PHOENIX – States' total net tax supported debt was nearly flat for the fourth straight year in 2016.

An annual report from Moody’s Investors Service, released Monday, showed that NTSD rose 0.8% year-over-year as states turned to more pay-as-you-go spending for infrastructure and other capital projects. This reflects the fourth year in a row that NTSD increased less than 1%, with total debt outstanding rising to $517 billion from $513 billion.

The rating agency said it expects the slow growth trend to continue at least into the near future.

“The small increase [last year] reflects a shift towards pay-go capital spending and a reluctance to take on new obligations amid slow revenue growth,” Moody’s said. “Minimal change in NTSD will likely continue over the next year due to continued modest revenue increases, higher interest rates, and uncertainty over federal fiscal policy and Medicaid funding.”

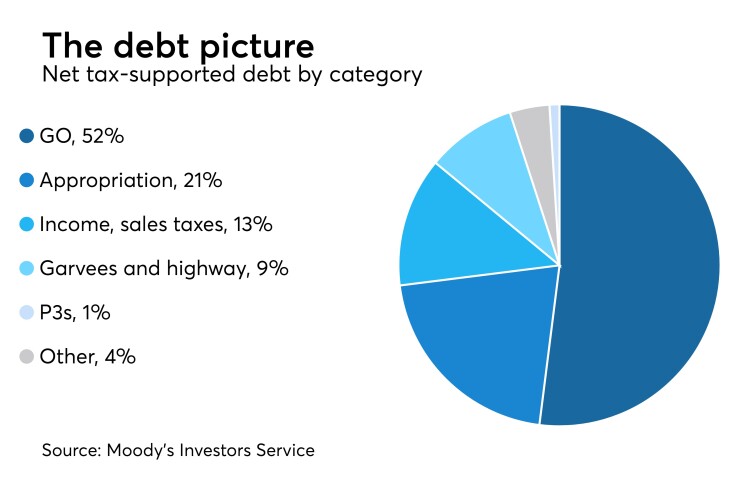

General obligation debt represents the largest chunk of net debt at 52%, Moody’s said, also predicting that highway revenue debt and GARVEEs, currently 9% of total state debt, are likely to increase as states address transportation infrastructure needs. The median NTSD per capita and as a percent of personal income stayed relatively level, a fact the rating agency attributed to population and income increases that are keeping pace with slow debt growth.

“States will continue to have more financial flexibility to tap into a growing economic base as debt liabilities remain fairly level,” said Moody’s.