With a light post-Labor Day calendar doing little to boost the municipal market, the big New York City and California deals are dominating investors’ attention this week, according to Peter Block, managing director of credit strategy at Ramirez & Co.

Municipal underperformance in August created better relative value in five-, 10- and 30 years, “although all spots continue to read fair-to-rich versus three-year averages, notably the two-year spot at 64.7%,” Block wrote in a Tuesday report.

The 30-year spot is “reading cheap” on a one-year basis, he said, as this ratio is again on the precipice of breaking through 100%, after it read 99.9% at the end of the last week.

Treasury weakness on the long-end — which is possible if Friday’s non-farm employment report comes in higher-than-expected — could push ratios past 100% and “incentivize investors to extend duration,” according to Block.

“We think the 30-year spot needs to trade well behind 100%, perhaps 102%, for investors to provide meaningful support for longer duration given the relative flatness of MMD 2s/30s at only 132 basis points,” Block wrote. “As rates, and possibly spreads, are likely to march higher towards the end of 2018, we think it makes sense at this time to improve portfolio credit quality into AA or better general market names and selectively add credit risk in A rated hospitals, higher education, and public power.”

Block currently prefers shorter-call structures from five- to eight-years inside 15-year maturities, which he believes captures 90% of the MMD yield curve. It also has “optimal roll return (50 basis points), and are generally cheaper versus shorter and more expensive 2-4 years call structures,” he added.

Primary market

Retail investors lined up on Wednesday to get more New York City Transitional Finance Authority bonds while the New York Metropolitan Transportation Authority remarketed a 2015 deal.

Loop Capital Markets held the second day of retail orders on the NYC TFA’s $901.76 million of tax-exempt future tax secured subordinate fixed-rate bonds ahead of the institutional pricing on Thursday.

On Tuesday, the deal was warmly received as buyers snapped up the bonds, prompting the underwriter to curtail retail orders in the 2023, 2028 and 2029 maturities.

Additionally, the TFA is set to sell $500 million of taxable bonds in two competitive sales on Thursday. The financial advisors are Public Resources Advisory Group and Acacia Financial Group. Bond counsel are Norton Rose and Bryant Rabbino.

The deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

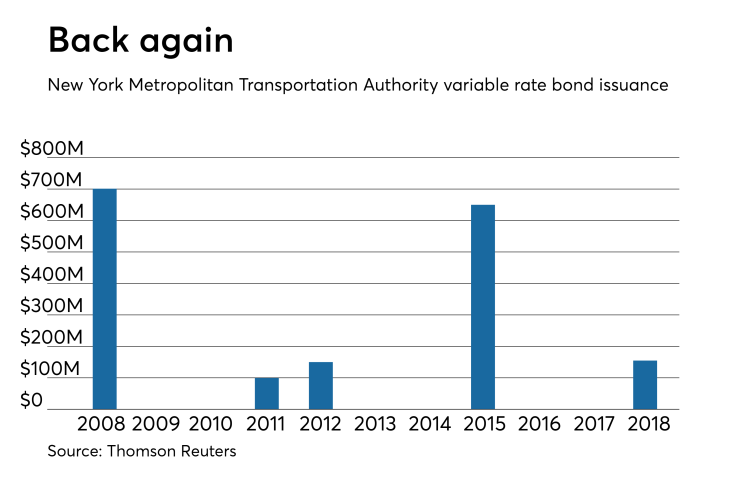

Bank of America Merrill Lynch priced as a remarketing the N.Y. MTA’s $154.85 million of Series 2015E-3 transportation revenue variable-rate bonds.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch and carries short-term ratings of VMIG1 from Moody’s, A-1 from S&P and F1-plus from Fitch.

Since 2008, the MTA has issued roughly $1.76 billion of variable rate bond debt, with the most issuance occurring in 2008 when it sold $701 million. It has been three years since it last sold variable rate debt and before that, it issued VRBDs in 2008, 2011 and 2012.

On Thursday, California is competitively selling over $989 million of general obligation and GO refunding bonds in three sales.

The offerings consisting of $516.035 million of tax-exempt various purpose GO refunding bonds, Bidding Group C, $338.38 million of tax-exempt various purpose GOs, Bidding Group B, and $134.855 million of taxable various purpose GO and refunding bonds, Bidding Group A.

