Municipal bonds were mixed at midday, traders said, as they prepared for the week’s $7.66 billion new issue calendar.

Secondary market

The yield on the 10-year benchmark muni general obligation fell as much as one basis point from 2.00% on Friday, while the 30-year GO yield was unchanged from 2.79%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were little changed on Monday. The yield on the two-year Treasury rose to 1.36% from 1.34% on Friday, the 10-year Treasury yield was unchanged from 2.32% and the yield on the 30-year Treasury bond was flat from 2.91%.

The 10-year muni to Treasury ratio was calculated at 86.2% on Friday, compared with 86.5% on Thursday, while the 30-year muni to Treasury ratio stood at 95.9% versus 96.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 35,437 trades on Friday on volume of $10.48 billion.

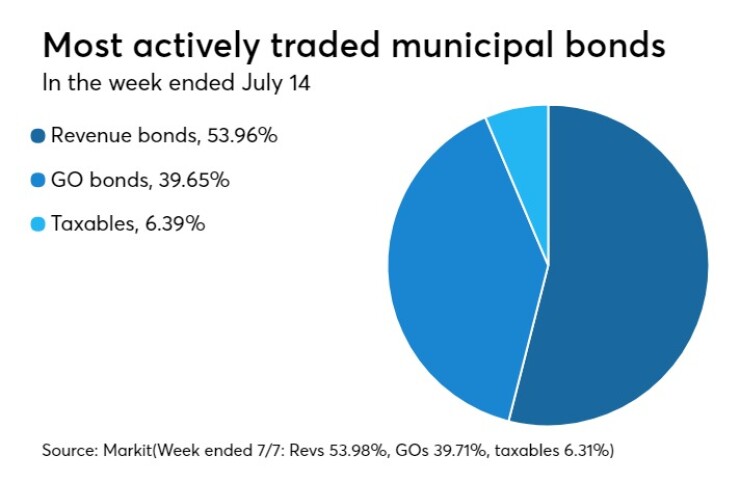

Prior week's actively traded issues

Revenue bonds comprised 53.96% of new issuance in the week ended July 14, down from 53.98% in the previous week, according to

Some of the most actively traded bonds by type were from Illinois and New York issuers.

In the GO bond sector, the Chicago Board of Education 7s of 2046 were traded 73 times. In the revenue bond sector, the New York City TFA 4s of 2036 were traded 106 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 56 times.

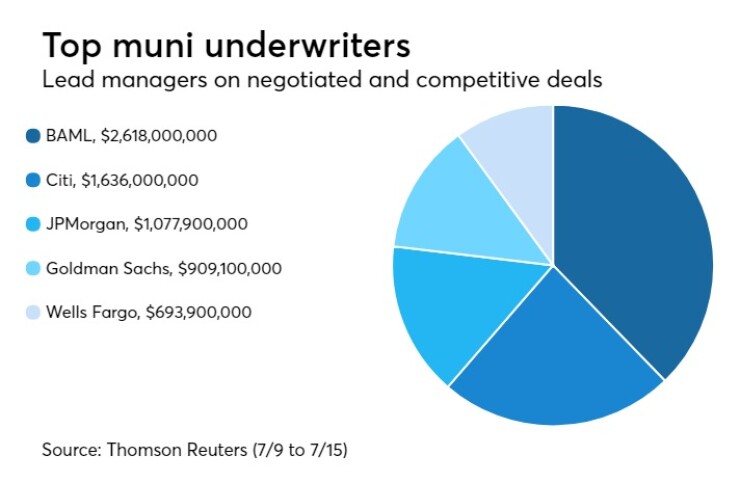

Previous week's top underwriters

The top negotiated and competitive municipal bond underwriters of last week included Bank of America Merrill Lynch, Citigroup, JPMorgan Securities, Goldman Sachs and Wells Fargo Securities, according to Thomson Reuters data.

In the week of July 9 to July 15, BAML underwrote $2.62 billion, Citi $1.64 billion, JPMorgan $1.08 billion, Goldman $909.1 million, and Wells $693.9 million.

Primary market

This week’s slate is composed of $3.99 billion of negotiated deals and $3.67 billion of competitive sales.

On Tuesday, the Dormitory Authority of the State of New York plans four separate competitive sales of state sales tax revenue bonds totaling $1.35 billion.

The DASNY deals consist of $473.08 million of Series 2017A Group C bonds, $448.74 million of Series 2017A Group B bonds, $354.68 million of Series 2017A Group A bonds and a taxable sale of $72.77 million of Series 2017B bonds.

Loop Capital Markets is expected to price the New Jersey Turnpike Authority’s $597.72 million of Series 2017B turnpike revenue bonds and Series 2017C taxable turnpike revenue bonds on Tuesday.

The deal is rated A2 by Moody’s Investors Service, A-plus by S&P Global Ratings and A by Fitch Ratings.

Also on Tuesday, Morgan Stanley is set to price the San Diego Regional Airport Authority’s $310.43 million of subordinate airport revenue bonds consisting of Series 2017A bonds not subject to the alternative minimum tax bonds and Series 2017B non-AMT bonds.

And Barclays Capital is expected to price the Connecticut Health and Educational Facilities Authority’s $250 million of Series 2014A revenue bonds as a remarketing for Yale University.

The deal is rated triple-A by Moody’s and S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $117.2 million to $9.09 billion on Monday. The total is comprised of $4.09 billion of competitive sales and $5.01 billion of negotiated deals.

BlackRock: Munis not adrift despite a shallow June dip

“The broad municipal bond index edged down in June -- its first negative performance month since the post-election sell-off,” according to BlackRock’s July 2017 municipal market update from Peter Hayes, head of the municipal bonds group, Sean Carney, head of municipal strategy, and James Schwartz, head of municipal credit research. “The U.S. Treasury and municipal curves flattened as yields rose (and prices fell) more on the short end than the long end in response to global central banks taking a more hawkish tone late in the month and the Fed reiterating its intention to continue on its path of interest rate normalization.”

The firm that manages $118 billion in municipal assets on behalf of clients also said new issuance once again largely underwhelmed expectations at just $36.8 billion, down 23% year-over-year and 6% below June’s 10-year average.

“Meanwhile, demand for the asset class remained steady, reflecting continued investor appetite for income, diversification and attractive yield,” the report said. “Municipal bond mutual funds brought in $3.3 billion, notching the largest inflow month this year and bringing year-to-date inflows to $12.7 billion. Long-term and high yield funds garnered the bulk of inflows given investors’ focus on yield.”