BOSTON — Long perceived as clunky and stagnant, the Massachusetts Bay Transportation Authority has begun to recraft itself.

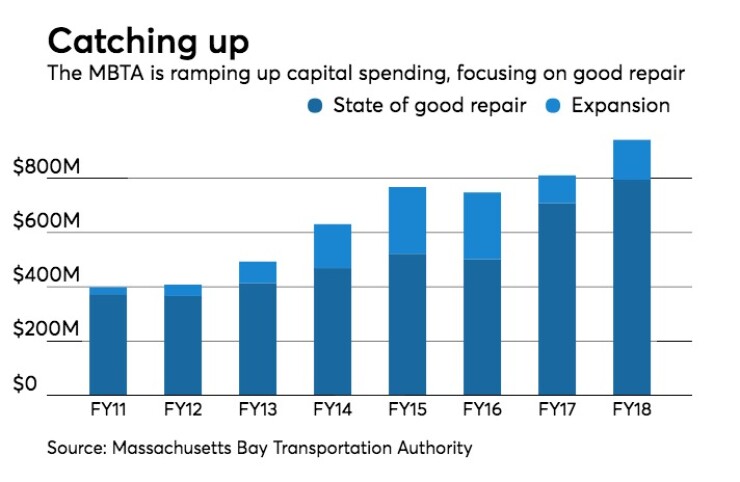

Working since 2015 under a state-appointed fiscal oversight board, the authority has moved to catch up with a state-of-good-repair backlog, contracted for a new fare-collection system, struck a deal to finish the long-awaited Lechmere streetcar extension and ordered new subway cars for the beaten-down Red and Orange lines.

Gov. Charlie Baker and lawmakers formed the

New management at the nation’s fifth-largest transit agency, which locals call the “T,” has whittled deficits, matched five-year capital spending with debt reduction, and even issued a

In late September the MBTA issued the tax-exempt sustainability bonds as part of a $574 million competitive sale. Officials at the T called it the first sale in the U.S. for such a bond. Proceeds earmark projects with environmental and/or social benefits.

“Most people don’t use the adjectives innovative and sophisticated when it comes to the T, but we were excited to come with this issuance because it reflects the core values of the organization,” MBTA treasurer Paul Brandley said at the seventh annual Massachusetts

The issuance won the Northeast Deal of the Year award from The Bond Buyer.

Projects included a new seawall for a bus depot in Boston’s water-exposed Charlestown neighborhood; positive train control safety technology; and the renovation of the 118-year-old Government Center station at City Hall Plaza.

About $100 million of sales tax bonds and the full $233 million of sales tax bond anticipation notes were identified as supporting sustainable projects.

The notes priced at a true interest cost of 1.37%. According to Brandley, nine banks participated in the sustainable offering while eight participated in the traditional offering.

Of the eight that participated in both, six offered stronger bids on the sustainable series than the traditional series.

“Given recent events in Florida and Texas, I climate resiliency is really, I think, top of mind,” said Brandley.

Overall changes at the MBTA have resonated in muniland.

“The MBTA is a phenomenal turnaround story,” said Michael Solomon, a senior vice president at FTN Financial. “In just over two years they have mitigated nearly the entire structural deficit they inherited while making record investments toward modernizing its critical infrastructure.”

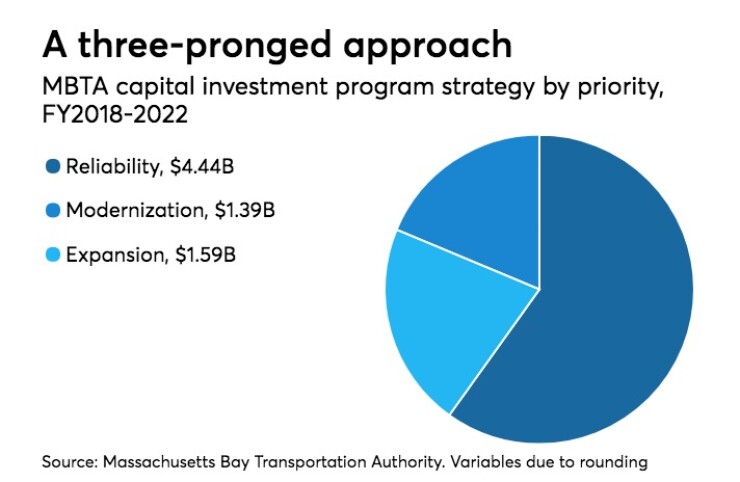

The authority’s five-year capital investment program for fiscal 2018-2022 is $7.4 billion, or nearly 14% larger than the plan of a year earlier. Catching up on about $8 billion of deferred maintenance is a high priority.

“We’ve got a meaningful state-of-good-repair backlog that’s been well-publicized,” said Brandley.

The MBTA is scheduled to pay down roughly $1.3 billion in existing principal over five years to offset the expected increase in revenue bond issuance.

“I think there’s a tinge of aspiration to it, but if you hold federal and state funding constant, you really need to fill the gap with something, and the gap is being filled with revenue bonds in this case,” said Brandley, who worked in New York for several years at Bear Stearns, Barclays and Goldman Sachs.