The financial advisor is Public Resources Advisory Group and the bond counsel is Orrick Herrington & Sufcliffe.

The deals are rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Also on Thursday, Barclays Capital is expected to price the New Jersey Housing and Mortgage Finance Agency’s $165 million of multi-family revenue bonds. The deal is rated AA-minus by S&P.

Stifel is set to price the University of North Dakota’s $92.99 million of tax-exempt and taxable green certificates of participation on Thursday form an infrastructure energy improvement project. The deal is rated A1 by Moody’s.

And Goldman Sachs is set to price Purdue University’s $90 million of student fee bonds. The deal is rated AAA by Moody's and S&P.

Wednesday's bond sales

New York:

Bond Buyer 30-day visible supply at $9.17B

The Bond Buyer's 30-day visible supply calendar increased $263.3 million to $9.17 billion for Wednesday. The total is comprised of $4.46 billion of competitive sales and $4.71 billion of negotiated deals.

Secondary market

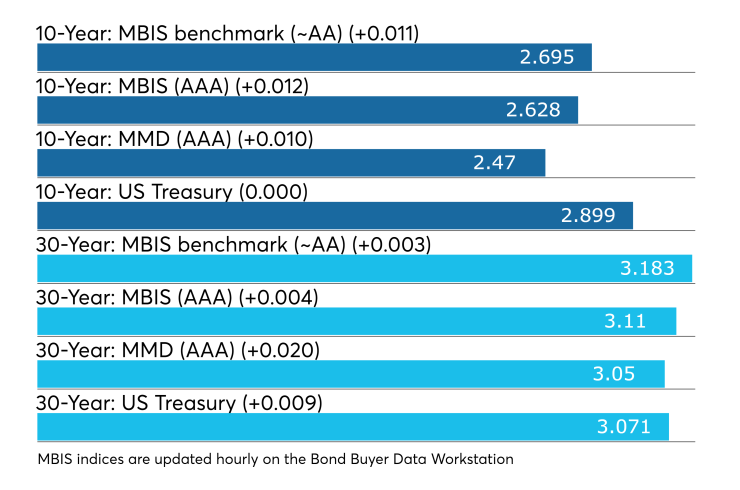

Municipal bonds were weaker on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as three basis points in the one- to 30-year maturities.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point across the curve.

Although the market “still feels like it is on vacation,” according to one Southern trader, one thing that was on the minds of muni market participants was news that the House Ways and Means Committee plans to vote next week on making the $10,000 federal cap on State And Local Tax deductions permanent as part of Tax Reform 2.0.

“I live in a low-tax, but high sales tax state — SALT caps are not as big of a concern in our local market, but my overall suspicion is that there is no momentum for a permanent SALT cap,” the trader said.

He added that he doesn’t think a vote happens but Thursday’s California competitive sale should “come at strong levels, highlighting the negative effects of SALT elimination.”

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising one basis point while the yield on 30-year muni maturity increased two basis points.

Treasury bonds were mixed as stock prices traded lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.2% while the 30-year muni-to-Treasury ratio stood at 99.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,151 trades on Tuesday on volume of $10.93 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 15.403% of the market, the Lone Star State taking 12.439% and the Empire State taking 8.666%.

Trend of positive rating actions continues

Rating upgrades from three agencies — Moody’s, S&P and Fitch — continued to outpace downgrades in the first half of 2018, Alan Schankel, managing director at Janney, wrote in a report released on Tuesday.

“On an annual basis, ups have surpassed downs every year since 2015, although there have been quarters with more downgrades for individual rating agencies,” he said. “Although this data can be useful in analyzing longer term trends, we caution that rating actions can be triggered by methodology or criteria changes, with the resulting rating changes often having little to do with underlying credit.”

For example, he noted, in the second quarter of this year, S&P bumped the ratings of 324 issuers while lowering 204. Not counting changes due to criteria, the numbers are 186 rating improvements and 177 deteriorating credits.

“Rating agencies took some much deserved heat following the 2008 financial crisis, which in the municipal world was manifested by the seemingly overnight credit deterioration of all AAA rated municipal bond insurers," Schankel said. "Not surprisingly, the drop in the use of bond insurance elevated the importance of traditional ratings, particularly for individual investors who typically lack the professional analytic capabilities and resources of institutional investors such as mutual funds and banks.”

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.