Municipals were little changed ahead of a $10 billion-plus new-issue week as California offered $2 billion of general obligation bonds to retail investors and the market considered the municipal bond provisions offered from Washington.

Triple-A benchmarks reported steady levels while U.S. Treasuries improved and equities also improved.

“The municipal market is relatively unchanged and not fazed by another reversal in the Treasury market, which has been the status quo for September so far,” Roberto Roffo, managing director and portfolio manager at SWBC Investment Company, said Monday.

Ratios have kept in a range with the 10-year muni-to-Treasury ratio at 71% and the 30-year at 80%, according to Refinitiv MMD. The 10-year muni-to-Treasury ratio was at 74% while the 30-year was at 80%, according to ICE Data Services.

This week's primary calendar, Roffo said, has several deals that will get investors’ attention, the $400 million Illinois deal and the $2 billion California offering.

The California GO sale is a true indication of where demand currently is in the market, according to Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

The recall election was doing little to affect the market for the deal, with levels coming in at expectations.

Morgan Stanley priced $2.096 billion of California GOs for retail Monday. The first, $1.044 billion, saw 5s of 2022 at 0.10%, 4s of 2025 at 0.34%, 5s of 2030 at 0.98%, 4s of 2036 at 1.48%, 4s of 2039 at 1.62%, 2.375s of 2046 at 2.46% and 2.375s of 2051 at 2.50%. The second, $1.052 billion, saw 4s of 2023 at 0.14%, 4s of 2026 at 0.47%, 5s of 2031 at 1.06%, 4s of 2036 at 1.48%, 5s of 2041 at 1.69% and 5s of 2041 at 1.49%.

A few trades of California paper showed 5s of 2023 at 0.12% and 5s of 2026 at 0.42%.

“Should that deal struggle it could lead to higher yields in the broader market as supply normally picks up this time of year,” Pietronico said, noting that Tuesday’s consumer price report will also be a key focus for the market as inflation concerns remain elevated.

Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co. agreed there is a hearty appetite for new issues as the end of year nears.

“Munis are entering the home stretch of 2021 and we may start to see some cheapening in the primary market as deals need to get priced heading to year-end,” Lipton said on Monday. “While there is a wall of retail cash sitting on the sidelines, the retail muni investor remains hesitant to commit at current valuations.”

Certain A-rated, non-hospital structures with 4% coupons within a premium range are generating interest, however, according to Lipton.

Much of the institutional demand is being seen in the 10-year space, with demand found among 5% kickers with 2025, 2026, and 2027 calls, he added.

Meanwhile, even though the four-week moving average of inflows has dropped slightly to $1.4 billion, demand still remains robust, with 27 consecutive weeks of inflows, Roffo noted.

“With a substantial amount of cash on the sidelines and Washington’s obsession with raising taxes, the municipal market should be on strong footing going into the final quarter,” he said.

Participants also on Monday

"While there are still many roadblocks to these provisions becoming law, this is a key positive step," Morgan Stanley strategists said.

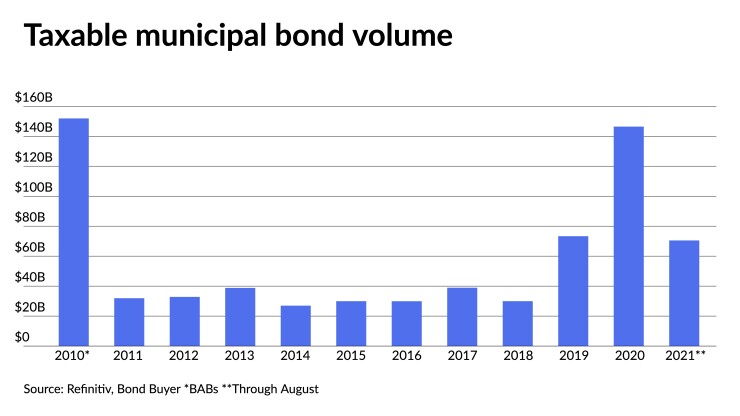

Morgan Stanley on Monday estimated that with the new direct-pay bond program, the market could see taxable issuance grow to $50 billion to $180 billion in the first year of adoption.