“Hopefully in five years’ time, I can say we have the same amount of debt outstanding but we’ve been able to get some really important capital projects done in the meantime.”

The MBTA’s sales tax credit is its workhorse. S&P Global Ratings and Moody’s Investors Service rate those bonds AA and Aa2, respectively. The authority also has a triple-A rated assessment credit in its arsenal.

“In the near term, with credit spreads so tight, it probably makes sense to borrow against a double-A, and if spreads were to widen we would use our assessment credit a little bit more,” said Brandley.

The authority conducts both negotiated and competitive bond sales.

“With all the potential changes on the horizon, whether it’s related to federal funding or tax reform or other types of variables that could affect the MBTA, I know that we’re going to rely on expertise of bankers through negotiated sales, and so I would envision a mix of both,” said Brandley.

The T has cut its projected deficits for 2016 and 2017 from $190 million and $242 million, respectively, to $86 million and $30 million, respectively.

“We’re bending the cost curve,” said the MBTA’s chief administrative officer, Michael Abramo.

Initiatives, he said, include zero-based budgeting; a 30% reduction in corporate and administrative positions; re-negotiating Carmen’s Union contract wage rates and work rules; and consolidating paratransit call centers.

Abramo, promoted from chief financial officer, is a Boston-area native whose private-sector affiliations included Ascend Learning, Alvarez & Marsal and PricewaterhouseCoopers.

Baker, a moderate Republican who works with a heavily Democratic legislature, had the MBTA crisis on his plate as soon as he took office in January 2015.

“Whenever something breaks on the T, it’s always 40 or 50 or 60 or 70 or 80 or 100 years old," said Baker.

Baker referenced Chicago, whose transit authority has emphasized core operations.

Its mayor, Rahm Emanuel, boasted in a New York Times op-ed that its back-to-basics thrust puts it ahead of New York’s and Washington’s systems, whose breakdowns made national news over the summer.

“The process of getting to this point was not an easy one,” said Baker. “We literally had to create the capacity inside the MBTA to do this. This is way more complicated than building a new spur, OK?”

The oversight board’s shelf life has been extended to five years from three. Jim Stergios, executive director of the Boston-based think tank Pioneer Institute, called overhauling the T “a decade-plus effort” and said the five-member board should remain in place for that long.

Joseph Aiello, the director of business development for North America at Meridiam Infrastructure, chairs the board.

“They are five experts who know capital projects, transportation, budgeting, riders, unions … they have incredible focus,” said Stergios.

“They meet weekly. The [Mass DOT] board would meet once a month and they were not experts. The T would come in with its usual dog-and-pony show and the board would just sign off on them.”

Stergios rates the T post-oversight “to be determined” on all fronts.

“Their financial success is absolutely clear. They’ve had fantastic success on the financial side. There used to be a parting of the ways between expenses and revenues, and they’ve changed that. They’ve gotten their arms around cost escalators, and their core support is way up.

“But people have to see an improvement in performance,” said Stergios, noting rider angst over breakdowns and delays on the Red and Orange subway lines, commuter trains and Green Line light-rail.

“There’s new competition in noncore areas that to some degree is eating the T’s lunch,” he added. Ride-sharing services such as Uber and Lyft are prime examples. “People have to put fannies in the T’s seats. Ridership is down. You’re seeing that in New York, too.”

On Nov. 20, the MBTA agreed to a $723 million contract with San Diego-based Cubic Corp. to overhaul its fare collection system and let riders board by tapping a credit card, smartphone or dedicated MBTA card. It will phase out the CharlieCard, which is named after the lead character in a 1958 Kingston Trio

The authority expects to phase the new system in beginning in late 2019.

New York’s MTA board six weeks ago approved a $574 million agreement with Cubic to install a similar tap system in its subways, although options could put the final bill above $1 billion over 13 years.

Also in November, the T chose GLX Constructors, a joint venture of several engineering and construction firms, the $1.1 billion winning bidder to finish the long-overdue 4.8-mile Green Line extension from Lechmere Square in Cambridge to Somerville and Medford.

The MBTA’s board two years ago halted the project, which the federal government has required as part of Big Dig megaproject mitigation. Cost overruns to the Lechmere project threatened to push the tab to $3 billion.

The new cars on the Red and Orange lines will replace a stock that dates back as far as 1969. Boston television even aired footage of their delivery to the airport in China last month.

The Red line was especially problematic during the blizzards of 2015, when then-MBTA general manager Beverly Scott said on national television, “Our trains aren’t spring chickens.”

Abramo, meanwhile, said in-house improvements include more automated and less cumbersome procurements. Since mid-November, he said, vendor processing has been 100% computerized.

“The T was a very paper-intensive organization,” said Abramo.

“Literally I would sign a purchase requisition in a wet form, with a wet signature, and then that same document would travel throughout the building and it would come back as a paper purchase order and I would have to sign it again with a wet signature to get mailed out to a vendor. I mean, it really slowed business down.”

While 40% of management is new, Pioneer’s Stergios said continued inflow at that level is essential to changing the T’s upper-echelon culture.

“They’re built like a beachhead in a war zone,” he said. “There’s still a dearth of good management. Much of the management coterie is unionized.

"In any business, culture matters.”