Underwriters priced the New York Metropolitan Transportation Authority’s $2.2 billion advance refunding deal for institutions on Tuesday. The green bonds were offered to retail buyers on Monday, who ordered about $770 million of the bonds, according to a market source.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as two basis points from 2.01% on Monday, while the 30-year GO yield increased as much as two basis points from 2.70%, according to a read of Municipal Market Data’s triple-A scale.

U.S. Treasuries were mixed on Tuesday. The yield on the two-year Treasury rose to 1.76% from 1.75% on Monday, the 10-year Treasury yield fell to 2.35% from 2.37% and the yield on the 30-year Treasury decreased to 2.76% from 2.79%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.9% compared with 85.0% on Friday, while the 30-year muni-to-Treasury ratio stood at 96.8% versus 96.2%, according to MMD.

MBIS 10-year muni at 2.288%, 30-year at 2.805%

The MBIS municipal non-callable 5% GO benchmark scale was stronger in mid-morning trading.

The 10-year muni benchmark yield dipped to 2.288% on Tuesday from the final read of 2.291% on Monday, according to

The MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

Primary market

Bank of America Merrill Lynch priced the N.Y. MTA’s $2.2 billion of Series 2017C transportation revenue refunding green bonds for institutions after holding a one-day retail order period.

On Tuesday, the $1.974 billion of Series 2017C-1 current interest bonds were priced to yield from 1.88% with a 5% coupon in 2023 to 3.37% with a 4% coupon in 2039.

The $202.986 million of Series 2017C-2 capital appreciation bonds were priced to yield 2.96% in 2027, 3.14% in 2029, 3.30% in 2032, 3.36% in 2033 and from 3.57% in 2039 to 3.61% in 2046.

On Monday, the $1.997 billion of Series 2017C-1 CIBs were priced for retail to yield 1.27% with a 5% coupon in 2018 and from 1.88% with a 5% coupon in 2023 to 3.36% with a 4% coupon in 2039. The $199.998 million of Series 2017C-2 capital appreciation bonds were priced for retail to yield 2.95% in 2027, 3.13% in 2029 and from 3.56% in 2039 to 3.63% in 2046.

A market sources said several of the maturities were oversubscribed during the retail order period.

The deal is rated A1 by Moody’s Investors Service, AA-minus by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

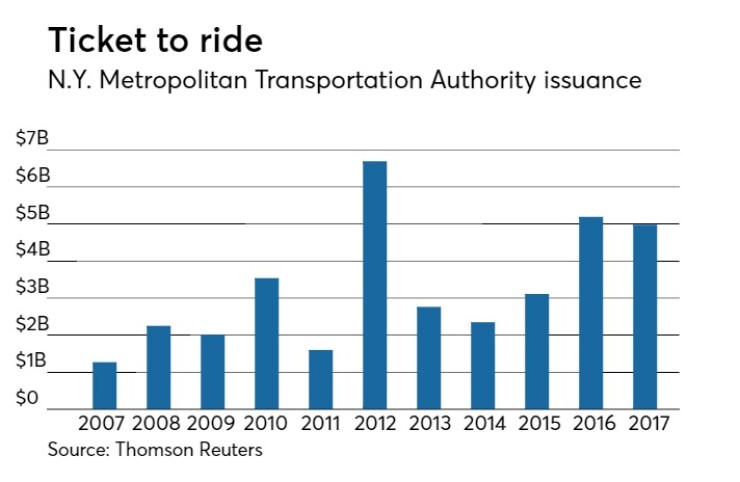

Since 2007, the MTA has sold about $35.76 million of debt, with the most issuance occurring in 2012 when it sold $6.69 billion. It sold the last amount of bonds in that period in 2007, when it issued $1.27 billion of securities.

Also on Tuesday, Wells Fargo Securities is expected to price the Virginia Transportation Board’s $479.41 million of Series 2017 federal transportation grant anticipation revenue and refunding notes.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

RBC Capital Markets is set to price Colorado’s $268.84 million of Building Excellent Schools Today certificates of participation.

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

JPMorgan Securities is expected to price the Louisiana Local Government Environmental Facilities and Community Development Authority’s $250 million of revenue refunding bonds on Tuesday.

The deal is rated Baa3 by Moody’s and BBB by S&P and Fitch.

The competitive arena sees the biggest deal of the week when Orange County, N.Y., is selling $73.23 million of public improvement serial bonds in three separate offerings.

The deals consist of $55.51 million of Series 2017A bonds, $13.21 million of Series 2017B bonds and $4.52 million of Series 2017C taxable bonds.

The deals are rated Aa3 by Moody’s.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $3.75 billion to $10.58 billion on Tuesday. The total is comprised of $4.03 billion of competitive sales and $6.55 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.