They

In the newest version, the bonds would come with subsidy rates of 35% for bonds issued from 2022-2024, 32% for bonds issued in 2025, 30% for bonds issued in 2026, and 28% for bonds issued in 2027 and beyond.

"Our core conclusion is this: with a BABs program, the taxable market would grow into the dominant form of issuance, albeit slowly at some times and quickly at others," the July report said. "Our model output shows that more generous subsidies and higher yield ratios (i.e., relative tax-exempt to taxable yields) drive a sharp increase in expected taxable supply."

Others pointed to the uncertainty the provisions will face as lawmakers debate the $3.5 trillion package. Lipton said it will be generally well-received by market participants, even though final inclusion and program specifics remain uncertain.

The return of tax-exempt advanced refundings may also alter the

"The renewed ability to market tax-exempt advance refunding bonds would certainly be welcomed by market participants, and would likely dilute taxable issuance especially if rates rise and compelling spread relationships shift course even more," Lipton said.

Secondary trading and scales

Trading showed a steady tone. New York City TFA 5s of 2023 traded at 0.18%-0.17%. Minnesota 5s of 2025 traded at 0.29% and 5s of 2026 at 0.42% versus 0.44% Friday.

Harvard 5s of 2030 traded at 0.85%. University of North Carolina-Chapel Hill 5s of 2031 at 0.97%-0.96%. Fairfax County, Virginia, 4s of 2032 at 1.10%.

Georgia road and tollway 4s of 2037 at 1.39%. NYC TFA 4s of 2042 at 1.85%.

New York City 4s of 2047 at 1.90% versus 1.91% Friday and 1.90% original.

Georgia road and tollway 3s of 2049 traded at 2.07%.

Refinitiv MMD's scale showed short yields steady at 0.08% in 2022 and 0.11% in 2023. The yield on the 10-year was steady at 0.94% while the yield on the 30-year sat at 1.53%.

The ICE municipal yield curve showed bonds steady in 2022 at 0.08% and at 0.11% in 2023. The 10-year maturity sat at 0.95% and the 30-year yield was down one to 1.52%.

The IHS Markit municipal analytics curve showed short yields steady at 0.09% and 0.11% in 2022 and 2023. The 10-year yield stayed at 0.94% and the 30-year yield sat at 1.53%.

The Bloomberg BVAL curve showed short yields steady at 0.07% and 0.07% in 2022 and 2023. The 10-year yield sat at 0.93% and the 30-year yield at 1.53%.

The 10-year Treasury was yielding 1.322% and the 30-year Treasury was yielding 1.904% in late trading. The Dow Jones Industrial Average gained 261 points or 0.76%, the S&P 500 rose 0.23% while the Nasdaq lost 0.07%.

Looking ahead to Fed

With a quiet week in terms of economic data, analysts are already pondering next week’s Federal Open Market Committee meeting.

Don’t expect a tapering announcement, they say. Morgan Stanley doesn’t expect word of a cutback until the December meeting, while Wells Fargo Securities is hedging its bets between the November and December gatherings.

“The slowdown in the economy has not swayed the Committee's broad support for tapering this year,” noted Morgan Stanley Chief U.S. Economist Ellen Zentner, “though it is noteworthy that one prominent voice calling for an earlier taper now believes it could happen ‘sometime this year.’"

The deciding factor will be the next two employment reports, she said. This meeting provides another opportunity for the Board to “hash out consensus on the mechanics of tapering,” she said.

Federal Reserve Bank of New York President John Williams conditioned tapering on continued improvement in the labor market, “fairly consistent” with his prior remarks on the topic, Zentner said. Her takeaway was the recent disappointing jobs report and the rise of the Delta variant, won’t derail tapering.

