Munis were a touch firmer in spots as short-term U.S. Treasuries cheapened and equities ended slightly higher.

The two-year muni-UST ratio Tuesday was at 60%, the five-year at 59%, the 10-year at 62% and the 30-year at 91%, according to Municipal Market Data's 3 p.m. EDT read. The two-year muni-UST ratio was at 61%, the five-year at 58%, the 10-year at 62% and the 30-year at 90%, according to ICE Data Services.

This week will be short but busy, as investors received $12 billion of maturing and called bond principal as of Feb. 15, said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

The smaller new-issue calendar due to the holiday-shortened week should be able to "soak up" some of the reinvestment demand, they said.

Following this week, the pace of issuance should pick up, Birch Creek strategists said.

Large deals on the calendar over the next few weeks include the University of California with $2 billion of general revenue bonds, the Triborough Bridge and Tunnel Authority with $817 million of payroll mobility tax refunding bonds and the Dormitory Authority of the State of New York with $2 billion of personal income tax revenue bonds.

"While the heavy inflows coinciding with seasonally strong reinvestment cash have been extremely supportive, the technical backdrop will likely shift as we head into tax season in March and April," Birch Creek strategists said.

Accounts often tap their muni portfolios to fund tax payments, while reinvestment cash in the spring can be some of the lowest of the year, they said.

If 2026 is the third straight year of record issuance, there may be "some better entry points as the market struggles to maintain the current level of stretched valuations when supply picks up amidst a less favorable demand environment," Birch Creek strategists said.

Last week, the muni market's strong start to the year continued, but with MMD-UST ratios at "aggressive levels," it was not surprising that the muni market underperformed the strong rate rally, they said.

Muni yields fell last week, with the short end of the curve seeing the largest bumps, said Jason Wong, vice president of municipals at AmeriVet Securities.

The 2027 maturity range saw the largest bumps of 7.7 basis points, while the 2028-2043 maturity range saw yields fall five to six basis points. The 2044-2047 maturities saw bumps of two to four basis points, and the 2048-2056 maturity range saw a two-basis-point bump, he said.

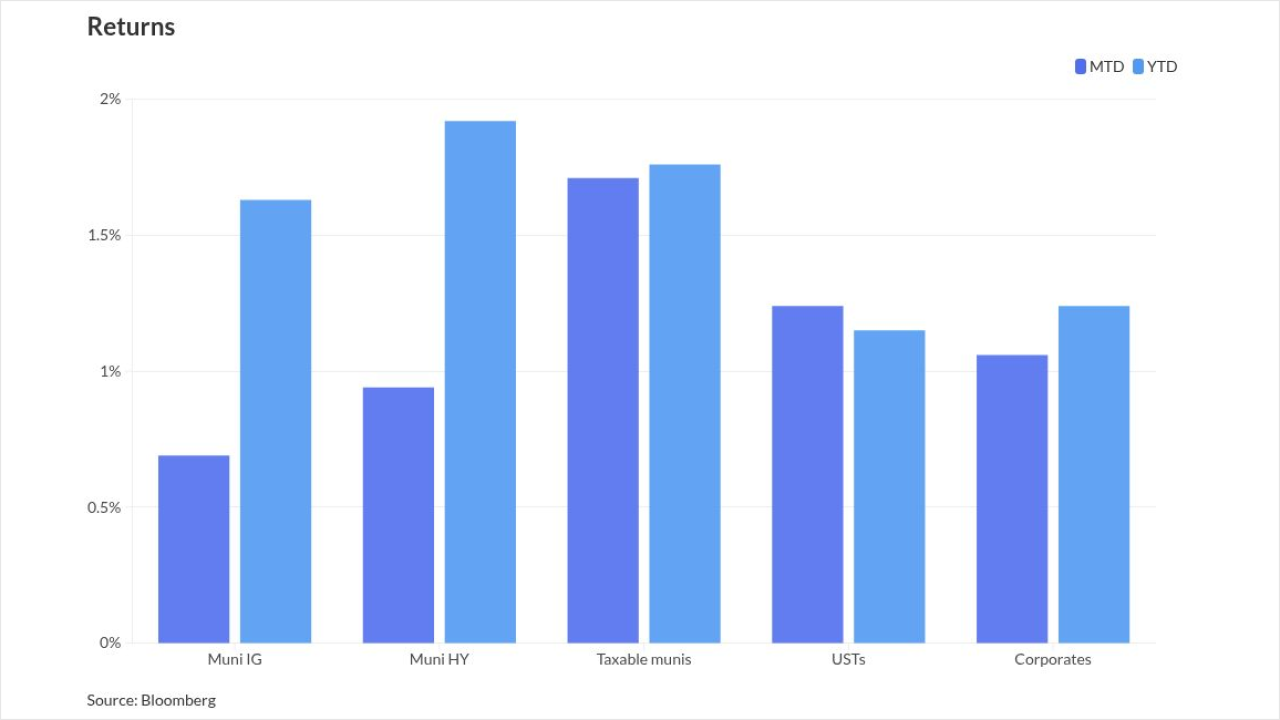

With falling yields, munis continued their rally with the month seeing gains of 0.69%, pushing year-to-date returns to 1.63%. At this point last year, munis were in the red for the month at negative 0.29% and returns for the year were only 0.21%, Wong said.

