PHOENIX – The Municipal Securities Rulemaking Board has published a “primer” on the role of munis in financing infrastructure that the board says is aimed at policymakers weighing infrastructure legislation and tax reform.

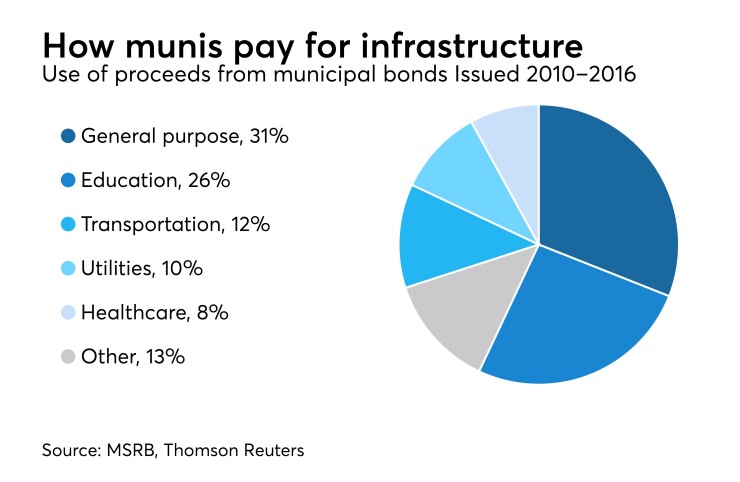

The twenty-page document, published Tuesday, includes information about the MSRB and its mission, explanations of different forms of municipal debt, and background on the challenge of paying for U.S. public infrastructure.

The primer is intended to be an educational tool for policymakers, MSRB chief communications officer Jennifer Galloway said.

“Our goal with the piece is to provide a resource for policymakers that underscores the role of the municipal securities in financing infrastructure,” said Galloway. “The primer provides a basic understanding of municipal securities, how the municipal market provides access to capital for state and local governments that own and maintain the majority of public works, and the role of the federal government and public-private partnerships in investing in public infrastructure.”

While much of the document is background information, a series of highlighted “considerations for policymakers” tackles subjects that have been more controversial with lawmakers and market participants, such as the tax exemption and direct-pay bonds.

“The tax exemption has been a key feature of municipal securities for over 100 years — since the inception of the nation’s infrastructure development and the U.S. tax code,” the primer states. “Proposals to prospectively limit the exemption by partially taxing municipal bond interest for high earners, have been considered under certain tax reform proposals that limit most deductions and exemptions for higher earners as a means of raising federal revenue.”

Questions about the status of the muni exemption and the possible use of tax-credit and direct-pay bonds similar to Build America Bonds are surfacing again as federal lawmakers gear up to attempt the first comprehensive tax reform in more than 30 years.

The Congressional Budget Office and Congress’s Joint Committee on Taxation have both said that tax-credit bonds and direct-pay bonds are more efficient than tax-exempt bonds in delivering the intended federal subsidy to the municipal entity that issues the bonds, the MSRB pointed out. But as the board further explained, both those types of bonds come with their share of policy baggage.

“Notwithstanding a theoretical efficiency analysis, certain risks have been experienced by users of both tax credit bond and direct-pay bond programs,” the MSRB said in its primer. “Tax credit bonds have faced challenges in achieving acceptance from investors and issuers given their quantities were limited by volume caps, a lack of taxable income for some investors such that a tax-credit would not be a benefit, and a complex structure that has included having the Treasury Department estimate and set the tax-credit rate. The interest subsidy for direct-pay bond programs has been decreased versus what was initially promised by Congress due to across-the-board discretionary budget cuts under the Budget Control Act (BCA), known as ‘sequestration.’ These reductions have made some issuers and investors wary of future issuance or investment in such programs.”

The primer concludes with an appeal to policymakers to protect the efficiency of the muni market even as they consider other ways to pay for infrastructure.

“Increasing infrastructure investment relies upon a municipal securities market that works for investors, state and local government issuers, and the public interest,” the MSRB said.