Newark, the largest city in New Jersey, Wednesday will sell $175.3 million of debt via competitive bid in its first new-money general obligation bond sale in several years.

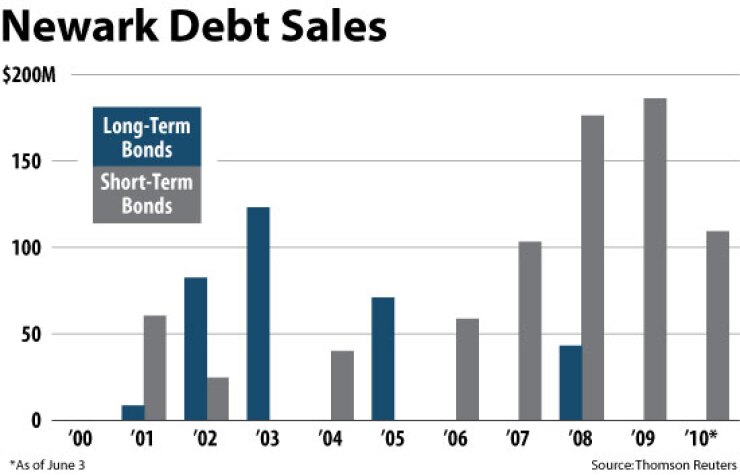

The city tends to issue short-term debt annually and then later roll over the notes into long-term debt.

“What we’ve been doing is rolling over our notes,” said Linda Dunn-Landolfi, Newark’s acting director of finance. “And we’re finally going to permanently finance and take advantage of lower interest rates and lock down those rates now and not take the interest rate risk going forward.”

The bonds will be sold as part of New Jersey’s Municipal Qualified Bond Act and its School Qualified Bond Act. Both programs direct a local government’s state aid to the state treasurer’s office to pay down debt-service costs.

Any municipality can use either program for borrowings, though the transaction is subject to approval from New Jersey’s Local Finance Board, which oversees most municipal borrowing in the state.

Bond proceeds for school construction are also secured by a state bond reserve act, which pledges repayment of such bonds if a school district is unable to meet debt-service payments.

The GO transaction is comprised of $120.6 million of general improvement bonds, $43.9 million of school bonds, $5.48 million of water utility bonds, and $5.28 million of taxable general improvement bonds, according to the preliminary official statement.

The bonds will offer serial maturities from 2011 through 2039. The taxable portion will have maturities in 2029 and 2030, the POS says.

NW Financial Group LLC is the financial adviser. Gluck Walrath LLP is bond counsel.

Moody’s Investors Service assigns the transaction an underlying rating of A2 with a negative outlook. Moody’s enhanced rating for the general improvement bonds and the water utility bonds is Aa3 with a stable outlook and Aa2 with a stable outlook for the school bonds.

The enhanced ratings are based on New Jersey’s Qualified Bond Act programs and the bond reserve act for the school construction debt.

Newark has about $500 million of outstanding debt, including this sale, Moody’s said.

Standard & Poor’s and Fitch Ratings do not rate Newark.

The city is heading to the market following Moody’s revision of its underlying outlook to negative from stable, due to narrowing liquidity. That problem prompted a cash-flow borrowing of $74.6 million of tax anticipation notes in May after the city ended fiscal 2009 on Dec. 31 with a lower fund balance than anticipated.

“The way New Jersey accounting works, it’s unusual to have to do a cash-flow borrowing,” said Moody’s analyst Lisa Cole. “That’s why we say that that’s indicative of a distressed liquidity position.”

Moody’s also is keeping an eye on when Newark will adopt its fiscal 2010 budget. The city will need to pass that plan by November in order to mail out tax bills later this year.

“Failure to adopt the 2010 budget in time to mail fourth-quarter tax bills in early November would exacerbate the city’s fiscal pressure,” a Moody’s report said.

Crafting the fiscal 2010 budget has its challenges. In addition to starting the year with a fund balance of $16.5 million — when it was expecting to start with $30 million — Newark may need to absorb a $16 million drop in state aid this year. Also, New Jersey municipalities in 2009 were able to defer a portion of their pension costs, an initiative that is not under consideration this year. That adds another $22.3 million that Newark must find in its fiscal 2010 budget.

To help rein in fiscal 2010 spending, city officials anticipate reducing full-time staff by 615 positions and there are proposals to reduce library and museum budgets. Officials also plan to try and renegotiate labor contracts, which could potentially save $7 million by freezing scheduled salary increases and other pay.

The city also plans to receive $50 million this year from a proposed new entity, the Municipal Utilities Authority. Newark aims to lease its water and sewer utilities for 40 years to the proposed MUA, with the agency then making yearly payments to the city that will decline over time.

The authority would also issue bonds to finance capital improvements of the water and sewer systems. Creation of the agency is dependant upon state approval.

“It is presently anticipated that the MUA would seek to issue approximately $165 million in bonds during the fourth quarter of 2010 in order to finance payment of a franchise fee to the city, together with various capital improvements to the water and sewer systems,” the POS said.

Following the new-money GO sale, Newark plans to issue $35 million of bonds in the last week of June to restructure prior debt to help spread out debt-service payments that will peak this year and next by moving a portion of those costs to later years.

The city anticipates the restructuring will reduce its debt service costs this year by $4.3 million, according to the POS.

The transaction will not extend the original final maturity of 2018, said Elizabeth Tutrone, vice president at NW Financial Group LLC, the city’s financial adviser.

“The city’s debt-service structure, as it is now, has a significant drop in 2016 and 2017 and for a city of that credit, it’s a very unusual debt structure,” Tutrone said. “They’re paying everything within the next couple of years and they have some tight fiscal constraints, so this is really providing some relief so that they can — which is what we’re doing now — permanently finance their outstanding notes and be responsible about that.”

While Newark is looking towards expenditure reductions and revenue enhancements to help balance the fiscal 2010 budget and end a history of structural deficits, it does have its strengths.

The city is home to Liberty International Airport, the Port of Newark, several higher educational institutions and hospitals, and cultural and sports facilities. In addition, the city is located eight miles from New York City across the Hudson River and is 80 miles northeast of Philadelphia.

The city has a large banking and corporate presence, including Prudential Insurance Co. It also has the state’s largest utility, Public Service Electric and Gas Co. Wachovia Bank NA, TD Bank NA, and Bank of America also have operations there.

Since taking office in 2006, Mayor Cory Booker has been active in promoting Newark’s assets to the private sector. Booker won re-election last month by more than 9,000 votes and seeks to turn the city into a revenue generator for the state.

The administration aims to revitalize its downtown area into a mixed-use environment that includes more residential development. It is tapping into its higher educational sector to develop a 50-acre, $200 million University Heights Science Park to attract technology and science-based businesses.

Its Brick City Development Corp. helps facilitate business growth and retention through loan programs and technical assistance. The city formed BCDC in 2007. It is a non-profit corporation.

“The city of Newark is pursuing a comprehensive economic development strategy,” the POS says. “The city’s economic development efforts will enable Newark to take full advantage of its strategic assets, including its location and transportation infrastructure; port and airport; a diverse and underutilized workforce; a large amount of developable land; a concentration of corporate and business service firms; several major universities; and a wealth of arts and cultural institutions.”

Newark’s population is 278,980, according to 2008 U.S. Census estimates. Roughly 25% of its residents live below the poverty level, compared to 13.2% in the U.S. overall, according to the Census.

The unemployment rate as of March is 15.5%, according to Moody’s.