Muni mutual funds saw another strong week of fund flows, with investors adding $1.576 billion, according to LSEG Lipper data. This is the fifth time over the past six weeks that inflows have topped $1 billion.

In the primary, the heavy new-issue calendar was well received, with "most negotiated deals being oversubscribed, bumped, and trading up a few bps on the break," Birch Creek strategists said, while competitive deals were "bid very strongly and most had good follow through."

Early last week, some residual balances lingered in the longer parts of the curve, but dealers started "cleaning those up" as the week progressed and the value proposition grew, they said.

New-issue market

In the primary market Tuesday, Morgan Stanley priced for the California Community Choice Financing Authority (Baa1////) $963.98 million of green clean energy project revenue bonds, Series 2026B, with 5s of 3/2036 at 4.01%, callable 12/1/2035.

J.P. Morgan priced for the Collier County Industrial Development Authority (A1/AA/BBB+/) $110.525 million of Assured Guaranty-insured healthcare facilities revenue and (revenue refunding) bonds (NCH Healthcare System Projects). The first tranche, $55.265 million of Series 2026A, saw 5s of 10/2036 at 3.19%, 5s of 2041 at 3.75%, 5s of 2046 at 4.47% and 5.25s of 2052 at 4.72%, callable 4/1/2034.

The second tranche, $55.26 million of Series 2026B, saw 5s of 4/2035 at 3.04%, callable 4/1/2034.

AAA scales

MMD's scale was bumped one to two basis points: 2.06% (-1) in 2027 and 2.06% (-1) in 2028. The five-year was 2.13% (-1), the 10-year was 2.52% (-1) and the 30-year was 4.24% (-2) at 3 p.m.

The ICE AAA yield curve was little changed: 2.09% (unch) in 2027 and 2.07% (+1) in 2028. The five-year was at 2.09% (unch), the 10-year was at 2.53% (-1) and the 30-year was at 4.21% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to one basis point: The one-year was at 2.06% (-1) in 2027 and 2.07% (-1) in 2028. The five-year was at 2.13% (-1), the 10-year was at 2.53% (-1) and the 30-year yield was at 4.20% (unch) at 3 p.m.

Bloomberg BVAL was bumped one to two basis points: 2.05% (-1) in 2027 and 2.04% (-1) in 2028. The five-year at 2.09% (-1), the 10-year at 2.50% (-1) and the 30-year at 4.10% (-2) at 4 p.m.

U.S. Treasuries were weaker on the front end.

The two-year UST was yielding 3.438% (+3), the three-year was at 3.468% (+2), the five-year at 3.62% (+1), the 10-year at 4.053% (flat), the 20-year at 4.63% (-1) and the 30-year at 4.683% (-1) near the close.

Primary to come

Chicago (/A+/A+/A+/) is set to price Wednesday $475.83 million of non-AMT general airport senior lien revenue bonds (Chicago O'Hare International Airport), Series 2026A. Jefferies.

The Bay Area Toll Authority (/AA/AA//) is set to price Wednesday $452.905 million of San Francisco Bay Area toll bridge refunding revenue bonds, consisting of $169.515 million of Series 2026A and $283.39 million of Series 2026F-1. Barclays Capital Inc.

The South Carolina Public Service Authority (Aa3/A-/A-//) is set to price Wednesday $447.175 million of revenue obligations, consisting of $210.925 million of Series 2026A tax-exempt improvement bonds, $106 million of Series 2026B taxable improvement bonds and $130.25 million of Series 2026C tax-exempt refunding bonds. J.P. Morgan.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price Wednesday $205 million of non-AMT mortgage revenue bonds, Series 2026A. BofA Securities.

Competitive

The Miami-Dade County School District, Florida, (Aa3///) is set to sell $354.415 million of GO school refunding at 10 a.m. Eastern, Wednesday.

The Metropolitan Government of Nashville and Davidson County, Tennessee, (Aa2/AA+//AA+/) is set to sell $204.57 million of GO improvement bonds, Series 2026A, at 10 a.m. Thursday; $241.38 million of GO improvement bonds, Series 2026C, at 10:30 a.m. Thursday; and $159.03 million of GO improvement bonds, Series 2026B, at 10:15 a.m. Thursday.

Denver, Colorado, (Aaa/AAA/AAA/) is set to sell $217.575 million of GO Vibrant Denver bonds, Series 2026A, at 10:30 a.m. Wednesday and $192.500 million of taxable GO Vibrant Denver bonds, Series 2026B, at 11 a.m. Wednesday.

South Washington County Schools, Minnesota, (Aa1///) is set to sell $217.265 million of GO school building, facilities maintenance and refunding bonds, Series 2026A, at 10:30 a.m. Thursday.