-

Gary Krellenstein is moving to where he thinks the action in munis is - credit analysis.

November 3 -

Moody's Investors Service calls it "the great credit shift." RBC Capital Markets calls it the new paradigm. Meredith Whitney calls it ... well, let's move on. The point is: the municipal bond market has transformed dramatically the last few years, opening doors for some and shutting doors for others.

November 2 -

Bond insurance executives made the case Wednesday that demand for their product still exists despite numerous headwinds that have reduced the insurable world of new product and created uncertainty among buyers.

November 2 -

The New York Supreme Court late Monday denied Countrywide and Bank of America’s motion to consolidate various claims against them made by four bond insurers led by MBIA Insurance Corp.

October 31 -

Munis just wouldn't budge on Friday despite a rallying Treasury market. Traders say another week of heavy supply is keeping a lid on buying new paper, but broader uncertainty is capping any big sell moves.

October 28 -

Munis just wouldn't budge on Friday despite a rallying Treasury market. Traders say another week of heavy supply is keeping a lid on buying new paper, but broader uncertainty it capping any big sell moves.

October 28 -

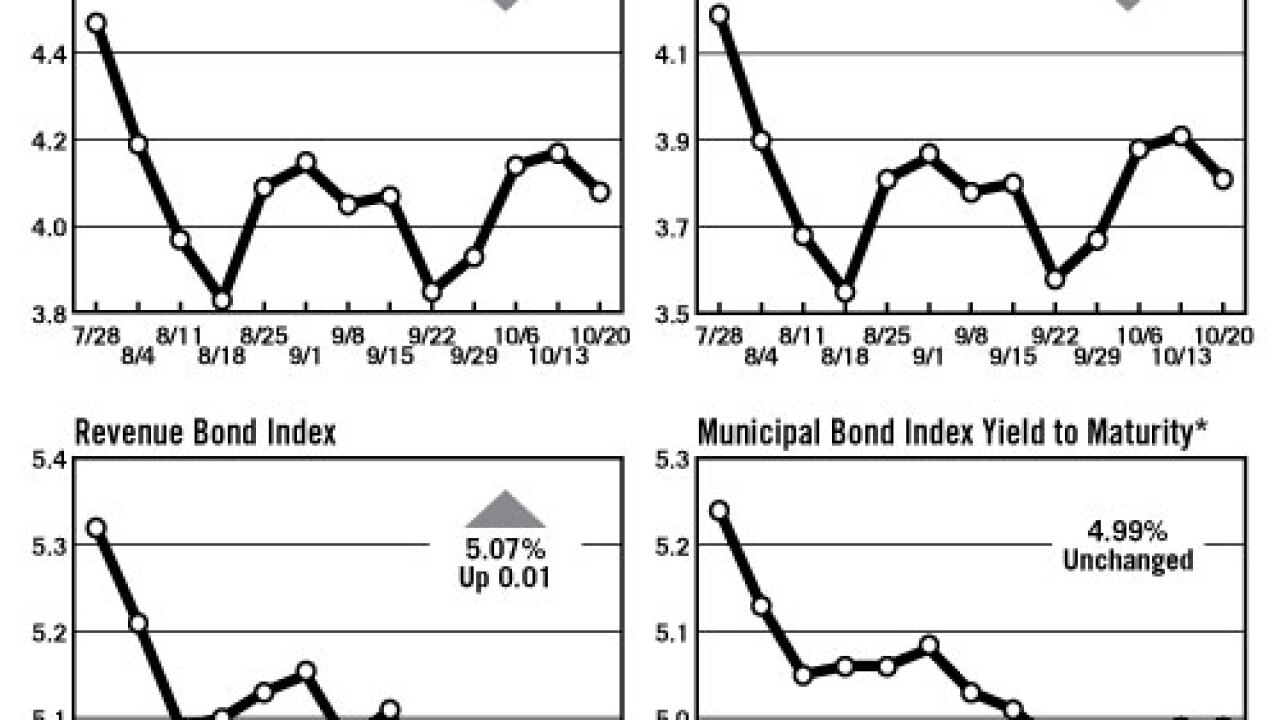

An eight basis point tightening in longer Treasury yields has yet to impact the benchmark municipal bond curve.

October 28 -

With the equity market pausing to catch its breath after a stellar rally Thursday, fixed income is back in vogue: the Treasury market has firmed across the curve and munis are slightly more attractive on a relative basis.

October 28 -

Coming off three weeks of price losses, municipal bonds staged a decent rally this week despite a jump in supply and weakness in Treasuries.

October 20 -

Super downgrades remain rare events, but they reflect a more aggressive posture by the rating agencies, market observers say.

October 20 -

Moody's Investors Service dropped the Orlando-Orange County Expressway Authority one notch to A2 on Tuesday, citing a lighter traffic outlook, reduced revenue support from the state, and deep exposure to variable-rate debt and swaps.

October 19 -

Proposals to limit the tax-exemption on municipal bonds get short shrift from the majority of market participants, but some state and local government experts on Tuesday seemed resigned to the notion that tax-reform efforts will inevitably do just that.

October 18 -

Market participants are still grappling with the pros and cons of the growing direct purchase sector for tax-exempt bonds.

October 17 -

For all the talk of credit issues driving the municipal bond market this year, only a minority of participants actually cite it as a top determinant.

October 14 -

Municipal bond yields ratcheted up more quickly the last three weeks than any other period in 2011. But instead of worrying the market, alienated investors are happy to see yields finally returning to attractive levels.

October 13 - Washington

Money market funds are supposed to be ultra-safe, but new provisions have popped up in recent years that can make it difficult for holders of variable-rate and short-term securities to interpret and monitor.

October 11 -

Municipal bonds are at some of their cheapest levels, relative to Treasuries, in market history. The problem is, most muni buyers don't care.

October 7 -

Muni yields plummeted in the wake of the Federal Reserve's Sept. 21 monetary policy meeting, prodding issuers to tap the capital markets. With back-to-back weeks of $8 billion in new supply, rates are now jumping back up.

October 6 -

A paradigm shift has transformed the municipal bond market in the last four years and RBC Capital Markets, now on the fifth rung of the underwriter ranking ladder, believes it has a firm hold on the new reality.

October 5 -

The common talking point that municipal bonds are now driven by credit rather than rates seems a bit off the mark in a week like this.

September 29