Municipals were a touch firmer in lighter secondary trading Wednesday but mostly sat out the day as traders digested another Federal Reserve Open Market Committee 75 basis point rate hike and its impact on broader markets.

U.S. Treasury yields rose and stocks sold off after Federal Reserve's Chair Jerome Powell's press conference that signaled a more hawkish tone.

The markets initially were interpreting the Federal Open Market Committee statement as acknowledging a slowdown in rate hikes after the panel approved a fourth consecutive three-quarter point increase, but at his press conference, Powell threw some cold water on those thoughts, saying the Fed "has a ways to go" and it was "premature" to discuss a pause in hikes.

Noting that further hikes "will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2%," the statement added, the FOMC "will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

"The references in the statement the lagged impact of 'cumulative' hikes to date and to 'attaining a sufficiently restrictive stance' point to rates topping out at the beginning of next year," said Brian Coulton, Fitch Ratings' chief economist. "That said there is nothing in here to suggest any desire to pivot to rate cuts later in 2023 — rates are more likely to be on hold through the rest of next year."

The key point the Fed made "is that rather than debating the speed of rate hikes, the FOMC now prefers to debate the duration of the tightening cycle," said Eric Winograd, senior vice president and U.S. economist at AllianceBernstein. "It's more about the terminal rate now than it is about the pace of rate hikes."

James Ragan, director of wealth management research at D.A. Davidson, said Powell's comments about inflation and rates staying higher longer "pushes back on the Fed pivot narrative."

"We think there a very good chance the Fed will need to keep raising the funds rate next year beyond the 5% implied by the OIS market," said Jim Solloway, SEI chief market strategist and senior portfolio manager. "The knee-jerk reaction of markets to the statement (stocks up, yields down) reflected investors' anticipation that the Fed 's tightening cycle will end sooner than later. SEI believes this view is too optimistic given the resiliency of the U.S. economy and the stickiness of inflation. During the press conference equity prices pulled back and yields modestly advanced."

SEI expects longer-run inflation will remain between 3% and 4%.

The days moves held muni to UST ratios to recent levels. The three-year muni-UST ratio was at 70%, the five-year at 75%, the 10-year at 82% and the 30-year at 98%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the three at 70%, the five at 74%, the 10 at 84% and the 30 at 99% at a 4 p.m. read.

"Outsized inflation has proven to be a stubborn adversary and we are seeing that the effects of the Fed's aggressive tightening cycle have yet to produce consequential results with achieving price stability," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

While today's enduring inflation "has been catalyzed by a number of unprecedented factors," Lipton said he believes "patience must be applied throughout the tightening cycle as the higher rate backdrop is poised to break the inflationary fever over the foreseeable future."

Munis have so far been steady this week amid the FOMC meeting after "spending much of last week flexing its independence muscle with tax-exempt yields backing up despite more favorable technical considerations" and rallying USTs, Lipton said.

Despite the muni underperformance during the last week of October, munis outperformed UST for the entire month.

"The Fed's pathway to arrest uncontrolled inflation by pursuing a restrictive interest rate policy has created a sea of red throughout fixed income, yet munis are outperforming UST and corporate securities [year-to-date]."

Maturities 20 years and out "significantly underperformed the broader muni market last month as that part of the curve played catch-up to the UST sell-off at certain points during the month and saw active bid lists with attendant heavy withdrawals from municipal bond mutual funds," according to Lipton.

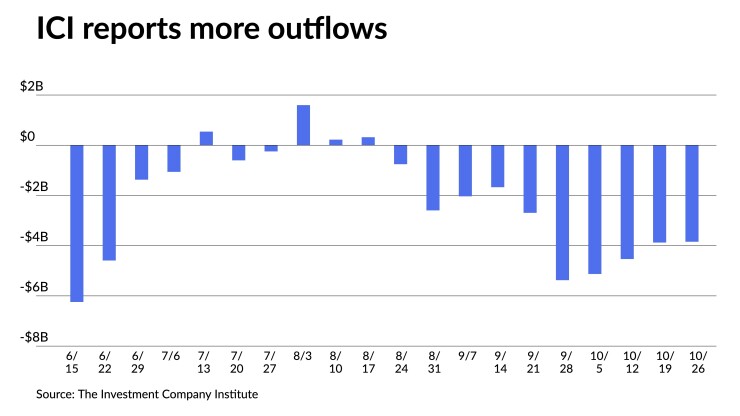

Municipal bond mutual funds saw more losses on Wednesday with the Investment Company Institute reporting another week of multi-billion-dollar outflows, bringing year-to-date losses to $119.5 billion.

Investors pulled $3.843 billion from mutual funds in the week ending Oct. 26 after $3.876 billion of outflows the previous week, according to ICI. ETFs saw inflows of $1.007 billion after $334 million of inflows the week prior, per ICI data.

Elevated secondary selling pressure and continued outflows, along with Fed policy, have contributed to

"The market volatility brought on by aggressive Fed tightening policy has kept a number of issuers sidelined, particularly as each and every FOMC meeting is billed as consequential," he said. "This dynamic certainly impacts pricing, placement and performance and makes for a very uncertain market."

Secondary trading

Charlotte, North Carolina, 5s of 2023 at 3.11%-3.06%. California 5s of 2023 at 3.09%-3.08%. Washington 5s of 2024 at 3.19%-3.18% versus 3.20%-3.19% original on Friday.

