Want unlimited access to top ideas and insights?

Yields in the municipal market rose by as much as 10 basis points Thursday as selling pressure emerged on the short end of the curve following Wednesday's 50-plus basis point sell-off.

In the primary, few deals were done, though Milwaukee sold $160.825 general obligation promissory notes and GO corporate purpose bonds to Citi. Before the sale, the city sent around a supplement to the preliminary official statement which stated that due to market conditions, the city was offering to allow term bonds. The city rejected a separate $120 million RAN bid from JP Morgan.

A large $400 million Portland Oregon deal was pulled from the competitive market.

There are only three negotiated deals that are over $100 million slated for next week.

Lipper reported $749.185 million of outflows, a much lower figure than the billions of the past few weeks.

The municipal market is facing never-before-seen challenges. A work-from-home workforce scattered about, liquidity constraints, ever-growing credit concerns and a mostly shut down economy that still somehow must provide market access.

Like the middle of March, the tone in the market has moved from a strong seller’s market to one where bidders could name their price.

Credit concerns are impacting the municipal market in a large way, according to Karel Citroen, head of municipal research at investment manager Conning.

“The spread widening is causing deals that were set to price, either get repriced or postponed, now showing up as day-to-day,” Citroen said Thursday before the close of trading.

“I believe two things are happening; at more attractive levels one is starting to see good crossover demand come in, and, at the same time, the traditional investor base is becoming more concerned with the credit implications of the COVID-19 virus,” Citroen said.

Finding new pricing levels where demand and supply meet is taking some time to establish and “is very fluid day to day,” he added.

“I think credit is the issue now in our sector, usual metrics you can throw out the window as percentages are just numbers at the moment,” said one New York trader. “Not sure why we rallied 153 basis points in three days? Clearly, too far too fast and on what? Fed buying Munis? Until we address the medical issues we are facing — we won’t stop the economic fallout.”

He added that with no treatment, no vaccine and people dying every day — furloughs, state budgets in shambles, pension obligations and other issues are hyper exasperated now.

“To pick a spot-now-as an entry point to buy munis seems a bit premature,” he said. “A lot of things need to stabilize before the point is clear, such as we need clarification on Fed relief for our market and many saying already is not enough, and we don’t know much yet. I just think it’s early in the journey, and the road is bumpy.”

Traders noted the volatility and ongoing credit concerns — not to mention a lack of new issuance — continue to pose challenges for municipal traders Thursday.

“There is no forward calendar and won’t be until there is price stability,” a New York trader said Thursday afternoon.

Forced selling continues and credit spreads are widening as much as 200 basis points in spots making for a large bid-ask disconnect in the market.

“There is a big disconnect in municipals,” an Atlanta trader said.

“The bid-asked spread is extremely wide and liquidity seems to be an issue,” adding that sellers are getting penalized.

Trade flows in the last month as reported by the MSRB show a heavy preference for higher-rated credits and shorter durations, according to Kim Olsan, senior vice president at FHN Financial.

Olsan pointed out that there has been a near-even split in trading between durations inside 12 years and that past 12 years. Flow breakdowns were 16% in the 1-3 year range, 12% between 3 and 7 years and 16% in the 7-12 year part of the curve. Past 12 years 55% of volume was traded.

“As more crossover activity has occurred in municipals, dealer sales to customers are 22% higher than buys,” Olsan said. “An interesting turn in inter-dealer volume shows a drop below 15% on a daily basis (since March 1). In more constructive markets, this figure runs above 30%.”

Trading of New York credits showed yields rising dramatically.

NYC TFAs, 4s of 2044, traded at 3.26%-3.28%. On Monday, they traded at 2.52% and 2.25% on Friday.

New York MTA green bonds, 4s of 2046, traded at 4.06%. New York Thruway Authority junior indebtedness obligations, 4s of 2045, traded at 4.09%-4.00%. They traded at 2.95% on March 26.

NYC waters, 5s of 2026, traded at 1.72% (customer sold) and 1.55% (inter-dealer).

California GOs, 3s of 2036, traded at 3.08%-3.00%. On Tuesday they traded at 2.60%-2.53%.

Illinois GOs, 5s of 2039, traded at 5.72%-5.81%. On March 27, they traded at 4.60%-4.48%.

Primary market

After a promising end to last week, as yields sunk, they have headed back North this week, bringing negotiated deals to a stand-still once again.

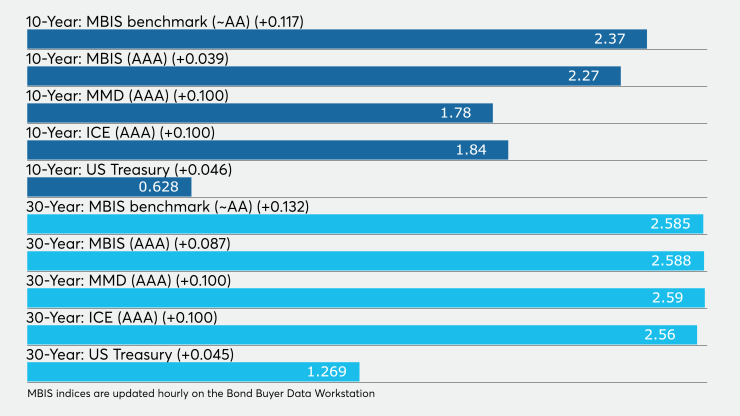

On Friday, March 27, the yield on the MMD 10-year was 1.26% and the 30-year was 1.84%. As of Thursday, the 10-year was yielding 1.78% and the long-bond was 2.59%.

