public-school buildings along with renovations and expansions of existing facilities.

The annual state aid payments are subject to state appropriation, and the rating agencies view the credit as tied to New Yorke’s double-A general obligation rating.

The rating analyts believe the risk of the state Legislature failing to allocate building aid is minimal given that education is an essential service. In addition, New Yorke’s constitution mandates that the state fund public education.

“Although there have been declines in [total] education aid paid by the state to the city and delays in the timing of education-aid payments in the recession, reflecting the state’s strained budgetary and cash position, building aid has continued to increase and been paid on schedule,” according to a Fitch report.

Once the state approves which New York City school construction projects will receive aid, it creates a 30-year amortization schedule for the project.

Confirmed building aid payments from 2012 through 2040 exceed annual debt-service payments, including the projected principal and interest costs for the Series 2011 S-2 bonds, according to the POS.

Debt service coverage ranges from 3.53 times in fiscal 2012 to 1.13 times in 2040 and will strengthen over time in the later years as the state approves additional funding.

“As New York City continues to add capital projects for education in the future, incremental associated building aid will be added, increasing coverage and providing more debt capacity,” according to a Moody’s report.

Officials anticipate the transaction will attract retail and institutional investors, with pension funds and insurance companies, along with other taxable funds, as potential buyers of the QSCBs.

Michael Pietronico, chief executive officer at Miller Tabak Asset Management, said compared to some other states, New York is working on getting its long-term expenses under control and New York City is outperforming other large metropolitan areas.

“The perception in the market has been of late that New York has its fiscal affairs in better shape than a fair amount of the rest of the country,” Pietronico said. “New York paper has traded near and dear of late because of that. We do have a bit of an uptick in New York supply, however it’s been met with reasonably good demand, so far, and our expectation in the near term is that will continue.”

Since the beginning of the year, yields on New York State GO 30-year debt have dropped by has much as 95 basis points, according to Thomson Reuters data. Yields on New York 30-year debt have ranged from a high 5.41% on Jan. 14 to a low 4.46% on June 16, a difference of 95 basis points.

While a double-A New York credit stands out amid the municipal market’s light issuance during the past few months, the TFA revenue bond transaction could benefit at market from the state’s strengthened fiscal position.

“I think a fair portion of that tightening is just the overall scarcity of municipal bonds so far this year, but I think from our view there is a perception that the New York credits — and this one in particular — might be performing better on the fiscal side than others,” Pietronico said.

Standard & Poor’s last week released a report stating that New York is moving towards long-term structural balance by implementing budget cuts and passing its operating budget on time.

“We view the enacted gap-closing actions as largely recurring budget solutions that will likely significantly lower out-year budget gaps,” the report said.

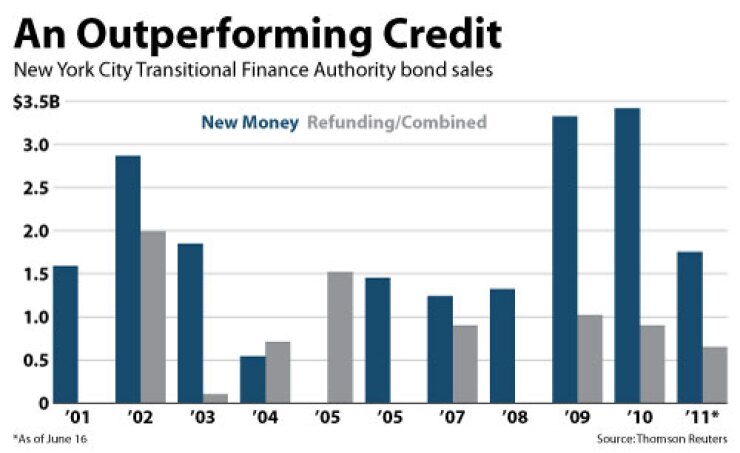

The TFA has total building aid revenue bond borrowing capacity of $9.4 billion. New York City’s QSCB allocation is $1.36 billion and after this week’s sale it will have sold about $500 million of QSCBs, Kim said.