The Massachusetts Bay Transportation Authority plans to issue tax-exempt sustainability bonds Tuesday as part of a $574 million competitive sale.

Officials from the MBTA, which operates mass transit in Greater Boston and whose board authorized the sale on Sept. 11, say it’s the first sale in the U.S. for such a bond.

Proceeds of sustainability bonds exclusively fund projects with environmental and/or social benefits. The MBTA has adopted a framework to assure conformance with International Capital Market Association standards for determining project eligibility, tracking bond proceeds and reporting on project impact.

This framework also calls for tracking bond proceeds and reporting on project impact. The MBTA consulted academic leaders, impact investors and sustainability leaders at Fortune 500 companies.

The issuance “represents an exciting market precedent,” June Matte, a managing director at financial advisor Public Financial Management, said on an investor call.

Moody’s Investors Service and S&P Global Ratings rate the bonds Aa3 and AA, respectively.

According to MBTA treasurer Paul Brandley, the sale will include $233.6 million of subordinated sales tax bonds split into two subseries, which fund capital projects for fiscal 2018 and 2019 and replenish commercial paper capacity. Series A-1 of that component will feature $101 million of sustainable bonds and $132.5 million will be sold in the traditional A-2 offering.

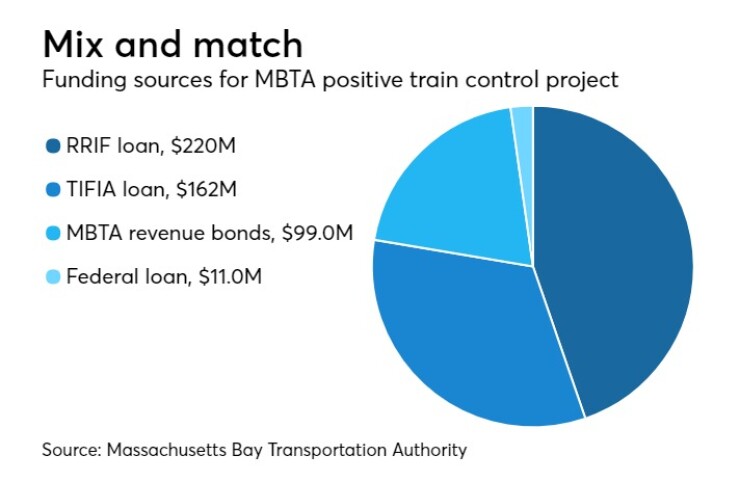

Additionally, $281.7 million of subordinated sales tax bond anticipation notes, along with $82 million of commercial paper, will fund $382 million in interim financing for a $492 million positive train control project.

Positive train control is a GPS-based remote system designed to prevent train crashes. The MBTA faces a federally mandated interim deadline of Dec. 31, 2018, and final deadline two years thereafter, to install it.

In 2021, said Brandley, the MBTA expects to take out the BANs and commercial paper with loan proceeds from the federal Transportation Infrastructure Finance and Innovation Act and Railroad Rehabilitation & Improvement Financing programs.

“TIFIA and RRIF loan agreements should be finalized in the coming weeks,” said Brandley.

Climate resilience projects include a $50 million undertaking in Boston’s Charlestown neighborhood to protect a critical bus facility from worsening storms and to minimize runoff, and the continuing $99 million work on the 118-year-old Government Center station in front of City Hall, which in 2016 became accessible to disabled people.

In addition, the MBTA is modernizing its bus fleet, earmarking $332 million for fuel-efficient hybrid vehicles. Its first hybrids entered in 2010 on the “trackless trolley” Silver Line.

The MBTA, the country’s fifth-largest mass transit system, has a $1.6 billion annual operating budget and a five-year capital investment plan of $7.4 billion. About 60% of its capital program funds state-of-good-repair projects such as signaling and tracks, with the balance split between expansion and modernization.

The authority carries about $5 billion in debt, with more than three-quarters of it through its sales-tax credit.

For the past two years the MBTA has operated under a fiscal oversight board that Gov. Charlie Baker and state lawmakers approved after a record 110 inches of snow hit Greater Boston in the winter of 2014-15. The storm paralyzed parts of the transit system and exposed operational flaws.

Former General Electric Co. executive Luis Ramirez took over last week as the MBTA’s general manager, while Michael Abramo was promoted to chief administrator last July. In addition, the state control board was extended to 2020.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo PC is bond counsel for the sale.