Municipal bond traders were wrapping up the week on Thursday as the last of the big deals came to market, with issuers in Colorado, Minnesota and Florida leading the pack.

A slew of bid wanted lists in the front end of the secondary market continued to put pressure on the municipal market Thursday, ahead of next week’s manageable new-issue calendar and the Federal Open Market Committee meeting, according to a New York trader.

“The front end is getting hammered,” he said. Ratios of muni-to-treasury yields on securities maturing in one or two years "are at three-month highs and continue to get weaker.”

The pressure is creating softness in the secondary market, and he said there is “not a lot of depth” to the municipal market, which continues to be focused on new issues.

The day’s large deals in Colorado and Pennsylvania were well received, he said. “Any money that was available to be spent, was spent on the new issue side.”

Though next week’s forward calendar is manageable, the FOMC meeting is creating some nervousness among investors.

Once the meeting concludes and the market digests its outcome, investors should begin to prepare for the anticipated $5.5 billion of forward supply on the calendar, which includes billion dollar deals from New Jersey and New York issuers in October.

Their activity will “depend on the Fed and the market’s reaction to the comments coming from the Fed chief,” he said. “Right now the calendar is manageable but when you factor in the bid wanted lists it’s just been weighing heavily on the market."

In addition, with the Treasury market hovering above 3% in 10 years, “there is some concern out there overall that fixed income will continue to weaken,” the trader said. “There is some nervousness going into the calendar next week.”

Primary market

Wells Fargo Securities priced Colorado’s $500 million of Series 2018A certificates of participation. The deal is rated Aa2 by Moody’s Investors Service and AA-minus by S&P Global Ratings.

Citigroup priced Minneapolis’ $263.89 million of Series 2018A healthcare system revenue bonds for Fairview Health Services. The deal is rated A2 by Moody’s and A-plus by S&P.

In the competitive arena, Miami-Dade County, Fla., sold $223.24 million of Series 2018 transit system sales surtax revenue bonds. Bank of America Merrill Lynch won the bonds with a true interest cost of 4.0667%.

Proceeds of the sale will be used to pay the cost of some transportation and transit projects in the county.

The financial advisor is PFM Financial Advisors; bond counsel is Hogan Lovells. The deal is rated AA by S&P and Fitch.

Elsewhere in the negotiated sector, PNC Capital Markets priced the Pennsylvania Turnpike Commission’s $180.155 million of Series of 2019 turnpike revenue refunding bonds for forward delivery with an expected settlement date of Sept. 24, 2019. The deal is rated A1 by Moody’s, A-plus by Fitch Ratings and AA-minus by Kroll Bond Rating Agency.

JPMorgan Securities priced as a remarketing the N.Y. Triborough Bridge and Tunnel Authority’s $107.28 million of Series 2001B general revenue variable-rate bonds, secured overnight financing rate tender notes, for MTA bridges and tunnels. The deal is rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll.

JPMorgan also priced Mason County, W.Va.’s $100 million of Series L pollution control revenue bonds for the Appalachian Power Co, project. The deal is rated Baa1 by Moody’s and A-minus by S&P.

Thursday’s bond sales

Colorado

Florida

Minnesota

Pennsylvania

New York

West Virginia

NYC TFA plans $1.4B BARB sale

The New York City Transitional Finance Authority plans to sell next month around $1.4 billion of building aid revenue bonds, comprised of $1.2 billion of tax-exempt fixed-rate bonds and $230 million of taxable fixed-rate bonds.

Proceeds from the sale will be used to refund outstanding bonds.

The tax-exempt fixed-rates are expected to be priced on Wednesday, Oct. 17, through an underwriting syndicate led by book-running lead manager Ramirez & Co. and joint lead manager Citigroup with BAML and Jefferies serving as co-senior managers. A two-day retail order period will be held beginning Monday, Oct. 15.

Also on Oct. 17, the TFA expects to competitively sell about $230 million of taxable fixed-rate bonds.

Bond Buyer 30-day visible supply at $4.88B

The Bond Buyer's 30-day visible supply calendar decreased $255.9 million to $4.88 billion for Thursday. The total is comprised of $2.23 billion of competitive sales and $2.64 billion of negotiated deals.

Uneventful, but uncertain

While municipals are currently benefiting from healthy September volume following strong summer reinvestment demand, thy face some uncertainties, according to Matthew Gastall, executive director at Morgan Stanley Wealth Management.

“We must pay close attention to a number of important events that loom on the horizon, such as this year’s FOMC decisions, current trade tensions, and the midterm elections,” Gastall wrote in a Sept. 19 monthly municipal report. The tone of the market has been “comparably less eventful for municipals.”

