Top-rated municipal bonds were weaker at mid-session, according to traders, who saw deals from New York City and Philadelphia hit the market.

Secondary market

The yield on the 10-year benchmark muni general obligation rose one to three basis points from 1.90% on Monday, while the 30-year GO yield gained one to three basis points from 2.69%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were weaker on Tuesday. The yield on the two-year Treasury gained to 1.38% from 1.36% on Friday, the 10-year Treasury yield rose to 2.31% from 2.25% and the yield on the 30-year Treasury bond increased to 2.90% from 2.83%.

On Monday, the 10-year muni to Treasury ratio was calculated at 84.4%, compared with 85.1% on Friday, while the 30-year muni to Treasury ratio stood at 95.0% versus 96.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 33,300 trades on Monday on volume of $5.29 billion.

Primary market

Bank of America Merrill Lynch held a second day of retail orders on New York City’s $820.45 million of Fiscal 2018 Series A general obligation bonds ahead of the institutional pricing on Wednesday.

On Tuesday, the bonds were priced for retail to yield from 0.90% with a 4% coupon in 2018 to 2.26% with a 5% coupon in 2028.

The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings. All three rating agencies assign a stable outlook to the bonds.

Barclays Capital priced Philadelphia’s $175.05 million of water and wastewater bonds on Tuesday.

The issue was priced as 5s to yield from 1.24% in 2020 to 2.96% in 2034. A 2017 maturity was offered as a sealed bid.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

On Monday a pre-marketing scale for the $265.99 million of taxable portion of Port of Seattle’s $266 million of Series 2017B taxable intermediate lien revenue and refunding bonds was circulating, according to a market source.

The source said that the bonds were about 55 basis points above the comparable Treasury in 2019 and about 140 basis points above the comparable Treasury in 2032. A term bond in 2036 was about 95 basis points above the comparable Treasury. The 2017 and 2018 maturities were offered as sealed bids.

The deal is rated A1 by Moody’s, A-plus by S&P and AA-minus by Fitch.

Citigroup is set to price the other two pieces of the Port deal on Tuesday: the $17.33 million of Series 2017A bonds and $324.8 million of Series 2017C alternative minimum tax bonds.

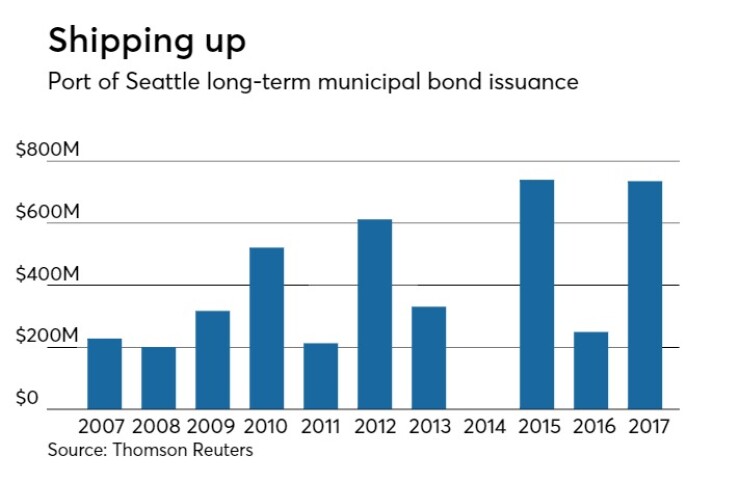

Since 2007, the port has issued $4.15 billion of securities, with the largest issuance occurring in 2015 when it sold $739 million. It did not come to market at all in 2014.

In the competitive arena on Tuesday, Alexandria, Va., sold $99.36 million of unlimited tax general obligation capital improvement bonds in two separate sales.

BAML won the $94.93 million of Series 2017A tax-exempt GOs with a true interest cost of 2.50%. The issue was priced to yield from 0.82% with a 5% coupon in 2018 to 3.09% with a 3.25% coupon in 2037.

Wells Fargo Securities won the $4.43 million of Series 2017B taxable GOs with a TIC of 3.08%. Both deals are rated triple-A by Moody's and S&P.

JPMorgan is expected to price Belton Independent School District, Texas' $114.365 million of unlimited tax school building bonds on Tuesday. The deal is backed by the Permanent School Fund Guarantee Program and is rated triple-A by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $148.1 million to $6.72 billion on Tuesday. The total is comprised of $2.07 billion of competitive sales and $4.65 billion of negotiated deals.