As New York’s Metropolitan Transportation Authority awaits a hoped-for second shot of federal rescue funds, calls have emerged for the mass-transit agency to focus internally.

According to the watchdog Citizens Budget Commission, prioritizing capital investments and other efficiencies can help the MTA through its COVID-19 related fiscal crisis, which Chairman Patrick Foye has likened to a "

“Federal aid should be a significant contributor to solving this crisis. Yet, even if the MTA receives all the aid it has requested, its leaders face hard choices about how to manage the resources they control,” CBC senior advisor Charles Brecher said.

The state-run MTA operates New York City’s subways and buses, two commuter railroads and several interborough bridges and tunnels. It has been hemorrhaging money since the coronavirus outbreak in March, with ridership plummeting due to stay-at-home measures.

According to recent estimates, the gaps for the MTA’s 2020 and 2021 operating budgets are between $8.4 billion and $12.6 billion and the capital plan also will fall short of billions in revenue.

MTA officials have requested nearly $4 billion in further federal aid to match what it received in April under the CARES Act. The U.S. Senate expects to reconvene next week.

A coalition of national public transportation agencies was scheduled to host a virtual rally Tuesday calling for up to $36 billion in emergency federal funding.

“The first step is inclusion in the next package of COVID-19 emergency relief,” MTA capital construction chief Janno Lieber said Monday on a webcast hosted by the Manhattan Institute for Policy Research.

The MTA, one of the largest municipal issuers with $47 billion of debt including special credits, has received multiple downgrades and warnings from rating agencies. The most recent came last week, when S&P Global Ratings lowered the authority’s transportation revenue bonds to BBB-plus from A-minus.

Fitch Ratings and Moody’s Investors Service rate those bonds A-plus and A2, respectively, while Kroll Bond Rating Agency assigns its AA-plus rating.

The MTA has issued $4.39 billion in debt through the

“The MTA used to be a gold-standard credit,” Lieber said. “Now we are borrowing at a full 300 basis points higher, a full 3 percentage points higher than we used to. That means obviously much more burden on the operating budget, which shoulders the burden of any interest on borrowings.

“It constrains our ability to provide service and to hopefully do capital work. It is having a huge impact on our overall financing.”

The MTA is an eligible borrower in the Federal Reserve’s Municipal Lending Facility, although it has yet to tap into it.

“The federal government so far has expressed a willingness to help us and support the credit for taking out existing financings, but not to do new borrowings," Lieber said. "And so we are subject to the fact that the market does not right now have a lot of confidence in us."

Still, said Lieber, the MTA has accelerated several important capital projects and in fact, finished work on repairing the Canarsie Tunnel repair, which connects lower Manhattan with Brooklyn via the L train and sustained considerable damage from Hurricane Sandy.

Service reductions and a systemwide shutdown between 1 and 5 a.m. during the pandemic have enabled work crews to tackle state-of-good-repair projects in the pipeline more quickly, Lieber added.

“We’re getting onto the track more often,” he said. “We’ve gotten a ton of work done that’s actually being accelerated.”

Also, said Lieber, closing entire lines enable crews to “piggyback” work on the same line.

“If you’re going to shut down, you might as well do all the work at once,” he said.

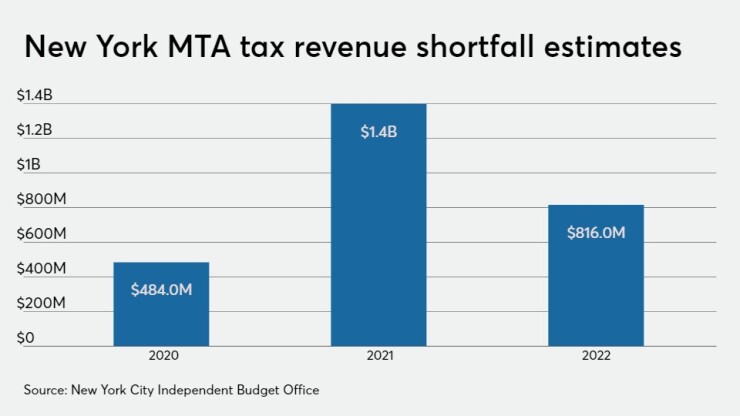

Beyond ridership drops affecting the farebox, the MTA is also experiencing a loss in dedicated tax revenues. The watchdog

IBO estimates the shortfall will be $484 million in 2020, $1.4 billion in 2021, and $816 million in 2022.

According to CBC’s Brecher, the MTA could consider postponing expansions and possibly slowing accessibility improvements while continually adjusting capacity to current demand and safety requirements. Collaborating with labor unions, he added, could help lower operating expenses.

“Notable examples include changes to bus driver schedules to reduce overtime, one-person train operation, and lower fringe benefit costs,” Brecher said.

MTA officials intend to present the new budget and financial plan at the July 22 board meeting.

A new financial plan, said Brecher, should restart the transformation plan, an initiative of Gov. Andrew Cuomo that the board approved last year. The pandemic, which escalated in March, forced a delay in the plan and put expense controls on hold.

Brecher also suggested the MTA consider larger increases for mass transit, and unlinking toll hikes from those of fares.

“The evidence from other global cities is that during reopening periods many former rail commuters shift to autos,” he said. “Significant toll increases could help reduce this shift and support the commuter lines with resources for their efforts to avoid crowding.”

Given the indefinite delay of congestion pricing for central Manhattan beyond January 2021, with a projected loss of $1 billion annual revenue for the MTA from that source, Brecher said the MTA could weigh a temporary large toll increases on MTA tunnels connecting directly to the central business district during the period of delay.