The other speaker that caught Zentner’s attention was Atlanta Fed President Raphael Bostic, whose opinion appears to have softened. He said say taper could happen "sometime this year," when previously he pushed for taper to come earlier, she said.

The FOMC would have only one more jobs report before the Nov. 2-3 meeting, so that September non-farms payroll number “would need to notably outperform in order to provide more evidence of meeting the ‘substantial further progress’ test on labor,” she said. “We think uncertainty around the data lines up with our call for a December tapering announcement.”

But the employment figures “have been very volatile throughout the re-opening process,” said Wells Fargo Securities Chief Economist Jay Bryson, Senior Economist Sarah House and Economist Michael Pugliese. “It is quite possible August's miss will be revised higher and/or offset by a stronger number in September. A potential peak in COVID cases, school re-openings and the end of enhanced unemployment benefits all point toward a rebound in job growth in September.”

The August employment report “and the uncertainties imparted by the recent surge in COVID cases on the economic outlook mean that an announcement of tapering at the upcoming meeting is quite unlikely,” they said.

Despite this, progress toward maximum employment continues. “Unless the economic recovery is completely derailed over the next few months,” they said, “we believe a taper announcement will be forthcoming at either the November or the December FOMC meetings.”

The Sept. 21-22 meeting also offers a new Summary of Economic projections, which will extend the forecasts into 2024. “The September dot plot could easily reveal a median of three hikes in 2024, with upside risk,” Zentner said. “According to our rates strategists, the bond market is pricing in a more shallow path. That said, three hikes may not be a surprise, though it would certainly catch attention. However, a dot plot that shows a median of four hikes in 2024 is bound to startle the complacent investor.”

The dot plot will be interesting, she said, with “a tug-of-war among the hawks and doves around 2024.” The seven officials that expect hikes next year “are bound to see the need for a much steeper path two years on. Their dots could yank the median higher in 2024.”

But the five doves who expect no increases through 2023, if they see “liftoff in 2024, they will no doubt mark down a more gradual start, exerting a gravitational pull on the median.”

For 2022, she said, “the median remains at zero.” With the June SEP providing “a major shift in the dots forward into 2022,” the following dot plot “tends to be more stable.”

If GDP expectations slip, it could “cause some dots to shift lower,” Bryson, House and Pugliese said. “But forecasts of lingering inflation next year may lead some members to conclude that the pace of tightening that they expected three months ago is still warranted.”

Further, the data released in the interim “should not have swayed the path of policy,” Zentner said. But, she noted, just two Fed officials moving higher could bring the median for 2022 up to 0.25%.

“Regardless of the outcome, Chair [Jerome] Powell is likely to talk down any hawkish move in the dots, reminding folks that the outlook is highly uncertain and the dot plot should be taken with not just a grain but a barrel of salt,” she said.

Powell’s smoothing will be easier for 2024. “Should the median move higher in 2022, however, Chair Powell will have to pound his fist on the table to show that tapering has nothing to do with the timing of the first rate hike,” she said. “It's important for the center of the Committee to continually remind financial markets of that separation principle and ensure that it remains effective.”

Separately, consumer’s inflation expectations are climbing, according to the Federal Reserve Bank of New York’s Survey of Consumer Expectations.

Both the one- and three-year were at series highs, with the shorter-term rising to 5.2% in August from 4.9% in July, and the three-year at 4.0%, up from 3.7% a month ago.

More than one in three respondents expect the unemployment rate to rise in the next 12 months, while earnings and spending growth slowed.

Also released Monday, the federal government ran a $170.6 billion deficit in August after a $302.1 billion shortage in July. Economists polled by IFR Markets expected a $173.0 billion deficit.

A year ago, the government posted a $200.0 billion deficit for the month.

Primary to come

California (Aa2/AA-/AA/) is set to price on Tuesday for institutional investors $2.092 billion of general obligation bonds, consisting of Series 1 $1.04 billion and Series 2 $1.051 billion. Morgan Stanley & Co. LLC.

