Munis were firmer Thursday as U.S. Treasuries richened and equities ended down.

Muni yields were bumped one to three basis points, while UST yields were five to eight basis points lower near the close.

The two-year muni-UST ratio Thursday was at 60%, the five-year at 58%, the 10-year at 62% and the 30-year at 91%, according to Municipal Market Data's 3 p.m. EDT read. The two-year muni-UST ratio was at 59%, the five-year at 56%, the 10-year at 61% and the 30-year at 88%, according to ICE Data Services.

This year started with some big geopolitical events, Invesco CIO Mark Paris said during a Wednesday panel at The Bond Buyer's National Outlook Conference.

"We had Greenland, we had Venezuela, we had a little bit of a shutdown, but at some point, we actually see some of that smoothing out," Paris said.

Amid these events, along with other developments over the past several years, including the Ukraine War and the United States' issues with China, financial markets have been resilient, said Rick Kolman, head of municipal securities at Academy Securities, at a separate panel Thursday.

"It is amazing how, despite the long list the market has been able to work with those risks," he said. "As you move forward, that geopolitical fragmentation is going to continue to overshadow the markets, but the expectation is that the markets will coexist with all those risks."

Currently, munis are largely operating "in their own world" — ignoring rich valuations and upcoming supply, said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital, in a report.

Fundamentals are too strong with inflows, redemptions and declining money fund balances driving momentum, she said.

CreditSights estimates principal and interest credits for Feb. 15 at $20 billion, which should provide "ample distribution opportunities," Olsan said.

Money market balances have steadily fallen in recent weeks, likely adding to inquiry for fixed maturities, she said, noting the most recent balance was $142 billion, down $11 billion from a month ago.

Elsewhere, investors are "looking for a range we can play in," which is important for issuers, as timing will matter over the next several weeks, Paris said.

With issuance between $12 billion and $17 billion per week, now may not be the right time to bring a larger deal to market, he said, noting some deals that priced last year would have benefited from coming a week earlier or later.

This week boasted two large mega deals: Washington with $1.3 billion of general obligation bonds across four series and the Harris County Cultural Education Facilities Finance Corp. with $1.26 billion of revenue refunding bonds (Houston Methodist).

This continues the trend of more mega deals coming to market over the past several years.

Mega deals were rarer years ago and market participants thought there would be a yield penalty for these larger deals, Bo Daniels, head of public finance at Loop Capital Markets, said during a Wednesday panel at the conference.

However, now mega deals are more commonplace, with 63 billion-dollar-plus deals that came to market in 2025, he said.

Currently, the muni yield curve is steep, which is great for investors, Invesco's Paris said.

"Investors are going to want to go out [long], but there's not a lot of ability by the sellside to maintain that long end, and the buyside doesn't have enough of the flows to do it," he said.

Therefore, between 20 and 25 years is a "great place" to invest, instead of 30 years, where deals tend to be oversubscribed, Paris said.