In one negotiated deal that priced on Wednesday, Raymond James ran the books on Virginia Housing Development Authority’s (Aa1/AA+/ / ) $200 million of rental housing taxable bonds.

The city of Milwaukee, Wisconsin ( /AA-/AA-/ ) sold $160.825 million of general obligation promissory notes and GO corporate purpose bonds on Thursday. Citi won the bidding with a true interest cost of 2.8176%.

Before the sale, the city sent around a supplement to the preliminary official statement which stated that due to market conditions, the city is offering to allow term bonds for the Series 2020 B5 Bonds and Series 2020 T7 Bonds and that no change to the bid form is required.

Jefferies priced $134 million of revenue anticipation notes for Suffolk County, New York, but pricing details were not available.

One competitive deal was shelved due to market conditions. School District No. 1J, Multnomah County, Oregon (part of Portland Public Schools) was scheduled to sell $441.320 million of GO bonds has officially been postponed.

There is pent up demand for new issuance and an Atlanta trader suspects with the second quarter starting, more issuers might start considering deals, with the higher quality issues the first out of the gate.

“The cleaner stuff is going to be a lot easier to get accounts to look at if there’s interest for it,” he said.

He said the “hairier stuff” will be more of a challenge to sell, even though there could be people who want the yields currently offered by health care, transportation, or airport credits.

“Obviously there’s a certain inquiry for that stuff but at the same time, there are people trying to get out of that because of the threat of future downgrades,” he said.

He said the current credit widening ranges from between 50 to 200 basis points depending on the credit and maturity.

The trader said there is growing importance of underlying ratings — and investors will be especially critical of it now when considering new issues.

Secondary market

Munis were weaker on the MBIS benchmark scale Wednesday, with yields rising 11 basis points in the 10-year maturity and by 13 basis points in the 30-year maturities. High-grades were also weaker, with yields on MBIS' AAA scale increasing by three basis points in the 10-year and by eight basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO rose 10 basis points to 1.78% while 30-year increased 10 basis points to 2.59%.

The MDD muni to taxable ratio was 283.9% on the 10-year and 203.8% on the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was up 10 basis points to 1.84% while the 30-year was up 10 basis points to 2.56%.

“Municipal bonds are continuing to fall, but not nearly to the degree seen yesterday,” ICE Data Services said in a Thursday market report. “Yields on ICE muni curve are showing a parallel shift higher today, by 10 basis points at 2 p.m.”

ICE said the New York Metropolitan Transportation Authority’s tax-exempt issues have by-and-large stabilized, but that their taxable and tax-exempt zeroes remain under pressure today.

“So far today, trade volumes are in line those from yesterday,” ICE said.

BVAL saw the 10-year rise 10 basis points to 1.84% and the 30-year rose 10 basis points to 2.68%.

Stocks were on the rise and back in the green as Treasury yields were heading north.

The Dow Jones Industrial Average rose about 2.24%, the S&P 500 index increased roughly 2.28% and the Nasdaq gained roughly 1.72%.

The three-month Treasury was yielding 0.089%, the Treasury two-year was yielding 0.237%, the five-year was yielding 0.385%, the 10-year was yielding 0.628% and the 30-year was yielding 1.269%.

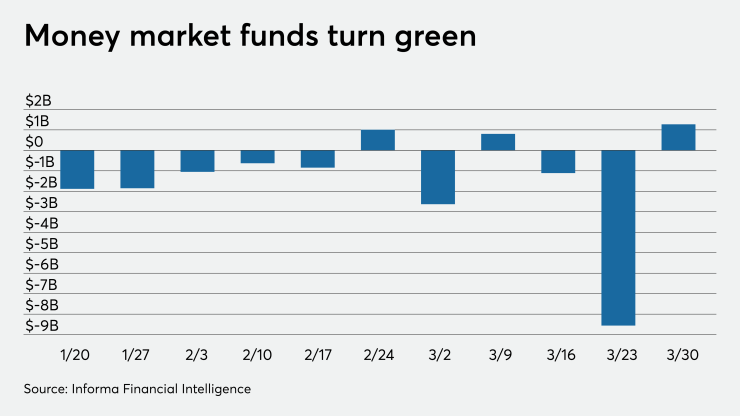

Muni money market funds reverse into positive territory

Tax-exempt municipal money market fund assets increased by $2.94 billion, raising their total net assets to $127.36 billion in the week ended March 30, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds declined to 3.31% from 3.35% in the previous week.

Taxable money-fund assets were up $162.44 billion in the week ended March 31, bringing total net assets to $4.146 trillion.

The average, seven-day simple yield for the 797 taxable reporting funds was slipped to 0.37% from 0.48% the prior week.

Overall, the combined total net assets of the 984 reporting money funds grew by $165.38 billion to $4.273 trillion in the week ended March 31.

The asset total is the largest-ever since iMoneyNet began tracking money-fund assets.

Christine Albano contributed to this report.