The municipal bond market will feel like it’s still on vacation next week as supply hovers around holiday-week-type levels.

Ipreo forecasts weekly bond volume will creep up to about $3.7 billion from a revised total of $2.9 billion this week, according to updated data from Thomson Reuters. The calendar is composed of $2.5 billion of negotiated deals and $1.3 billion of competitive sales.

The Federal Open Market Committee is holding its two-day monetary policy meeting in Washington next week but is not expected to take any action on interest rates, but observers will pay close attention to any discussion of balance sheet reduction for hints of flexibility.

Primary market

The focus next week will be on the competitive arena, where several large offerings are set for sale.

On Monday, the Wauwatosa School District in Wisconsin will sell $124.9 million of general obligation school building and improvement bonds in two offerings, consisting of $63 million of Series 2019A GOs and $61.9 million of Series 2019B GOs. Proceeds will be used to finance various school improvements.

The financial advisor is Robert W. Baird; the bond counsel is Quarles & Brady. The deals are rated Aa1 by Moody’s Investors Service.

On Tuesday, Fairfax County, Va., is selling $270.3 million of public improvement bonds and refunding bonds in two offerings consisting of $225.395 million of Series 2019A bonds and $44.88 million of Series 2019 taxable refunding bonds. Proceeds will be used to finance various public and school improvements and to refund some outstanding debt.

The financial advisor is PFM Financial Advisors; the bond counsel is Norton Rose.

The deal is rated triple-A by Moody’s, S&P Global Ratings and Fitch Ratings.

Shelby County, Tenn., is selling $243.325 million of GO public improvement and school bonds in two offerings consisting of $170.865 million of Series 2019A GOs and $72.46 million of Series 2019B GO refunding bonds.

Proceeds will be used to finance various capital and school improvements and to redeem some outstanding debt.

Financial advisors are ComCap Partners and PFM Financial Advisors; the bond counsel is Butler Snow.

The deal is rated AA-plus by S&P and Fitch.

The Broward County School District, Fla., is selling $175.845 million of Series 2019 GO school bonds.

Proceeds will be used for the acquisition, construction, renovation and equipping of educational facilities within the School District, including safety enhancements and instructional technology upgrades.

The financial advisor is PFM Financial Advisors; the bond counsel are Greenberg Traurig and Edwards & Feanny. The deal is rated AA-minus by Fitch.

In the negotiated sector, the biggest offering is a $345.53 million composite deal from the Orange County Health Facilities Authority in Florida for the Orlando Health Obligated group.

The issue consists of hospital revenue bonds, forward delivery hospital revenue refunding bonds and taxable corporate CUSIP hospital revenue bonds.

Goldman Sachs is expected to price the taxable corporate CUSIP bonds on Tuesday and the tax-exempt bonds on Wednesday.

The deal is rated A2 by Moody’s and A-plus by S&P.

Bond Buyer 30-day visible supply at $5.56B

The Bond Buyer's 30-day visible supply calendar decreased $793.3 million to $5.56 billion for Friday. The total is comprised of $2.30 billion of competitive sales and $3.26 billion of negotiated deals.

Secondary market

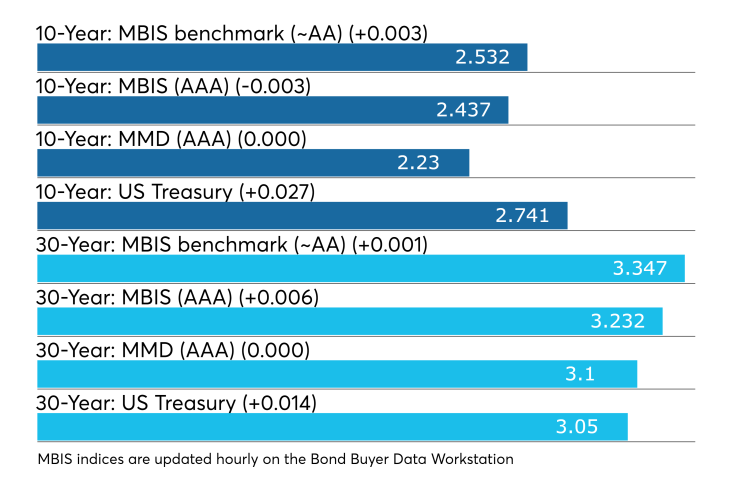

Municipal bonds were mixed on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the three- to seven-year and 16- to 25-year maturities, rose as much as one basis point in the one- and two-year, eight- to 15-year and 29- and 30-year maturities and remained unchanged in the 26- to 28-year maturities.

High-grade munis were also mixed, with muni yields falling less than one basis point in the four- to seven-year and 10- to 24-year maturities, rising less than a basis point in the one- to three-year, eight- and nine-year and 26- to 30-year maturities and remaining unchanged in the 25-year maturity.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stock prices rose.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.0% while the 30-year muni-to-Treasury ratio stood at 102.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Lipper: Muni bond funds see inflows

Investors in municipal bond funds kept their confidence and put cash into them in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $834.371 million of inflows in the week ended Jan. 23 after inflows of $945.911 million in the previous week.

Exchange traded funds reported outflows of $117.588 million, after outflows of $306.220 million in the previous week. Ex-ETFs, muni funds saw inflows of $951.959 million after inflows of $1.252 billion in the previous week.

The four-week moving average remained positive at $683.673 million, after being in the green at $707. million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $500.408 million in the latest week after inflows of $401.730 million in the previous week. Intermediate-term funds had inflows of $243.066 million after inflows of $497.610 million in the prior week.

National funds had inflows of $701.121 billion after inflows of $774.506 million in the previous week. High-yield muni funds reported inflows of $383.195 million in the latest week, after inflows of $411.038 million the previous week.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,207 trades on Thursday on volume of $14.26 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 13.178% of the market, the Empire State taking 12.069% and the Lone Star State taking 10.607%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Jan. 25 were from Texas, New York and Illinois issuers, according to

In the GO bond sector, the Birdville Independent School District, Texas, 3.75s of 2044 traded 24 times. In the revenue bond sector, the New York City Municipal Water Finance Authority 5s of 2024 traded 39 times. In the taxable bond sector, the Chicago Sales Tax Securitization Corp. 4.787s of 2048 traded 38 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended Jan. 25, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 6s of 2042 were quoted by 98 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 104 dealers. Among two-sided quotes, the California taxable 6s of 2040 were quoted by 22 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.