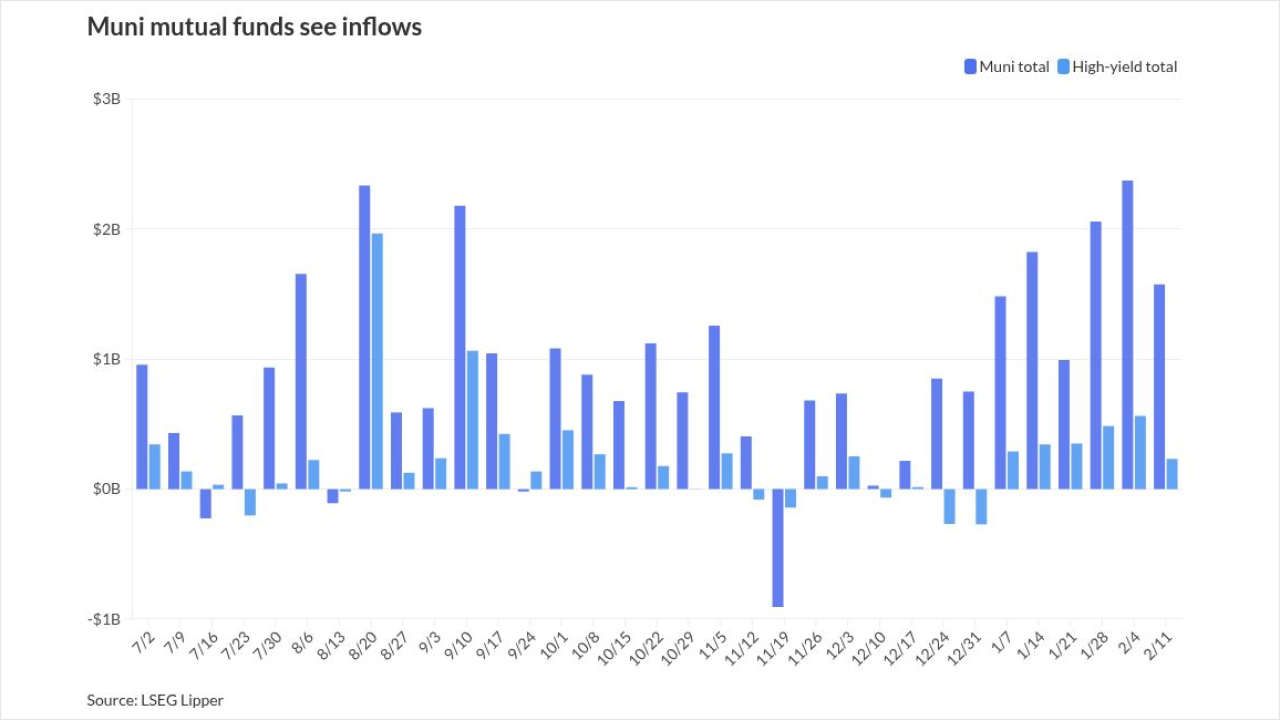

Fund flows

Investors added $1.576 billion to municipal bond mutual funds in the week ended Wednesday, following $2.374 billion of inflows the prior week, according to LSEG Lipper data. This is the fifth time over the past six weeks that inflows have topped $1 billion.

High-yield funds saw inflows of $232.8 million compared to inflows of $563.6 million the previous week.

Tax-exempt municipal money market funds saw outflows of $277.8 million for the week ending Feb. 9, bringing total assets to $142.48 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds was 1.97%.

Taxable money-fund assets saw $13.544 billion added, bringing the total to $7.591 trillion.

The average seven-day simple yield was 3.36%.

The SIFMA Swap Index was at 2.52% on Wednesday compared to the previous week's 2.17%.

New-issue market

In the primary market Thursday, BofA Securities priced for the District of Columbia Water and Sewer Authority (Aa2/AA+/AA/) $675.415 million of public utility subordinate lien revenue refunding bonds. The first tranche, $339.44 million of Series 2026A bonds, saw 5s of 10/2026 at 2.12%, 5s of 2031 at 2.34%, 5s of 2036 at 2.83%, 5s of 2041 at 3.36% and 5s of 2044 at 3.78%, callable 4/1/2036.

The second tranche, $335.975 million of green Series 2026B bonds, saw 5s of 10/2026 at 2.12%, 5s of 2031 at 2.34%, 5s of 2036 at 2.83%, 5s of 2041 at 3.36% and 5s of 2045 at 3.92%, callable 4/1/2036.

BofA Securities priced for the University of Oregon (Aa2/AA-//) $203.835 million of general revenue and refunding bonds, Series 2026A, with 5s of 4/2036 at 2.75%, 5s of 2045 at 3.88% and 5s of 2046 at 4.02%, callable 4/1/2036.

Piper Sandler priced for the Unified Government of Wyandotte County/Kansas City, Kansas, $117.175 million of sales tax special obligation revenue bonds (Northwest Speedway STAR Bond District Project), with 4s of 3/2036 at 4.18%, 4.75s of 2041 at 4.93% and 5.5s of 2046 at 5.68%, callable 3/1/2031.

In the competitive market, Virginia Beach, Virginia, (Aaa/AAA/AAA/) sold $146.63 million of GO public improvement bonds, to BofA Securities, with 5s of 8/2026 at 2.09%, 5s of 2031 at 2.20%, 5s of 2036 at 2.65%, 4s of 2041 at 3.51% and 4s of 2045 at 4.05%, callable 8/1/2036.

The city also sold $77.365 million of GO public improvement refunding bonds, to BofA Securities, with 5s of 8/2026 at 2.09%, 5s of 2031 at 2.20% and 5s of 2035 at 2.55%, noncall.

AAA scales

MMD's scale was bumped one to two basis points: 2.07% (-1) in 2027 and 2.07% (-1) in 2028. The five-year was 2.14% (-1), the 10-year was 2.55% (-2) and the 30-year was 4.29% (-2) at 3 p.m.

The ICE AAA yield curve was bumped three basis points: 2.09% (-3) in 2027 and 2.06% (-3) in 2028. The five-year was at 2.10% (-3), the 10-year was at 2.55% (-3) and the 30-year was at 4.23% (-3) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped one to two basis points: The one-year was at 2.07% (-1) in 2027 and 2.08% (-1) in 2028. The five-year was at 2.14% (-2), the 10-year was at 2.56% (-1) and the 30-year yield was at 4.23% (-1) at 3 p.m.

Bloomberg BVAL was bumped one to three basis points: 2.07% (-3) in 2027 and 2.06% (-2) in 2028. The five-year at 2.11% (-2), the 10-year at 2.53% (-2) and the 30-year at 4.14% (-1) at 4 p.m.

U.S. Treasuries were firmer.

The two-year UST was yielding 3.465% (-5), the three-year was at 3.51% (-6), the five-year at 3.667% (-8), the 10-year at 4.103% (-7), the 20-year at 4.675% (-8) and the 30-year at 4.728% (-8) near the close.