The Black Belt Energy Gas District (A2///) is set to price on Wednesday $805.325 million of gas project revenue bonds, 2021 Series B. Goldman Sachs & Co. LLC.

Providence St. Joseph Health Obligated Group (Aa3/AA-/AA-/) is set to price on Tuesday $775 million of taxable bonds, Series 2021A. Goldman Sachs & Co. LLC.

The Long Island Power Authority (A2/A/A/) is set to price on Tuesday $737.74 million of electric system general revenue bonds, Series 2021, consisting of $368.25 million of Series 21A, serials 2022-2042; $175 million of mandatory tender bonds, Series 21B, serial 2051; and $194.49 million of taxable of Series 21C, serial 2023. Wells Fargo Corporate & Investment Banking.

The New York City Municipal Water Finance Authority (Aa1/AA+/AA+/) is set to price on Tuesday $633 million of water and sewer system second general resolution revenue bonds, Fiscal 2022 Series BB, consisting of: $545 million, Series BB-1, serials 2039, 2044-2045, and $88 million, Series BB-2, serial 2027. Raymond James & Associates.

The North Texas Higher Education Authority, Inc. is set to price $478 million of taxable student loan asset-backed notes, Series 2021-1, consisting of $118 million Series A-1A (/AA+//), $350 million Series A-1B (/AA+//), and $10 million Series 21-1B (/AA//). BofA Securities.

Illinois (/BBB+/BBB+/AA+) is set to price on Wednesday $400 million of Build Illinois Bonds sales tax revenue bonds, junior obligation taxable Series B and junior obligation tax-exempt refunding Series C. Ramirez & Co., Inc.

Atlanta (Aa3//AA-/) is set to price on Tuesday airport general revenue refunding bonds, consisting of: $45.145 million, Series 2021A (non-AMT), serials 2022-2042; $132.455 million, Series 2021B (non-AMT), serials 2022-2042; and $164.11 million, Series2021C (AMT), serials 2022-2042. Loop Capital Markets.

The Texas Transportation Commission (Aaa/AAA/AAA/) is set to price on Thursday $250 million of State of Texas general obligation mobility fund put bonds, Series 2014-B. Wells Fargo Corporate & Investment Banking.

Texas (Aaa/AAA/AAA/) is set to price on Wednesday $209.285 million of general obligation bonds, consisting of $29.03 million of water financial assistance bonds, Series 2021A, serials 2022-2046; $164.435 million of water financial assistance refunding bonds, Series 2021B, serials 2022-2038; and $15.815 million of water financial assistance refunding bonds (Economically Distressed Areas Program), Series 2021, serials 2022-2029. Raymond James & Associates, Inc.

The Washington Health Care Facilities Authority (Aa3/AA-/AA-/NR) is set to price on Tuesday $192.755 million of refunding revenue bonds, Series 2021B. Morgan Stanley & Co. LLC.

The Kentucky Public Transportation Infrastructure Authority (A2/AA//AA+) is set to price $191.81 million of taxable first tier toll revenue bonds (Downtown Crossing Project), Series 2021A, insured by Assured Guaranty Municipal Corp., serials 2021, 2025-2033, terms 2039, 2049, 2053. Citigroup Global Markets Inc.

The East Whittier City School District, Los Angeles County, California, (Aa2///) is set to price $180 million of election of 2016 general obligation bonds, Series D. RBC Capital Markets.

The Mt. Diablo Unified School District, California (Aa3///) is set to price on Thursday $170 million of refunding and forward deliver bonds. Stifel, Nicolaus & Company, Inc.

The State of Connecticut Health and Educational Facilities Authority (A2/A/A+/) is set to price $167.365 million of Hartford Healthcare revenue bonds, serials 2025-2041, terms 2046, 2051, on Tuesday. Citigroup Global Markets Inc.

