After a lackluster week, the municipal bond market is hoping to get back on track.

Ipreo forecasts weekly bond volume will hit $6.4 billion, up from a revised total of $4.92 billion in thepast week, according to updated data from Thomson Reuters. The calendar is composed of $4.9 billion of negotiated deals and $1.5 billion of competitive sales.

“Two factors are in play,” said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management. First "the deals were so expensive this past week, so there was a little bit of a buyers strike happening, based upon pricing" and interest rates, after a year-end rally in municipals.

Second, “there is also a lack of fund flows,” he said. “There is still a lot of cash to be re-deployed from tax loss selling, plus the New Year hangover effect is having some impact as well.”

In the past week, the calendar was top heavy, with a few larger deals dominating the market. The way the calendar is shaped for the upcoming week could also help get munis out of the rut.

“I think a chunkier calendar of deals will help. I get the feeling some investors are waiting for a bigger, deeper calendar, where they can pick and choose,” Heckman said. “The upcoming week has more choices and variety so we will see if that helps, but it will still come down to pricing.”

Traders and managers said that seasonal forces aside, the municipal market fared well during the first official trading week of the year.

The strong technical condition of the municipal market is the primary driver of performance so far this year, according to Michael Pietronico, chief executive officer of Miller Tabak Asset Management.

“As is the case in many years, there is too much money chasing too few bonds in January,” he said Friday, noting that slowing global growth should keep demand steady.

“We expect that the market will remain relatively firm throughout the month as global growth is seen as slowing, which is a favorable backdrop for bonds,” Pietronico said.

Investor demand is also being buoyed by the dovish turn by the Federal Reserve Board as it relates to monetary policy, he said.

Others agreed the strong demand is benefiting performance.“There were strong inflows to bond funds this week,” said one New York trader on Friday afternoon. “That said, there are still lots of bonds for the bid,” he added.

Stronger demand exists for bonds inside 10-years as was the case in the Massachusetts deal where maturities were heavily oversubscribed, he noted. He added that with about $6 billion expected the calendar was manageable.

Primary market

Topping the week’s slate is the

Citigroup is slated to price the bonds on Wednesday in two fixed-rate term bonds, with the $222 million maturity due in 2038 and the $329 million maturity due in 2048.

The sale wraps up the sales tax securitization refunding program the Windy City launched in 2017 to trim existing interest costs. Proceeds of the sale will refund general obligation bonds.

The deal is rated AA-minus by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

Also next week, Barclays Capital will price the New York City Municipal Water Finance Authority’s $450 million of tax-exempt fixed-rate second general resolution revenue bonds on Wednesday after a one-day retail order period.

Proceeds will be used to fund capital projects.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P and Fitch.

Citi is set to price the Massachusetts Department of Transportation’s $441 million of metropolitan highway system revenue refunding bonds on Tuesday.

The bonds are rated Aa2 by Moody’s, AA by S&P and AA-plus by Fitch.

Bond Buyer 30-day visible supply at $8.42B

The Bond Buyer's 30-day visible supply calendar increased $954.6 million to $8.42 billion for Friday. The total is comprised of $3.07 billion of competitive sales and $5.35 billion of negotiated deals.

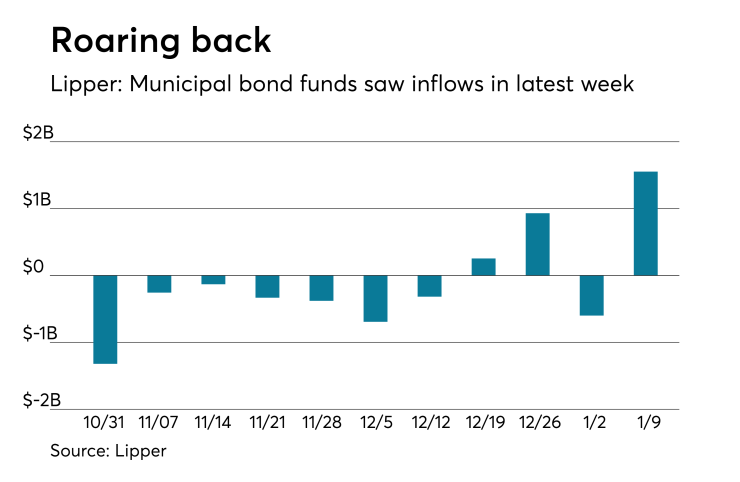

Lipper: Muni bond funds saw big inflows

Investors in municipal bond funds regained their confidence and put cash into them in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $1.554 billion of inflows in the week ended Jan. 9 after outflows of $599.194 million in the previous week.

“The persistent outflows from muni mutual funds that characterized the final three months of last year reversed decisively in the first full week of 2019, as Lipper reported $1.55 billion of inflows in the week ended January 9, the most of any week since April 2017,” according to a Friday market comment from Janney.

“The strong inflows for muni bond funds reflect the markets’ volatility,” said Daniel Berger, MMD senior market strategist.

