The municipal market saw a flurry of deals come and go, on the day before the Federal Reserve will presumably cut interest rates.

Recent and upcoming data paint a rosy picture when it comes to the municipal bond market, according to managers and analysts.

Reflecting on last week’s deals, demand remains strong — even in the dog days of summer, according to Peter Delahunt, managing director of municipals at Raymond James & Associates.

He pointed to the New York City general obligation deal from last week as a prime example. “Strong institutional demand made it be able to clear the deal that led to the acceleration by the underwriter and the city to capitalize on that strength in the market,” he said last week after the deal’s pricing a day ahead of the originally scheduled sale date on July 24.

Meanwhile, an upcoming and expected interest rate cut on the horizon with the arrival of this week’s Federal Reserve Board meeting, municipal players said.

“Favorable data on the U.S. labor market and last week’s stronger-than-expected retail sales makes a case for reduced Fed stimulus, although various Fed officials have made it clear that a rate cut is highly likely — primarily since inflation remains below the Fed’s 2% target,” Peter Block, managing director at Ramirez & Co. wrote in a July 22 municipal week column.

In a new report on Monday, he said this week’s Fed meeting and key economic data — including the U.S. Department of Labor report on jobs Friday — will drive market attention. “The market-implied probabilities for a 25 bps Fed rate cut this Wednesday is 78%, while a 50 bps cut on Wednesday has a 22% probability,” he wrote.

Additional rate cuts of 25 basis points in September and October have 60% and 45% probabilities, respectively, according to Block. Central banks across the globe have already begun to reduce rates to counter slowing growth, including Indonesia, New Zealand, South Korea, and South Africa, Block noted.

“Besides the Wednesday FOMC meeting, the market will digest and dissect Powell’s press conference following the Fed meeting and Core PCE before that, followed by consumer confidence index for July, ISM Manufacturing Index, construction spending, trade balance, factory orders, and durable goods orders,” he wrote.

The July non-farm payroll report expects to add 160,000 jobs and the unemployment rate is expected to be unchanged at 3.7%, Block said . Meanwhile, in other segments of the municipal market, he said the pace of municipal bond sales is poised to accelerate, with the volume of state and local debt offerings scheduled for the next 30 days rising to the most in nine months.

“Governments are set to sell about $14.9 billion of bonds over the next 30 days, the highest visible supply since October 16, 2018,” Block wrote in his July 22 report. Deals already placed on the municipal bond calendar for the next 30 days “may capture only a fraction of what will actually be issued because many sales are scheduled with less than a month’s notice,” Block added.

The 30-day visible net supply is negative $20.16 billion, comprised of the addition of $13.10 billion new-issue paper against the loss of $33.26 billion in maturing and called bonds, according to Block.

“We expect net supply to reach a 2019 peak in August at negative $17 billion, which includes maturities and calls of about $46 billion and the addition of gross supply of about $30 billion, he added. “Reinvestment available from maturities and calls declines dramatically in September to December, but appears roughly balanced with expected supply at about $26 billion to $30 billion a month,” he wrote Monday.

“Continuation of strong tax-driven fund inflows — which we expect — however, should maintain good pricesupport through year-end,” Block added.

NYC TFA to sell $1.35B bonds

The New York City Transitional Finance Authority on Tuesday announced it will be selling $1.35 billion Fiscal 2020 Series A future tax secured tax-exempt and taxable subordinate bonds. The TFA said it intends to competitively sell the Fiscal 2020 Series A bonds on Aug. 6

The following subseries are gout up for bid: $128.58 million of Subseries A-1 tax-exempts; $379.335 million of Subseries A-2 tax-exempts; $342.085 million of Subseries A-3 tax-exempts; $241.325 million of Subseries A-4 taxable; and $258.675 million of Subseries A-5 taxables.

Proceeds will be used to fund capital projects.

Primary market

BofA Securities priced the Texas Private Activity Bond Surface Transportation Corp.’s (Baa3/ /BBB-) $659.08 million of senior lien revenue bonds for the NTE Mobility Partners Segments 3 LLC Segment 3C Project on Tuesday.

Morgan Stanley priced San Francisco Bay Area Rapid Transit’s (Aaa/AAA/) $511.685 million of transit district general obligation green bonds also on Tuesday. There is also a $129.24 million taxable green bond portion.

JPMorgan Securities priced Michigan Finance Authority’s $338.67 million of state aid revenue notes.

BofA also priced the City of Philadelphia's (A2/A/A-) $297.510 million of GO bonds.

Silicon Valley Clean Water, Calif., sold $209.30 million of Wastewater Revenue Notes. BofA won with a true interest cost of 1.279772%.

Tuesday’s bond sales

Secondary market

Munis were weaker in late trading on the

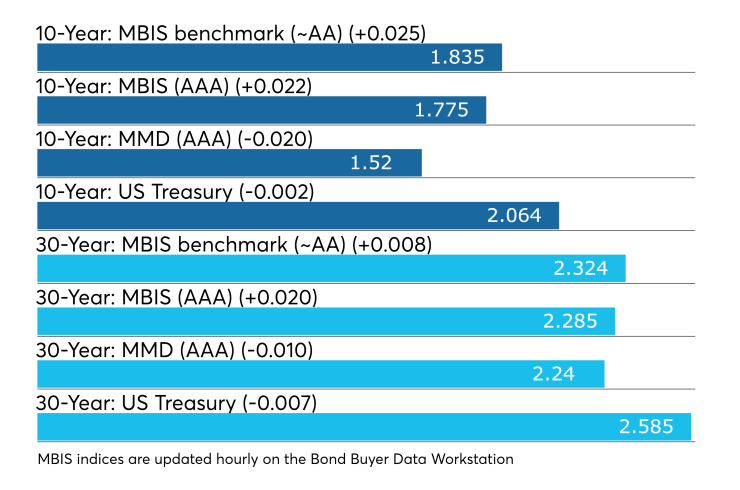

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell two basis points while the 30-year GO yield dipped one basis point to 1.52% and 2.24%, respectively.

“The ICE muni yield curve is one basis point lower as the market awaits tomorrow’s Fed decision,” ICE Data Services said in a Tuesday market comment. “High-yield and tobaccos are moving with the broader market as well. Puerto Rico is stable. Taxables are yielding one basis point higher.”

The 10-year muni-to-Treasury ratio was calculated at 72.1% while the 30-year muni-to-Treasury ratio stood at 85.7%, according to MMD.

Treasuries were little changed as stocks traded mixed. The Treasury three-month was yielding 2.090%, the two-year was yielding 1.858%, the five-year was yielding 1.852%, the 10-year was yielding 2.064% and the 30-year was yielding 2.585%.

The ICE muni yield curve is one basis point lower as the market awaits tomorrow’s Fed decision,” ICE Data Services said in a Tuesday market comment. “High-yield and tobaccos are moving with the broader market as well. Puerto Rico is stable. Taxables are yielding one basis point higher.”

Previous session's activity

The MSRB reported 28,724 trades Friday on volume of $7.737 billion. The 30-day average trade summary showed on a par amount basis of $10.64 million that customers bought $5.654million, customers sold $3.18 million and interdealer trades totaled $1.92 million.

California, Texas and New York were most traded, with the Golden State taking 17.104% of the market, the Lone Star State taking 12.314% and the Empire State taking 10.04%.

The most actively traded security was the New York State Thruway Authority 4s of 2020, which traded 19 times on volume of $35.85 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.