Though primary market volume is hovering at nearly 8% below the year to date historical average, it is one of the dynamics that is supporting the current municipal climate, he noted.

The healthy September supply, according to Gastall, is competing for the month’s second largest volume in seven years, behind 2016’s pre-election rush.

Muni money market funds see inflows

Tax-free municipal money market fund assets increased $271.6 million, raising their total net assets to $131.10 billion in the week ended Sept. 17, according to the Money Fund Report, a service of iMoneyNet.com.

The modest inflows are a slight drop from last week’s $392 million, but makes it five straight weeks of inflows, after seeing back-to-back billion-dollar outflows. The average, seven-day simple yield for the 199 tax-free reporting funds rose to 1.04% from 1.03%.

Taxable money-fund assets decreased by $25.29 billion in the week ended Sept. 18, lowering its total net assets to $2.700 trillion. The average, seven-day simple yield for the 831 taxable reporting funds nudged up to 1.62% from 1.61% last week.

Overall, the combined total net assets of the 1,030 reporting money funds declined by $25.02 billion to $2.856 trillion in the week ended Sept.18.

Secondary market

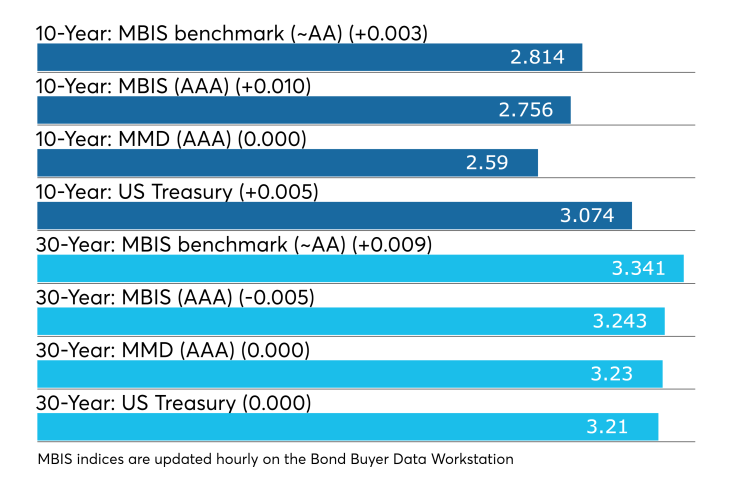

Municipal bonds were weaker on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose three basis points in the one- and two-year maturities, as much as two basis points in the three- to six-year maturities and less than a basis point in the seven- to 30-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS' AAA scale rising four basis points in the one-year maturity, rising as much as three basis points in the two- to six-year maturities and rising less than a basis point in the seven-year and 10- to 27-year maturities while falling less than a basis point in the eight- and nine-year and 28- to 30-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were mixed as stock prices traded higher.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 83.5% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,126 trades on Wednesday on volume of $12.84 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 14.245% of the market, the Lone Star State taking 14.079% and the Empire State taking 10.674%.

ICI: Long-term muni funds saw $30M inflow

Long-term tax-exempt municipal bond funds saw an inflow of $30 million in the week ended Sept. 12, the Investment Company Institute reported.

This followed an inflow of $4 million into the tax-exempt mutual funds in the week ended Sept. 5 and inflows of $273 million, $531 million, $662 million, $723 million, $163 million, $600 million, $1.765 billion, $1.028 billion and $356 million in the nine prior weeks.

Taxable bond funds saw an estimated inflow of $7.177 billion in the latest reporting week, after seeing an inflow of $3.515 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $2.088 billion for the week ended Sept. 12 after outflows of $4.204 billion in the prior week.

Treasury announces auction details

The Treasury Department announced these auctions:

- $31 billion of seven-year notes selling on Sept. 27;

- $38 billion of five-year notes selling on Sept. 25;

- $37 billion of two-year notes selling on Sept. 24;

- $17 billion of one-year 10-month floating rate notes selling on Sept. 25;

- $42 billion of 182-day bills selling on Sept. 24; and

- $48 billion of 91-day bills selling on Sept. 24.

Treasury sells TIPs

The Treasury Department sold $11 billion of inflation-indexed 9-year 10-month TIPs at a 0.910% high yield, an adjusted price of 98.890361, with a 3/4% coupon. The bid-to-cover ratio was 2.57.

Tenders at the market-clearing yield were allotted 13.36%. Among competitive tenders, the median yield was 0.855% and the low yield 0.800%, Treasury said.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.