Municipals remained mixed late in Thursday's session as Treasury investors made an about-face and pulled down yields in the wake of a stock market swoon. New issues were well received and the municipal market had an improving tone on Thursday afternoon as investors continued to adjust to the new levels following a volatile week.

“The snap back in Treasuries was in response to the equity market,” and municipals benefited, a New York trader said. “With the way Treasuries sold off in the last five days and with stocks off, all of a sudden Treasuries were oversold. People are somewhat reluctant because equities are cheaper,” he added.

Overall the market is still in a transition period after muni yields rose as much as 24 basis points in the first eight trading sessions of the fourth quarter, the trader said.

Retail prefers the 4% coupons at a discount that have been available during the backup, he said, but “the last thing they want to see it volatility.”

Bonds in the secondary market, meanwhile, has already become scarce in the municipal market in response to the Treasury adjustment, he said.

“Now with the snapback, people are less willing to offer bonds and Street traders are pulling back their horns a little bit,” he said. “There is not a lot to buy.”

Secondary market

Municipal bonds were mixed on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to four-year and 10- to 28-year maturities while falling as much as a basis point in the five- to nine-year and 29- and 30-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS' AAA scale rising as much as one basis point in the one- to four-year and 10- to 26-year maturities and falling as much as two basis points in the five-to nine-year and 27-to 30-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling two basis points while the yield on 30-year muni maturity dropped four basis points.

Treasury bonds were stronger and stocks traded sharply lower.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 87.2% while the 30-year muni-to-Treasury ratio stood at 103.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 54,727 trades on Wednesday on volume of $12.06 billion.

New York, California and Texas were the municipalities with the most trades, with the Empire State taking 15.101% of the market, the Golden State taking 14.605%, and the Lone Star State taking 10.644%.

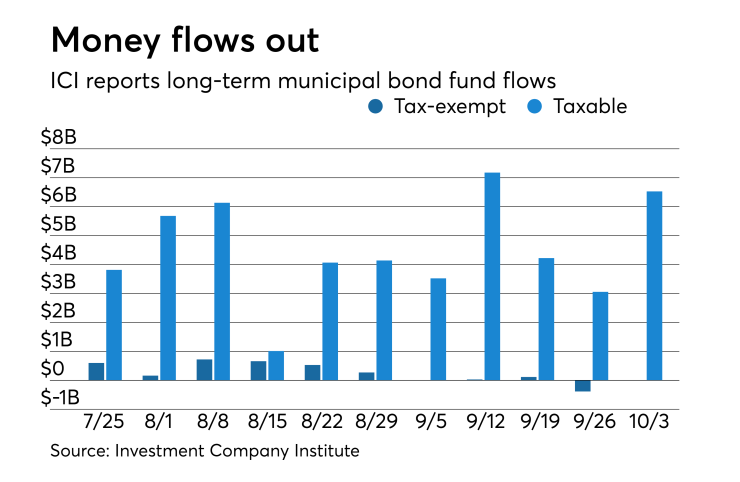

ICI: Long-term muni funds saw $2M outflow

Long-term tax-exempt municipal bond funds saw an outflow of $2 million in the week ended Oct. 3, the Investment Company Institute reported.

This followed an outflow of $385 million in the week ended Sept. 26 and inflows of $116 million. $30 million, $4 million, $273 million, $531 million, $662 million, $723 million, $163 million, and $600 million in the nine prior weeks.

Taxable bond funds saw an estimated inflow of $6.527 billion in the latest reporting week, after seeing an inflow of $2.087 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $47 million after outflows of $994 million in the prior week.

Primary market

JPMorgan Securities priced the Maricopa County Special Health Care District, Ariz.’s $422.13 million of Series 2018C general obligation bonds.

The deal is rated Aa3 by Moody’s Investors Service and AAA by Fitch Ratings.

Siebert Cisneros Shank & Co. priced the North Texas Tollway Authority’s $358.16 million of Series 2018 second tier revenue refunding bonds.

