Top-quality municipal bonds finished weaker on Thursday, according to traders, as yields rose as much as seven basis points for some maturities. Treasury bonds were also weaker while stocks slumped.

In the primary, the N.Y. MTA’s $700 million green bond deal was postponed while Goldman Sachs priced the Los Angeles Department of Water & Power’s bonds.

Secondary market

Bonds were hit Thursday by a combination of global central bank comments, strong Eurozone economic data, and rising expectations of another interest rate hike by the Federal Reserve this year.

The yield on the 10-year benchmark muni general obligation rose seven basis points to 1.99% from 1.92% on Wednesday, while the 30-year GO yield increased five basis points to 2.79% from 2.74%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were also weaker on Thursday. The yield on the two-year Treasury rose to 1.37% from 1.35% on Wednesday, the 10-year Treasury yield gained to 2.27% from 2.22% and the yield on the 30-year Treasury bond increased to 2.82% from 2.77%.

U.S. equities were lower in late trade, with the Dow Jones Industrial Average off about 0.7%, the S&P 500 down around 0.9% and the Nasdaq off nearly 1.8%.

Recent hawkish comments from European central bank officials added to traders' expectation that there would be an end to accommodative monetary policies sooner rather than later.

According to the CME Group's FedWatch tool, Fed funds futures now show a 55% chance of another Fed rate increase by the end of 2017, the highest the odds have been in seven weeks.

On Thursday, the 10-year muni to Treasury ratio was calculated at 87.7%, compared with 85.6% on Wednesday, while the 30-year muni to Treasury ratio stood at 99.0% versus 98.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 45,098 trades on Wednesday on volume of $12.58 billion.

Primary market

The New York Metropolitan Transportation Authority’s $744.95 million of climate bond certified Series 2017B transportation revenue green bonds was postponed on Thursday. The deal had been priced for retail investors on Wednesday.

The MTA did not immediately comment on the postponement.

Gov. Andrew Cuomo on Thursday announced a series of

“In my opinion [the postponement of the MTA deal] was a combination of a few things all happening at the same time,” said one New York trader. “From a pricing perspective, the market was weaker most of the week and then again this morning. Roughly half of the deal was a refunding, so the math likely wasn’t as beneficial, and from a market perspective and getting the deal subscribed for, it’s month-end and quarter-end and also right before a long

The New York trader pointed to a shift in investor attitude that is pressuring prices.

“If you add it all up, it made more sense to pull the deal, wait and hope for better conditions next week,” he said.

The deal, rated A1 by Moody’s, AA-minus by S&P and Fitch and AA-plus by Kroll Bond Rating Agency, had been increased from an expected $500 million. Last week, the MTA competitively sold $500 million of transportation revenue bond anticipation notes in a sale that was decreased from the $700 million originally planned.

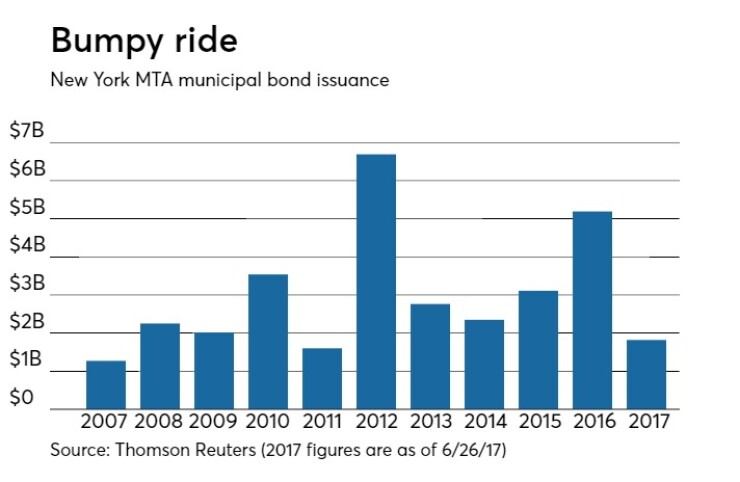

Since 2007, the N.Y. MTA has sold roughly $32.59 billion of securities, with the highest issuance in 2012 when it sold roughly $6.69 billion. The issuance was lowest in 2007 when it sold $1.27 billion.

Goldman Sachs priced and repriced the Los Angeles Department of Water and Power’s $375 million of Series 2017C power system revenue bonds.

The bonds were priced to yield from 1.25% with a 5% coupon in 2022 to 2.89% with a 5% coupon in 2038. A 2042 term bond was priced as 5s to yield 2.92% and a 2047 term was priced as 5s to yield 3.02%.

The deal is rated Aa2 by Moody’s and AA-minus by S&P and Fitch.

Raymond James & Associates priced the Comal Independent School District, Texas’ $227.16 million of Series 2017 unlimited tax school building bonds.

The issue was priced to yield from 1.04% with a 5% coupon in 2019 to 2.85% with a 5% coupon in 2039; a 2042 maturity was priced as 5s to yield 2.91%.

The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

NYC TFA Sets $1B bond sale for July 12

The New York City Transitional Finance Authority said it will sell $1 billion of its building aid revenue bonds on Wednesday, July 12, after a two-day retail order period starting on July 10.

Proceeds of the sale will be used to refund outstanding BARBs.

The deal will be priced by book-running senior manager Bank of America Merrill Lynch with Jefferies and Ramirez & Co. serving as co-senior managers.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $549.1 million, bringing total net assets to $129.16 billion in the week ended June 26, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $41.9 million to $129.71 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds jumped to 0.39% from 0.34% in the previous week.

The total net assets of the 850 weekly reporting taxable money funds increased $10.56 billion to $2.467 trillion in the week ended June 27, after an outflow of $39.28 billion to $2.457 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.60% from 0.57% in the prior week.

Overall, the combined total net assets of the 1,082 weekly reporting money funds increased $10.01 billion to $2.596 trillion in the week ended June 27, after outflows of $39.24 billion to $2.586 trillion in the prior week.