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price on Tuesday $161.205 million of housing mortgage finance program social bonds. Morgan Stanley & Co. LLC.

The Milpitas Unified School District, California (Aa1/AA//) is set to price on Tuesday $150 million of general obligation bonds, serials 2022-2041, term 2046. Citigroup Global Markets Inc.

The City of Farmington, New Mexico (Baa2/BBB//) is set to price on Wednesday $146 million of pollution control revenue refunding bonds (Public Service Company of New Mexico San Juan and Four Corners Projects). U.S. Bancorp Investments Inc.

The Nebraska Public Power District (A1/A+/A+/) is set to price on Tuesday $138.845 million of general revenue bonds. Goldman Sachs & Co. LLC.

The California Municipal Finance Authority (//A-/) is set to price on Thursday $120 million of HumanGood senior living revenue bonds. Ziegler

The Mt. Diablo Unified School District, California, (Aa3///) is set to price on Thursday $170 million of refunding and forward delivery bonds. Stifel, Nicolaus & Company, Inc.

The State of Connecticut Health and Educational Facilities Authority (A2/A/A+/) is set to price $167.365 million of Hartford Healthcare revenue bonds, serials 2025-2041, terms 2046, 2051, on Tuesday. Citigroup Global Markets Inc.

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price on Tuesday $161.205 million of housing mortgage finance program social bonds. Morgan Stanley & Co. LLC.

The Milpitas Unified School District, California, (Aa1/AA//) is set to price on Tuesday $150 million of general obligation bonds, serials 2022-2041, term 2046. Citigroup Global Markets Inc.

The City of Farmington, New Mexico, (Baa2/BBB//) is set to price on Wednesday $146 million of pollution control revenue refunding bonds (Public Service Company of New Mexico San Juan and Four Corners Projects). U.S. Bancorp Investments Inc.

The Nebraska Public Power District (A1/A+/A+/) is set to price on Tuesday $138.845 million of general revenue bonds. Goldman Sachs & Co. LLC.

The California Municipal Finance Authority (//A-/) is set to price on Thursday $120 million of HumanGood senior living revenue bonds. Ziegler.

Competitive

The Massachusetts School Building Authority (Aa3/AA/AA+) is set to sell $344.335 million of taxable subordinated dedicated sales tax refunding bonds, 2021 Series A at 10 a.m. eastern on Tuesday.

Hennepin County, Minnesota, (/AAA/AAA) is set to sell $100 million of general obligation bonds, Series 2021A at 11:30 a.m. Tuesday.

Austin, Texas, (-/-/AA+) is set to sell $20.38 million of certificates of obligation, taxable series 2021 taxable, at 11:30 a.m. Tuesday.

Austin (-/-/AA+) is set to sell $29.425 million of public property finance contractual obligations, Series 2021, at 10:30 a.m. Tuesday.

Austin (-/-/AA+) is set to sell $36.535 million of certificates of obligation, Series 2021, at 10:30 a.m. Tuesday.

Austin (-/-/AA+) is set to sell $83.655 million of public improvement and refunding bonds, Taxable Series 2021 Taxable, at 11:30 a.m. Tuesday.

Austin (-/-/AA+) is set to sell $163.095 million of public improvement and refunding bonds, Series 2021, at 10:30 a.m. Tuesday.

Frederick County, Maryland, (Aaa/AAA/AAA) is set to sell $30.91 million of general obligation public facilities taxable refunding bonds, Series 2021B taxable, at 10:30 a.m. Tuesday.

Frederick County (Aaa/AAA/AAA) is set to sell $150.5 million of general obligation public facilities taxable refunding bonds, Series 2021A, at 10:15 a.m. Tuesday.

Greenville, Texas, (-/AA-/-) is set to sell $54.5 million of general obligation bonds, Series 2021, at 10 a.m. Tuesday.

Greenville (-/AA-/-) is set to sell $67.625 million of combined tax and revenue certificates of obligation, Series 2021, at 10 a.m. Tuesday.