Ramirez & Co. priced the New York State Housing Finance Agency’s $135.97 million of Series 2018H affordable housing revenue bonds, climate bond certified green bonds.

The deal is rated Aa2 by Moody’s.

Wells Fargo Securities received the official award on the Pennsylvania Turnpike Commission’s $141.2 million of Series 2018B variable-rate turnpike revenue bonds.

The deal is rated A1 by Moody’s, A-plus by Fitch and AA-minus by Kroll Bond Rating Agency.

Barclays Capital and Citigroup received the official award on Franklin County, Ohio’s $127.295 million of Series 2018A hospital facilities revenue bonds, $50 million of Series 2018B hospital facilities revenue bonds and $61.14 million of Series 2011B of hospital facilities revenue refunding bonds as a remarketing for the OhioHealth Corp.

The deal is rated Aa2 by Moody’s and AA-plus by S&P Global Ratings and Fitch.

Bank of America Merrill Lynch received the official award on the Oklahoma Capital Improvement Authority’s $113.04 million of Series 2018D state agency facilities revenue bonds which are subject to an annual appropriation.

The deal is rated AA-minus by S&P and Fitch.

Thursday’s bond sales

Arizona

New York

Pennsylvania

Ohio

Oklahoma

Bond Buyer 30-day visible supply at $9. 91B

The Bond Buyer's 30-day visible supply calendar increased $411.8 million to $9.91 billion for Thursday. The total is comprised of $3.81 billion of competitive sales and $6.10 billion of negotiated deals.

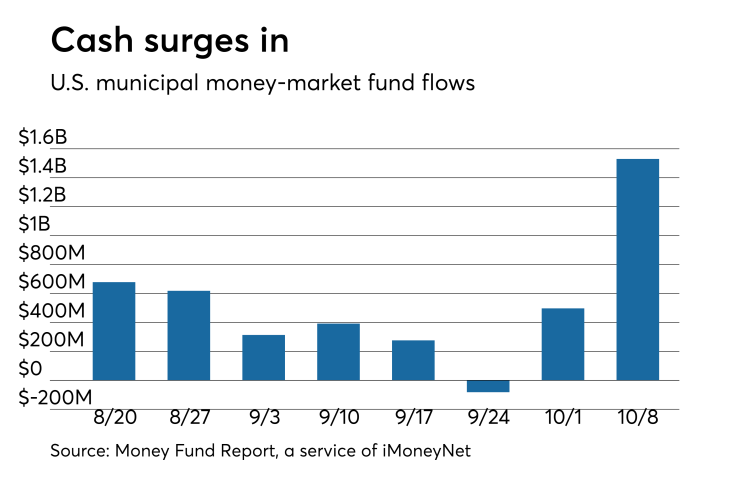

Muni money market funds see inflow

Tax-free municipal money market fund assets increased $1.53 billion, raising their total net assets to $131.52 billion in the week ended Oct. 8, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 199 tax-free and municipal money-market funds fell to 1.08% from 1.09% last week.

Taxable money-fund assets increased $14.90 billion in the week ended Oct. 9, raising total net assets to $2.718 trillion.

The average, seven-day simple yield for the 830 taxable reporting funds rose to 1.75% from 1.72% last week.

Overall, the combined total net assets of the 1,029 reporting money funds rose $16.43 billion to $2.851 trillion in the week ended Oct. 9.

Treasury details auctions

The Treasury Department announced these auctions:

- $5 billion of 29-year 4-month 1% TIPs selling on Oct. 18;

- $39 billion of 182-day bills selling on Oct. 15; and

- $45 billion of 91-day bills selling on Oct. 15.

Treasury sells re-opened 30-year bonds

The Treasury Department Thursday auctioned $15 billion of 29-year 10-month bonds with a 3% coupon at a 3.344% high yield, a price of 93.532007. The bid-to-cover ratio was 2.42.

Tenders at the high yield were allotted 5.26%. The median yield was 3.309%. The low yield was 3.230%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.