November municipal bond issuance hit a 23-year low for the month, as total volume for dipped below $20 billion.

Issuance declined 47% year-over-year as issuers dealt with continued market volatility and uncertain Federal Reserve policy.

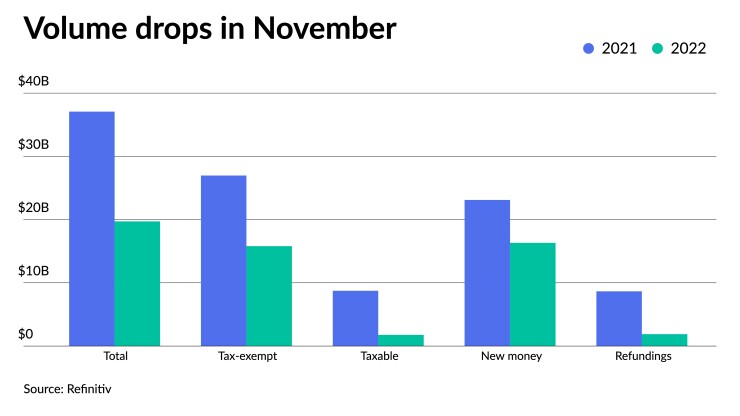

Total November volume stood at $19.712 billion, the lightest of any month year-to-date, in 527 versus $37.073 billion in 1,055 issues a year earlier, according to Refinitiv data. Issuance for the month is $6.6 billion less than the second-to-lowest month, January, which saw $26.340 billion.

Taxable issuance totaled $1.764 billion in 56 issues, down 79.8% from $8.745 billion in 183 issues a year ago. Tax-exempt issuance was down 41.4% to $15.8 billion in 462 issues from $26.967 billion in 864 issues in 2021 and alternative-minimum tax issuance rose to $2.148 billion, up 57.8% from $1.361 billion.

New-money issuance fell 29.4% to $16.321 billion in 487 transactions from $23.106 billion a year prior.

Refunding volume decreased 78.3% to $1.881 billion from $8.654 billion in 2021.

"These declines are rather dramatic, but not a real surprise given the market environment and market circumstances," said Jeff Lipton, managing director of credit research at Oppenheimer Inc. "It's a confluence of events that tells the full story of why November volume year-over-year is down almost 47%."

The drop of this magnitude, he said, is a byproduct of the Federal Reserve's tightening sequence and the move to higher interest rates.

At the start of the month, the Federal Open Market Committee implemented its fourth consecutive 75 basis point rate hike.

"All expectations were that they were going to raise interest rates, and they did," said Cooper Howard, a fixed income strategist focused on munis at Charles Schwab. "So that wasn't a surprise."

But, he noted, there was still the possibility of a surprise.

Howard noted that during FOMC meeting weeks, issuance generally is much lighter as a result.

Issuance throughout the month varied with some weeks seeing paltry new issues due to the FOMC meeting and the Thanksgiving holiday.

"Since we're looking at a holiday week, this month is always kind of difficult to analyze everything because Thanksgiving tends to influence a lot of factors to it," Howard said.

"With all the market volatility, Fed policy uncertainty and the dramatic rise in interest rates, a lot of issuers have taken the position, 'Let's sit on the sidelines. We don't need to access the capital markets for now,'" Lipton said.

But, he said, not all issuers can wait. Those with critical infrastructure and financing needs, in desperate need of capital, decided to come to market.

Taxables and refundings, meanwhile, are also significantly down, something Lipton said "goes hand in hand."

Given higher interest rates, Lipton said there's a "limited compelling argument in the way of taxable advanced refundings … because the Tax Cuts and Jobs Act eliminated that ability." Then the Build Back Better legislation never came to fruition.

One positive about the lower issuance, Howard said, is the benefit for total returns.

Municipals are on pace to have their

As of Tuesday, the Bloomberg Municipal Index was showing November returns at 4.57%.

Additionally, Howard said, "We've started to see fund flows shift from outflows back to inflows, and lower supply has helped those total returns for the month."

While the economy is still in pretty strong shape, Lipton believes some regions are displaying slower growth than others across the country.

For some issuers, along with market volatility, Fed policy uncertainty and rising interest rates, there are also expectations of slower economic growth.

Howard said he would not be surprised to see lower issuance going for the remainder of the year.

As December begins and with the December holidays right around the corner, Lipton said he believes several issuers have closed the books on the year.

It's generally only those who "absolutely need to raise capital in an efficient and orderly manner, that need to exhaust their bond authorizations for the current year, will access the market during the remaining months of the year."

Issuance details

Revenue bond issuance decreased 41.2% to $12.848 billion from $21.860 billion in November 2021, and general obligation bond sale totals dropped 54.9% to $6.864 billion from $15.213 billion in 2021.

Negotiated deal volume was down 45.4% to $14.927 billion from $27.362 billion a year prior. Competitive sales decreased to $4.505 billion, or 43.2%, from $7.935 billion in 2021.

Deals wrapped by bond insurance dropped 26.7%, with $2.043 billion in 95 deals from $2.786 billion in 164 deals a year prior.

Bank-qualified issuance dropped to $711.1 million in 178 deals from $1.243 billion in 297 deals in 2021, a 42.8% decrease.

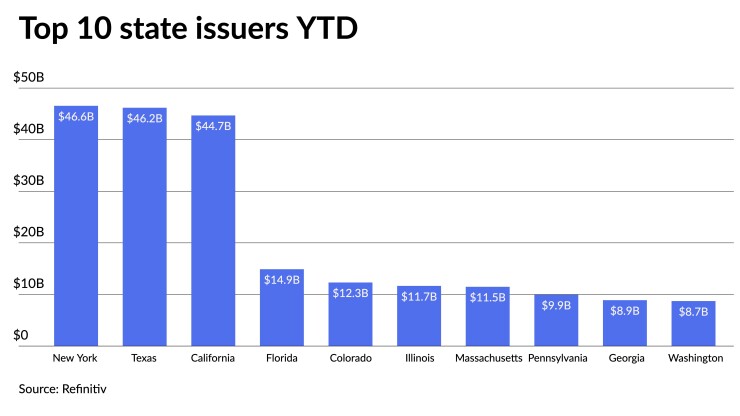

In the states, New York claimed the top spot year-to-date.

Issuers in the Empire State accounted for $46.563 billion, up 7.6% year-over-year. Texas was second with $46.189 billion, down 8.8%. California was third with $44.692 billion, down 41.1%, followed by Florida in fourth with $14.895 billion, down 8.1%, and Colorado in fifth with $12.320 billion, a 2.7% increase from 2021.

Rounding out the top 10: Illinois with $11.661 billion, up 3.7%; Massachusetts with $11.484 billion, up 7.6%; Pennsylvania with $9.942 billion, down 43.1%; Georgia at $8.895 billion, up 2.7%; and Washington with $8.724 billion, down 30.5%.