Triborough Bridge and Tunnel Authority 5s of 2027 at 3.28% versus 3.33% Tuesday. DC 5s of 2028 at 3.27%-3.25%. Maryland 5s of 2028 at 3.22%-3.23% versus 3.34%-3.31% on 10/21 and 2.98%-3.01% on 10/13.

California 5s of 2034 at 3.65% versus 3.70% Tuesday and 3.42%-3.40% on 10/14. Maryland 5s of 2035 at 3.64%-3.62% versus 3.69% Tuesday and 3.45%-3.44% on 10/13. NYC TFA 5s of 2036 at 4.10% versus 4.22% Tuesday.

NYC 5s of 2042 at 4.50% versus 4.58% Tuesday. Washington 5s of 2044 at 4.21% versus 4.32%-4.28% Tuesday and 4.32%-4.31% on 10/24. City and County of Denver 5s of 2044 at 4.13%.

LA DWP 5s of 2047 at 4.28%-4.26% versus 4.47%-4.46% on 10/26. NYC TFA 5s of 2051 at 4.71%-4.70%. Virginia 5s of 2052 at 4.13% versus 4.35% Monday and 4.39% original on 10/26.

AAA scales

Refinitiv MMD's scale was bumped two basis points: the one-year at 3.09% (-2) and 3.14% (-2) in two years. The five-year at 3.18% (-2), the 10-year at 3.32% (-2) and the 30-year at 4.04% (-2).

The ICE AAA yield curve was bumped two to five basis points: 3.10% (-4) in 2023 and 3.14% (-4) in 2024. The five-year at 3.19% (-4), the 10-year was at 3.40% (-4) and the 30-year yield was at 4.14% (-5) at a 4 p.m. read.

The IHS Markit municipal curve was bumped two basis points: 3.08% (-2) in 2023 and 3.14% (-2) in 2024. The five-year was at 3.19% (-2), the 10-year was at 3.31% (-2) and the 30-year yield was at 4.03% (-2) at a 4 p.m. read.

Bloomberg BVAL was bumped one to three basis points: 3.07% (-1) in 2023 and 3.13% (-2) in 2024. The five-year at 3.18% (-2), the 10-year at 3.31% (-3) and the 30-year at 4.05% (-1) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.595% (+5), the three-year was at 4.537% (+4), the five-year at 4.281% (+1), the seven-year 4.185% (+2), the 10-year yielding 4.078% (+4), the 20-year at 4.404% (+4) and the 30-year Treasury was yielding 4.121% (+3) at the close.

Did FOMC signal slowdown?

"The FOMC left the door open for less dramatic Fed action in future meetings," said Brent Ciliano, chief investment officer at First Citizens Bank Wealth Management. "The members are willing to slow the pace of hikes as higher rates feed into the financial system. That said, we still expect markets to remain volatile as investors navigate slowing global growth, inflation, and higher interest rates."

Given the historical nine to12 months from the last hike to the first cut, said Jan Szilagyi, Toggle AI CEO, "it's reasonable to expect the first cut to happen late in 2023 or at the latest by Q1 2024."

But some disagreed.

"At first glance, it was looking like Christmas might have come early for Wall Street," said Edward Moya, senior market analyst at OANDA. But "the Fed remains data-dependent and that should suggest that if both the next couple of inflation readings and nonfarm payroll reports remain hot, that they will remain aggressive with taking policy further into restrictive territory."

"No matter how hard you squint, there's no way of seeing today's Fed announcement as a pivot," said Morning Consult Chief Economist John Leer. "Looking ahead, Chair Powell and the committee need to see evidence of slowing core PCE and retreating inflation expectations before they take their foot off the gas, and last week's data provided them no reason to pivot."

Powell said it is more important to determine the level at which to stop rather than the pace of hikes. "We still have a ways to go," he said, refusing to suggest a half-point hike at the December meeting is the likely outcome. "It's very premature to think about pausing."

While inflation must come down "decisively," Powell said that alone wasn't the test to slow rate hikes.

A soft landing is still possible, he said, but "the path has narrowed" since inflation hasn't declined sufficiently.

"While the policy statement was initially perceived as dovish, the press conference is decidedly hawkish as the Fed commits to carry on with bringing inflation towards its targets," said Marvin Loh, senior global macro strategist at State Street. "And while longer-term inflation expectations remain fairly well anchored, continued high realized inflation risks having consumer expectations de-anchor from longer-term stability. From this perspective, the Fed will likely need to push on until it sees a series of decisively improving inflation prints, which pushes out any major changes in policy towards the second quarter, 2023 at the earliest."

Primary to come:

The City and County of Denver, Colorado (Aa3/AA-/AA-/), is set to price Thursday for and on behalf of its Department of Aviation $850 million of fixed rate non-AMT, fixed rate AMT and term rate AMT airport system revenue bonds. Barclays Capital.

The Public Finance Authority, Wisconsin, (Baa2/AA//) is set to price Thursday $210 million of project revenue bonds (CFP3 - Eastern Michigan University Student Housing Project), consisting of $209.250 million of exempts, Series A-1, and $750,000 of taxable, Series A-2, insured by Build America Mutual Assurance. Barclays Capital.

Bexar County, Texas, (Aaa/AAA/AAA/) is set to price Thursday $196 million of combination tax and revenue certificates of obligation, consisting of $46 million of Series 2022A, serials 2023-2048, and $150 million of Series 2022B, serials 2023-2048. HilltopSecurities.