Exchange traded funds reported inflows of $205.218 million, after inflows of $107.278 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.348 billion after outflows of $706.472 million in the previous week.

The four-week moving average remained positive at $535.216 million, after being in the green at $67.686 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $949.276 million in the latest week after outflows of $542.820 million in the previous week. Intermediate-term funds had inflows of $494.374 million after outflows of $550.066 million in the prior week.

National funds had inflows of $1.388 billion after outflows of $156.142 million in the previous week. High-yield muni funds reported inflows of $508.889 million in the latest week, after outflows of $8.143 million the previous week.

Secondary market

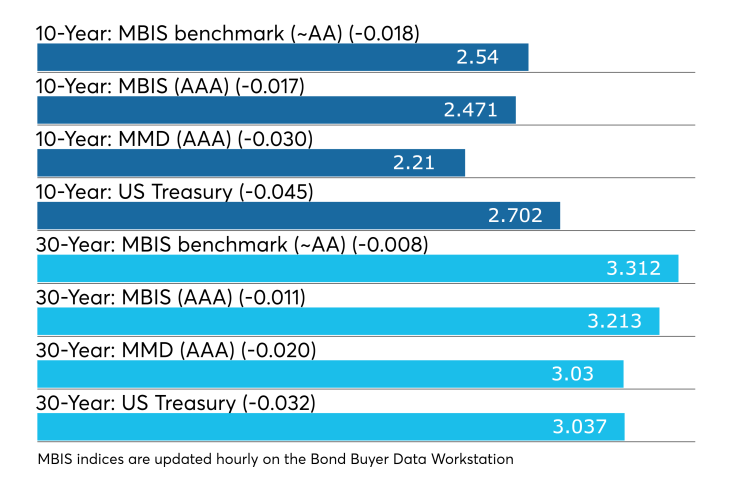

Municipal bonds were mostly stronger on Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the two- to 30-year and rose five basis points in the one-year maturity.

High-grade munis were also mostly stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the two- to 30-year maturities and rising five basis points in the one-year maturity.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity falling one to three basis points.

Treasury bonds were stronger amid stock market weakness. The Treasury 30-year was yielding 3.024%, the 10-year yield stood at 2.693%, the five-year was at 2.519%, the two-year was at 2.545% while the Treasury three-month bill stood at 2.427%.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,940 trades on Thursday on volume of $13.53 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.659% of the market, the Empire State taking 11.821% and the Lone Star State taking 8.172%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Jan. 11 were from New York, Texas and Puerto Rico issuers, according to

In the GO bond sector, the Suffolk County, N.Y., 5s of 2019 traded 99 times. In the revenue bond sector, the Texas 4s of 2019 traded 41 times. And in the taxable bond sector, the Puerto Rico Government Development Bank Recovery Authority 7.5s of 2040 traded 14 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended Jan. 11, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5.25s of 2041 were quoted by 68 unique dealers. On the ask side, the NYC taxable 5.206s of 2031 were quoted by 85 dealers. And among two-sided quotes, the California taxable 7.5s of 2034 were quoted by 25 dealers.

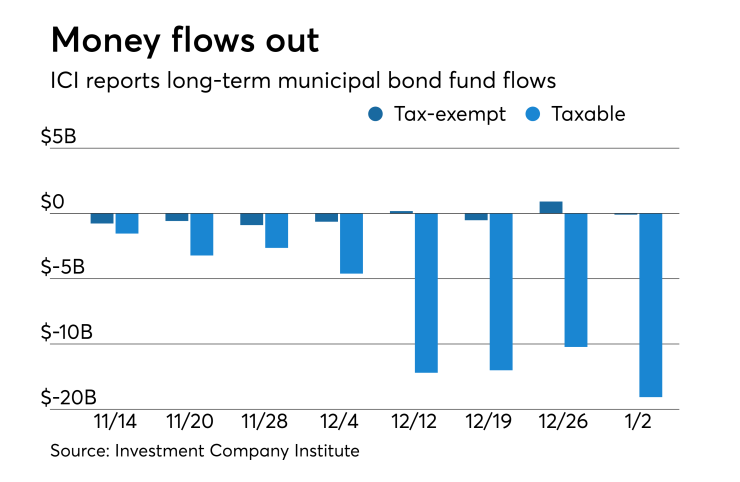

ICI: Long-term muni funds see $96M outflow

Long-term municipal bond funds and exchange-traded funds saw a combined outflow of $96 million in the week ended Jan. 2, the Investment Company Institute reported on Wednesday.

This followed an inflow of $913 million from the tax-exempt mutual funds in the week ended Dec. 26.

Long-term muni funds alone saw an outflow of $235 million while ETF muni funds saw an inflow of $139 million in the week ended Jan 2.

Taxable bond funds saw combined outflows of $14.07 billion in the latest reporting week after experiencing outflows of $10.23 billion in the previous week.

ICI said the total combined estimated outflows to long-term mutual funds and exchange-traded funds were $30.40 billion for the week ended Jan. 2 after outflows of $37.95 billion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.