Top-shelf municipal bonds were weaker in late morning activity, according to traders, who are looking ahead to next week’s holiday-lite calendar.

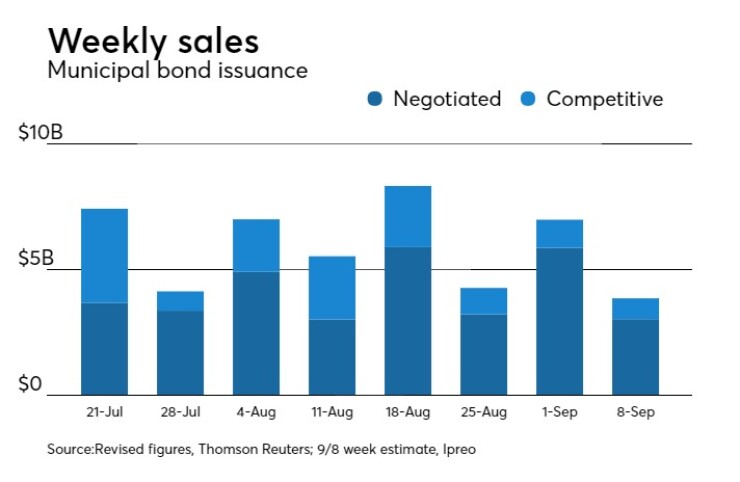

Ipreo estimates total bond volume for next week at $3.86 billion, down from a revised total of $7.02 billion this week, according to data from Thomson Reuters.

Next week’s slate is composed of $3.03 billion of negotiated deals and $828.2 million of competitive sales.

Secondary market

The municipal bond market was winding up the week ahead of the three-day holiday weekend. Markets will be closed on Monday in observance of Labor Day.

Bonds were weaker on Friday after the release of a the unemployment report for August.

Non-farm payrolls rose 156,000 last month while the unemployment rate rose to 4.4% from 4.3%. Economists surveyed by IFR Markets had expected non-farm payrolls to rise by 184,000 and the jobless rate to remain at 4.3%.

The yield on the 10-year benchmark muni general obligation rose one to two basis points from 1.86% on Wednesday, while the 30-year GO yield increased as much as one basis point from 2.70%, according to a read of Municipal Market Data's triple-A scale.

The yield on the two-year Treasury rose to 1.34% from 1.33% on Thursday, the 10-year Treasury yield gained to 2.16% from 2.13% and the yield on the 30-year Treasury bond increased to 2.77% from 2.73%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 87.7%, compared with 87.1% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 99.1% versus 98.7%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 35,165 trades on Thursday on volume of $10.97 billion.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Sept. 1 were from California, Texas and Illinois issuers, according to

In the GO bond sector, the California 4s of 2047 were traded 173 times. In the revenue bond sector, the Texas 4s of 2018 were traded 67 times. And in the taxable bond sector, the Chicago Board of Education 6.138s of 2039 were traded 26 times.

Week's actively quoted issues

Illinois and Georgia names were among the most actively quoted bonds in the week ended Sept. 1, according to Markit.

On the bid side, the Chicago Board of Education taxable 6.319s of 2029 were quoted by 67 unique dealers. On the ask side, the Metropolitan Atlanta Rapid Transit Authority revenue 3.25s of 2039 were quoted by 237 dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 27 unique dealers.

Week’s primary market

Goldman Sachs priced the state of California’s $2.54 billion of general obligation bonds. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

Goldman also priced the Southern California Public Power Authority’s $107.83 million of Series 2017-1 refunding revenue bonds for Magnolia Power Project A. The deal, which consists of mandatory put bonds, is rated AA-minus by Fitch.

RBC Capital Markets priced the Greater Orlando Aviation Authority, Fla.’s $926.57 million of Series 2017A priority subordinated airport facilities revenue bonds subject to the alternative minimum tax. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

BAML priced the Illinois Finance Authority’s $559.77 million of Series 2017 revolving fund revenue bonds issued under the state of Illinois' clean water initiative. The deal is rated AAA by S&P and Fitch.

BAML priced the Wisconsin Health and Educational Facilities Authority’s $314.44 million of Series 2017B and 2017C revenue bonds for the Marshfield Clinic Health System. The deal is rated A-minus by S&P and Fitch.

BAML priced the Oregon Housing and Community Services Department’s $110.18 million of mortgage revenue bonds for the single-family mortgage program featuring alternative-minimum tax bonds and non-AMT bonds. The deal is rated Aa2 by Moody’s.

In the competitive arena, Prince George’s County, Md., sold $480.85 million of GOs in two separate offerings. BAML won the $366.46 million of Series 2017A GO consolidated public improvement bonds with a true interest cost of 2.46%. BAML also won the $114.39 million of Series 2017B GO consolidated public improvement refunding bonds with a TIC of 1.69%. The deals are rated triple-A by Moody’s, S&P and Fitch.

Beaumont, Texas, competitively sold $113.94 million of Series 2017 unlimited tax refunding bonds. BAML won the bonds with a TIC of 2.85%. The deal, which is backed by the Permanent School Fund guarantee program, is rated AAA by S&P.

In the short-term competitive arena, the South Carolina Association of Governmental Organizations sold $131.1 million of certificates of participation in two separate offerings. BAML won the $114.95 million of Series 2017D tax-exempt COPs with a bid of 3% and a premium of $1,092,015.49, an effective rate of 0.867733%. Jefferies won the $17.15 million of Series 2017C taxable COPs with a bid of 2% and a premium of $42,184.08, an effective rate of 1.446931%. The SCAGO COPs are rated Aa1 by Moody’s.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $566.6 million to $6.36 billion on Friday. The total is comprised of $2.87 billion of competitive sales and $3.48 billion of negotiated deals.

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash into the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters drew $344.518 million of inflows in the week of Aug. 30, after inflows of $750.500 million in the previous week.

Exchange traded funds reported inflows of $80.152 million, after inflows of $126.924 million in the previous week. Ex-EFTs, muni funds saw $264.366 million of inflows, after inflows of $623.576 million in the previous week.

The four-week moving average was positive at $578.250 million, after being in the green at $528.082 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $248.440 million in the latest week after inflows of $464.851 million in the previous week. Intermediate-term funds had inflows of $35.870 million after inflows of $159.635 million in the prior week.

National funds had inflows of $339.475 million after inflows of $708.408 million in the previous week.

High-yield muni funds reported inflows of $184.234 million in the latest week, after inflows of $235.522 million the previous week.