The municipal market saw the first issuance of the week come trickling in, with deals for retail and institutional investors alike, as the market was finding its footing with a flood of issuance expected over the next few days.

“It has been quiet for a while with the holiday, so it’s nice to get some action,” said one New York trader. “Seems as though the market is finding its footing here before those bigger deals come later in the week.”

Bank of America Merrill Lynch priced New York City’s $855.405 million of tax-exempt fixed-rate bonds, consisting of Fiscal 2019 Series D Subseries D-1 and Fiscal 2008 Series J Subseries J-1 and J-11 as a reoffering, for retail investors on Tuesday. A second day of retail orders will follow on Wednesday, with institutional pricing on Thursday.

BAML also priced the Metro Water District of Southern California’s $137 million for retail investors on Tuesday, ahead of institutional pricing on Wednesday.

Piper Jaffray priced Unified School District No. 383, Riley County, Kansas’ $130 million of taxable general obligation bonds on Tuesday.

Tuesday’s bond sales

Secondary market

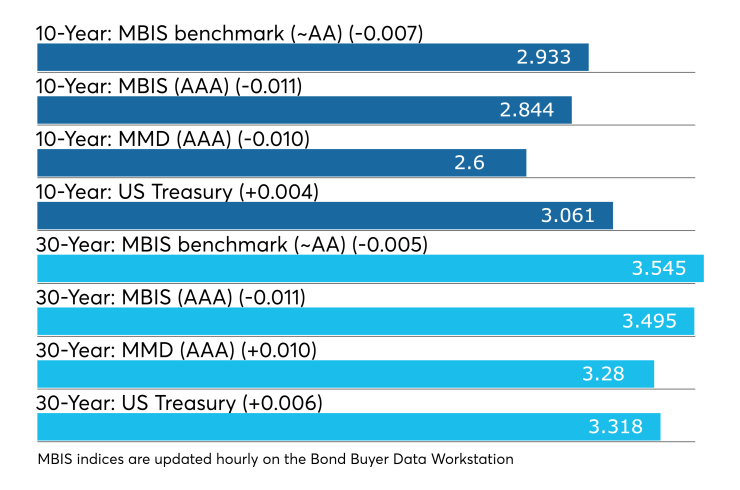

Municipal bonds were stronger on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell no more than one basis point in all 30 maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing as much as one basis point across the board.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation lower by as much as one basis point and the yield on 30-year muni maturity higher by as much as one basis point.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 85.1% while the 30-year muni-to-Treasury ratio stood at 98.5%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,464 trades on Monday on volume of $9.054 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 20.493% of the market, the Empire State taking 13.123% and the Lone Star State taking 9.083%.

Treasury auctions

The Treasury Department Tuesday auctioned $40 billion of five-year notes, with a 2 7/8% coupon, a 2.880% high yield, a price of 99.976871.

The bid-to-cover ratio was 2.49.

Tenders at the high yield were allotted 71.92%. All competitive tenders at lower yields were accepted in full.

The median yield was 2.849%. The low yield was 2.780%.

Treasury also auctioned $50 billion of four-week bills at a 2.270% high yield, a price of 99.829750.

The coupon equivalent was 2.305%. The bid-to-cover ratio was 2.75.

Tenders at the high rate were allotted 7.39%. The median rate was 2.240%. The low rate was 2.180%.

Treasury also auctioned $30 billion of eight-week bills at a 2.315% high yield, a price of 99.652750.

The coupon equivalent was 2.355%. The bid-to-cover ratio was 3.23.

Tenders at the high rate were allotted 28.73%. The median rate was 2.290%. The low rate was 2.270%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.