The municipal bond market was giving this week's new issues a warm reception right out of the gate on Tuesday as the biggest deals of the week priced for retail investors.

Traders returned to their desks after the long holiday weekend, eyeing closely the Treasury Department's securities auctions that are raising a record $258 billion this week.

Primary market

After millions of dollars in bid wanted lists went out for sale last week, that theme continued on Tuesday, according to Peter Block, managing director of fixed income research at Ramirez & Co.

“The trend of many bonds for sale is continuing today,” he said Tuesday morning. “It’s as if even traditional accounts are trading accounts with traditional trading accounts, and dealers for that matter, remaining heavy with bonds available for sale.”

“Fortunately for the market, new supply remains light this week, but we do feel some of the supply will come cheaper,” Block said, pointing to California and New York paper inside 10 years and general market names inside five years having very strong demand at noon.

“The long end really has very little sponsorship,” he added.

Ipreo estimates this week’s

Bank of America Merrill Lynch priced the

“The LAUSD deal came in pretty cheap, especially on the long end,” said one retail portfolio manager. “High net worth individuals in large income tax states like California and New York always like having well-known, high-rated paper – particularly in volatile and uncertain times.”

Jefferies priced New York City’s

Additionally, the city will competitively sell on Thursday $250 million of taxable fixed-rate bonds in two separate offerings consisting of $188.11 million and $61.89 million GOs.

In the competitive arena, Frederick County, Md., sold

Citigroup won the bonds with a true interest cost of 2.9812%.

The portfolio manager added that with the primary muni market dehydrated from puny supply, he envisions the deals this week being much welcomed and needed.

“I got the feeling that things will go swimmingly for most of the deals this week,” he said. “It feels like it is the first real week of the year.”

Buyside players agreed the market was off to a good start in terms of demand for new deals.

“The first deal out of the shoot, $107 million Frederick County, Md., went well,” said Peter Delahunt, managing director for at Raymond James & Associates. “Citi bought the deal and more than half is away, so, signs of a good start with this week as our first week with any real calendar of supply.”

Prior week's actively traded issues

Revenue bonds comprised 57.35% of new issuance in the week ended Feb. 16, up from 56.69% in the previous week, according to

Some of the most actively traded bonds by type were from Puerto Rico and Pennsylvania issuers.

In the GO bond sector, the Puerto Rico Commonwealth benchmark 8s of 2035 traded 100 times. In the revenue bond sector, the Pennsylvania Commonwealth Financing Authority tobacco 4s of 2039 traded 144 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.05s of 2036 traded 19 times.

Secondary market

Treasury sold $51 billion of three- month bills, $45 billion of six-month bills, $55 billion of four week bills and $28 billion of two-year notes. It also plans to sell $15 billion of re-opened two-year floating rate notes, $35 billion of five-year notes and $29 billion of seven year notes.

Tender rates for the 91-day and 182-day discount bills moved higher, as the three-months incurred a 1.630% high rate, up from 1.570% in the prior week and the six-months incurred a 1.820% high rate, up from 1.785% the week before. Coupon equivalents were 1.659% and 1.862%, respectively. The price for the 91s was 99.587972 and that for the 182s was 99.079889.

The median bid on the 91s was 1.600%. The low bid was 1.560%. Tenders at the high rate were allotted 59.37%. The bid-to-cover ratio was 2.74. The median bid for the 182s was 1.800%. The low bid was 1.780%. Tenders at the high rate were allotted 87.18%. The bid-to-cover ratio was 3.11.

Treasury sold $28 billion of two-year notes with a 2 1/4% coupon at a 2.255% yield, a price of 99.990276. The bid-to-cover ratio was 2.72. Tenders at the high yield were allotted 67.49%. The median yield was 2.210%. The low yield was 1.888%.

Treasury also auctioned $55 billion of four-week bills at a 1.380% high yield, a price of 99.892667. The coupon equivalent was 1.401%. The bid-to-cover ratio was 2.48. Tenders at the high rate were allotted 4.98%. The median rate was 1.320%. The low rate was 1.300%.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,772 trades on Friday on volume of $9.73 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 14.713% of the market, the Lone Star State taking 13.516%, and the Empire State taking 9.023%.

Previous week's top underwriters

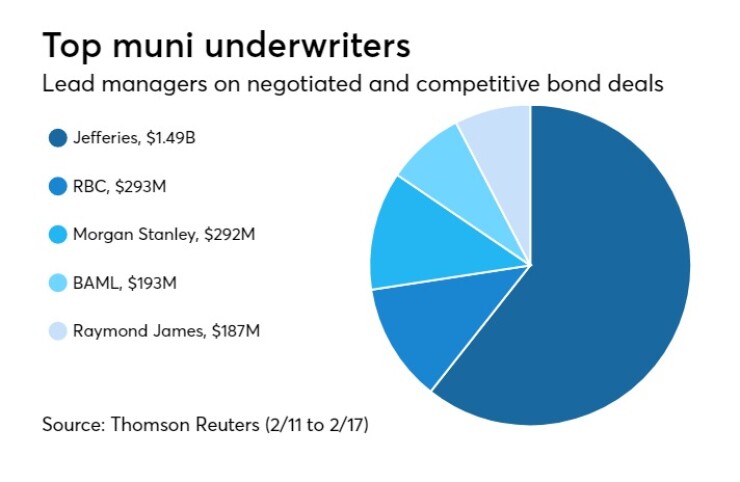

The top municipal bond underwriters of last week included Jefferies, RBC Capital Markets, Morgan Stanley, Bank of America Merrill Lynch and Raymond James, according to Thomson Reuters data.

In the week of Feb. 11 to Feb. 17, Jefferies underwrote $1.49 billion, RBC $293.2 million, Morgan Stanley $292.4 million, BAML $193.0 million and Raymond James $187.2 million.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.