Municipal bond prices backed up significantly on Thursday as the market struggled to digest new supply. Yields tracked Treasuries higher with some maturities climbing to their highest peaks in a month.

Tax-exempt yields jumped as much as six basis points Thursday in the belly of the curve, marking the fourth day in a row of rising rates.

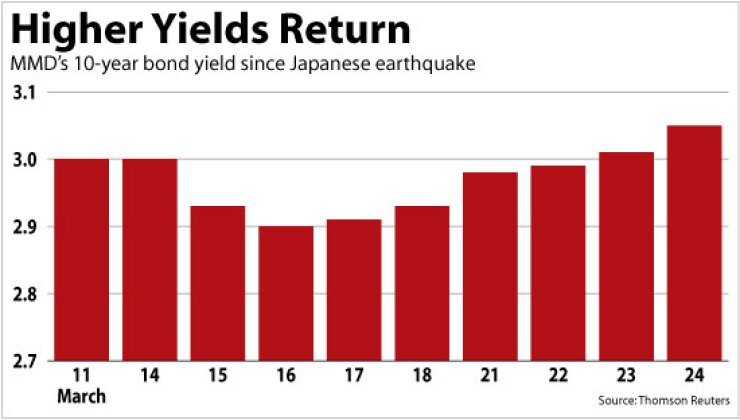

The benchmark 10-year tax-exempt muni moved up five basis points to 3.05%, the highest yield since Feb. 23, according to Municipal Market Data’s triple-A scale.

The two-year yield was lifted two basis points Thursday to 0.63%, the highest since an earthquake struck Japan on March 11 and initiated a strong flight to quality. The 30-year bond yield rose three basis points to 4.73%, a nine-day high.

“There’s some anxiety that new supply might be coming to the market,” a trader in Chicago said, adding that buyers are being selective. “There’s not a tremendous amount of built-in demand in the market right now.”

Losses in the Treasury market were more dramatic. The 10-year note climbed seven basis points on Thursday to 3.42%, while the two-year note ticked up three basis points to 0.70% and the 30-year bond yield rose four points to 4.49%.

Price discovery owing to scarce supply remains a problem for muni traders. With little direction from the primary market, there are few choices but to follow Treasuries.

A trader in Los Angeles said big moves among Treasuries are affecting munis, but for smaller moves there is still a disconnect between the two markets.

“I don’t think we’re following quite as much as we had, but the relationship is becoming more normal over time,” he added.

Municipal market participants have been saying for weeks that light supply has been keeping yields low and masking weak underlying sentiment.

That thesis gained some traction in the last few days as the biggest volume in four weeks entered the market.

That played a role in pushing the 10-year yield up 15 basis points from the 2.90% level on March 16, which was the lowest since December.

“Technically the market has moved from being really positive over the last few weeks to, at this point, a neutral position,” said the L.A. trader.

The rise in the MMD curve placed it back to levels that accurately capture what’s going on in the market, the Chicago trader said.

Traders said the give-back in yields this week doesn’t represent heightened risks so much as a return to normalcy following the strong urge to put money into safe-haven assets earlier in the month.

The Bond Buyer 20-bond index of 20-year general obligation yields rose five basis points this week to 4.91% — the same level as two weeks ago.

The revenue bond index, which measures 30-year revenue bond yields, increased two basis points in the week to 5.52%, also equivalent to two weeks ago. And the 11-bond index of higher-grade 20-year GO yields climbed four basis points to 4.64%, just one basis point below the two-week ago level.

The average weekly yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged this week at 5.64%.

“Continuing concerns about the mutual fund liquidations has dried up considerably,” the Los Angeles trader said. “The fear factor that was driving yields higher in the latter part of November is out of the market at the moment.”

Still, he said an element of anxiety still exists, and it’s not just related to the risk of new supply.

“Until we get through the budget season, which is over the next few months, I think everybody is going to be a little stressed out,” he added.

A trader in Philadelphia said muni yields didn’t get as much downdraft during the flight to safety in the wake of the Japanese calamities as Treasuries did, and they haven’t been as quick to back up, but the directions are the same.

The benchmark 10-year Treasury yield slid from 3.39% on March 11 to as low as 3.21% on March 16, before backing up to 3.42% Thursday. The 10-year tax-exempt yield moved from 3% to 2.90% over the same period, before ticking up to 3.05% Thursday.

The recent weakening is a bit surprising in light of global events — Portugal could be bailed out by the European Union, the Middle East remains in turmoil as Western militaries impose a no-fly zone in Libya, and Japan continues to deal with the risks of radiation.

New domestic data hasn’t been so hot either. New home sales tumbled to a new low in 50 years of records on Wednesday, with average housing prices declining to levels not seen since 2003, according to the Commerce Department.

Thursday’s durable goods report then showed new orders fell 0.9% in February — the second decline in 2011 — against expectations of a robust 1.5% advance.

“This is bad news given that businesses, with their healthy balance sheets, were supposed to step up to the plate and take full advantage of the new tax law that allows them to write-off nearly all purchases of machinery and equipment in 2011,” Jennifer Lee, economist at BMO Capital Markets, wrote in a research note.

The Los Angeles trader said the fixed-income market weakened and equities rose based on a longer-term view.

“You would think the housing numbers this week and durable goods this morning would raise Treasury prices higher and yields lower, but there’s still a feeling that there’s global growth going on which eventually will drive growth domestically,” he said.

He added that a lot of money did flow into Treasuries in previous weeks, “so the fact there’s some give-back isn’t so surprising.”

Guy LeBas, chief fixed-income strategist at Janney Capital Markets, called it “largely inevitable that Portugal will require external assistance” after its parliament rejected the prime minister’s austerity plan Wednesday.

LeBas said there’s a presumption in the markets that Portugal can receive a bailout, “and those presumptions are never a good thing.”

Among new issues Thursday, Montgomery, Ohio, priced for institutions $100 million of tax-exempt revenue bonds.

The deal, rated Aa3 by Moody’s Investors Service and AA-minus by Fitch Ratings, was led by Barclays Capital. Yields on the bonds ranged from 1.65% in 2012 to 4.93% in 2023, unchanged from the retail pricing Wednesday.