Municipals were stronger Tuesday ahead of this week’s new issue calendar. Volume will rise to slightly over $5 billion, consisting of $3.7 billion of negotiated deals and $1.5 billion of competitive sales.

Primary market

“Yale University (Aaa/AAA/NR) tops the calendar with a $536 million remarketing deal,” Janney wrote in a Tuesday market comment. “Both Pennsylvania and New Jersey have turnpike issues scheduled for the week.”

Citigroup is slated to price the New Jersey Turnpike Authority’s $226 million of Series 2019A turnpike revenue bonds on Thursday.

The deal is rated A2 by Moody’s Investors Service, A-plus by S&P Global Ratings and A by Fitch Ratings. Proceeds will finance the final piece of the turnpike’s $7 billion capital improvement plan.

Wells Fargo Securities is set to price the Pennsylvania Turnpike Commission’s $85 million of first series of 2019 turnpike revenue refunding bonds on Wednesday.

The deal is rated A1 by Moody’s, A-plus by Fitch and AA-minus by Kroll Bond Rating Agency. Proceeds will refinance a 2017 issue.

Bond Buyer 30-day visible supply at $7.61B

The Bond Buyer's 30-day visible supply calendar increased $388.4 million to $7.61 billion for Tuesday. The total is comprised of $3.50 billion of competitive sales and $4.11 billion of negotiated deals.

Secondary market

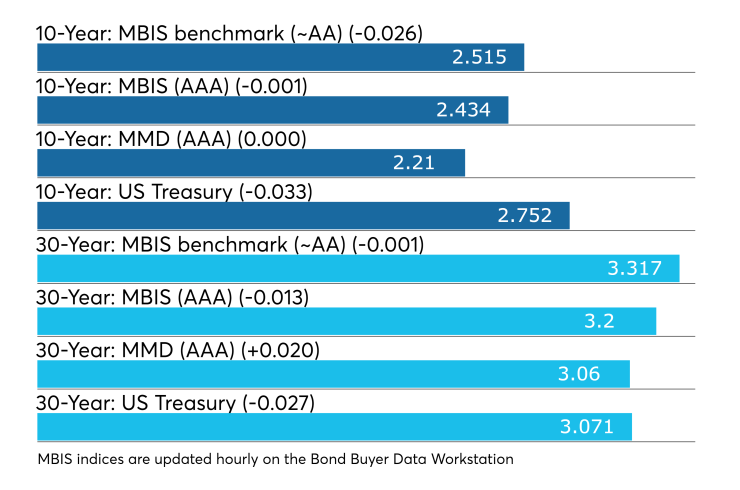

Municipal bonds were stronger on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as three basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale falling as much as three basis points across the curve.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on 30-year muni maturity rose as much as two basis points.

Treasury bonds were stronger as stock prices traded lower.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 79.4% while the 30-year muni-to-Treasury ratio stood at 99.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,358 trades on Friday on volume of $9.29 billion.

California, New York and Texas were the municipalities with the most trades, with the he Golden State taking 17.414% of the market, the Empire State taking 11.459%, and the Lone Star State taking 10.899%.

Prior week's actively traded issues

Revenue bonds comprised 56.52% of total new issuance in the week ended Jan. 18, according to

Some of the most actively traded munis by type in the week were from Puerto Rico, California and Illinois issuers.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 49 times. In the revenue bond sector, the San Francisoc Airports Commission 5s of 2049 traded 56 times. And in the taxable bond sector, the Chicago Sales Tax Securitization Corp. 4.787s of 2048 traded 31 times.

Week's actively quoted issues

Puerto Rico, Florida and California names were among the most actively quoted bonds in the week ended Jan. 18, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 6s of 2042 were quoted by 127 unique dealers. On the ask side, the Florida Hurricane Catastrophe Fund Finance Corp. taxable 2.995s of 2020 were quoted by 133 dealers. And among two-sided quotes, the California taxable 7.5s of 2034 were quoted by 22 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.