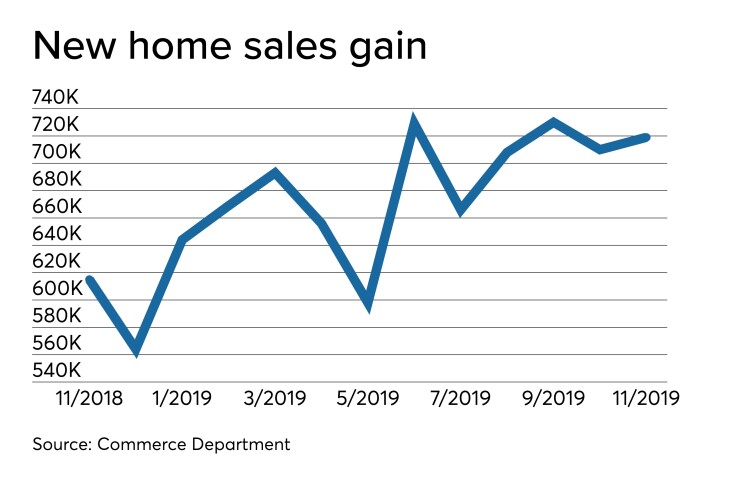

New home sales rose to 719,000 in November, less than expected, the Commerce Department said Monday in a report that also lowered the home sales figure for October.

Economists polled by IFR Markets expected sales to rise to 735,000 sales in November. The pace of sales was up from 710,000 in October, first reported as 733,000.

“New home and existing home sales continued to show big improvement over year ago,” Grant Thornton Chief Economist Diane Swonk tweeted. “Inventories are ridiculously tight, and pushing prices up, especially on entry level. Means we are not getting as much bang out of low mortgage rates as should.”

Sales in the past three months averaged just under 720,000, the best three months since July 2007.

Year-over-year sales grew 16.9% from a 615,000 pace.

The median sales price grew to $330,800 in November from $316,900 the month before and $308,500 a year earlier.

The months supply fell to 5.4 months from 5.5 months.

"Fueled by the limited number of resales available for purchase, low interest rates and low unemployment, new home sales are finishing the year strong," said Greg Ugalde, chairman of the National Association of Home Builders.

"With almost all the 2019 data in, the housing rebound continued through second half of the year," said NAHB Chief Economist Robert Dietz. "New home sales are running 10 percent higher than in 2018, and high levels of builder confidence point to production gains going into 2020."

Separately, durable goods orders fell 2.0% in November after a 0.2% rise in October, Commerce reported. Excluding transportation, orders were flat in the month after 0.3% growth the month before.

Economists expected a 1.5% gain, with orders rising 0.1% excluding transportation.

Non-defense capital goods excluding aircraft, seen as a proxy for future business spending, climbed 0.1%, after rising 1.1% the month before. These orders were expected to increase 0.2% in the month.

“Durable goods orders dropped on a huge — 72.7% — decline in defense aircraft orders,” Swonk said in a tweet. “Core durable goods orders were nearly unchanged after an October rebound. Core shipments, which track business investment remained weak. CEOs still somewhat skittish and treading w caution.”

She added: “Still hoping we see a bit of modest rebound in investment as short-term projects come back on line. Wounds of the trade wars run deep.”

National activity index

The Federal Reserve Bank of Chicago’s national activity index (CFNAI) showed above-average growth in November, after two months of below-average growth.

The index grew to 0.56 from negative 0.76 in October, as production-related indicators added 0.49 to the index in November, after a 0.60 negative contribution the month before.

The CFNAI-MA3, a three-month moving average, narrowed to negative 0.25 in November from negative 0.35 in October.

The CFNAI Diffusion Index, also a three-month moving average, edged up to negative 0.23 in November from negative 0.24 in October.

Positive contributions came from 50 of the 85 individual indicators that comprise the index, the rest made negative contributions. While 64 of the indicators were better in November, 21 deteriorated. Of the 64 that improves, 19 still made negative contributions.