Municipal bonds finished stronger on Monday as the market held in while equity prices remained volatile. The primary looks to remain quiet in this holiday-shortened trading week.

Issuance so far this year totals $300 billion as of Nov. 15, down 15.8% from the same time last year, according to Lauren Sobel, a municipal research strategist and Bank of America Merrill Lynch.

“For the year-to-date, total refundings were 31% of the total issuance, compared to 52% in the same period last year,” Sobel wrote in a Monday market comment.

The ICE BAML U.S. Municipal Securities Index returned negative 0.949% for the year to date, outperforming both the ICE BAML U.S. Treasury & Agency Master Index's negative 1.887% and the ICE BAML U.S. Corporate Index's negative 3.670%, she wrote.

Primary market

This week's supply is estimated at $1.1 billion, consisting of $845.6 million of negotiated deals and $253.1 million of competitive sales. Wednesday’s trading will be curtailed at 2 p.m., ahead of the long weekend.

There are only two deals on the calendar that are over $100 million.

JPMorgan Securities is expected to price the North Carolina Turnpike Authority’s $394 million of Series 2018 senior lien turnpike revenue refunding bonds for the Triangle Expressway System on Tuesday.

The deal is rated BBB by S&P Global Ratings and BBB-minus by Fitch Ratings.

Also on Tuesday, RBC Capital Markets is set to price Colorado’s $242 million of Series 2018N tax-exempt certificates of participation for the Building Excellent School Today program.

The deal is rated Aa2 by Moody’s Investors Service and AA-minus by S&P.

There are no competitive deals over $100 million.

Last week's actively traded issues

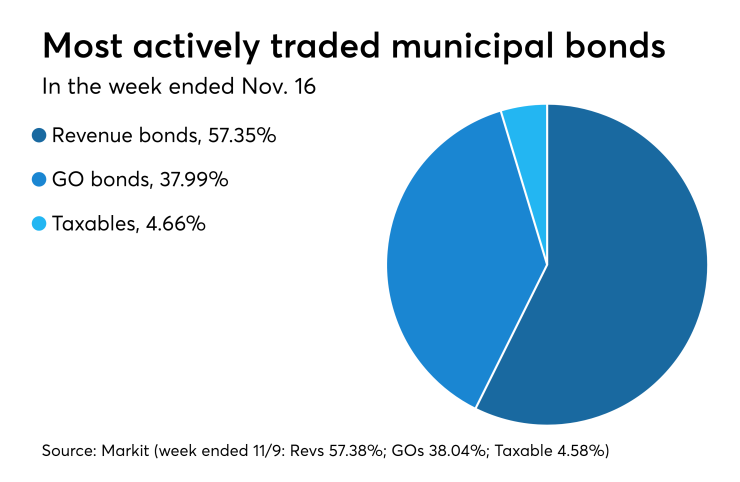

Revenue bonds comprised 57.35% of total new issuance in the week ended Nov. 16, down from 57.38% in the prior week, according to

Some of the most actively traded munis by type in the week were from Puerto Rico and South Carolina issuers.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 37 times. In the revenue bond sector, the South Carolina Jobs and Economic Development Authority 4.25s of 2048 traded 33 times. And in the taxable bond sector, the Puerto Rico Government Development Bank 4.5s of 2019 traded 10 times.

NYC to sell $1.36B GOs

New York City is planning to sell about $1.36 billion of general obligation bonds, which are comprised of $856 million of tax-exempt fixed rate bonds, $350 million of taxable fixed rate bonds and $150 million of variable-rate demand bonds, the city announced on Monday.

Proceeds from the sale will be used to fund capital projects, with the exception of a portion of the tax-exempt fixed rate bond proceeds, which will be used to convert $175 million of outstanding floating-rate bonds into fixed-rate bonds, the city said.

The tax-exempt fixed-rate bonds are slated to be priced for institutions on Thursday, Nov. 29 after a two-day retail order period by book-running lead manager Bank of America Merrill Lynch and joint lead manager Blaylock Van with Citigroup, Goldman Sachs, JPMorgan Securities, Jefferies, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co. serving as co-senior managers.

Also on Nov. 29, the City plans to competitively sell $350 million of taxable fixed-rate bonds via competitive bid.

Additionally, the city intends to sell $150 million of tax-exempt variable-rate demand bonds during the week of Dec. 17, bringing the total GO sale to $1.36 billion.

Bond Buyer 30-day visible supply at $3.38B

The Bond Buyer's 30-day visible supply calendar decreased $307.0 million to $3.38 billion for Monday. The total is comprised of $1.30 billion of competitive sales and $2.08 billion of negotiated deals.

Week's actively quoted issues

Illinois, New York and New Jersey names were among the most actively quoted bonds in the week ended Nov. 16, according to Markit.

On the bid side, the Illinois taxable 5.1s of 2033 were quoted by 32 unique dealers. On the ask side, the New York Metropolitan Transportation Authority revenue 5s of 2024 were quoted by 187 dealers. And among two-sided quotes, the New Jersey Economic Development Authority taxable 7.425s of 2029 were quoted by 26 dealers.

Prior week's top underwriters

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Wells Fargo Securities, RBC Capital Markets, Loop Capital Markets and Citigroup, according to Thomson Reuters data.

In the week of Nov. 11 to Nov. 17, BAML underwrote $1.1 billion, Wells Fargo $996.1 million, RBC $857.0 million, Loop $612.4 million and Citi $582.7 million.

Secondary market

Municipal bonds were stronger on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields dipped as much as two basis points in the one- to 30-year maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity falling one basis point.

Treasury bonds were mixed as stocks traded sharply lower. The Treasury 10-year stood at 3.056% while the Treasury 3-month bill was at 2.358%.

In late trade, the Dow Jones Industrial Average was off 1.9% while the Nasdaq Composite Index fell 3% and the S&P 500 Index lost 1.8%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 86.3% while the 30-year muni-to-Treasury ratio stood at 99.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

“The muni bond market is a mixed bag today. The investment grade issues are generically a basis point lower in yield (two basis points in the long end) while high yield names are moving the other way, by 1bp, as the lingering fallout from the FDA’s statement on flavored tobacco products and menthol cigarettes weigh on tobacco-related bonds,” ICE Data Services said in a late Monday comment. “Taxable yields are slightly outperforming their Treasury counterparts as well as moving in the same direction, causing both curves to flatten. Puerto Rico bonds are generally quiet.”

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,971 trades on Friday on volume of $12.61 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.105% of the market, the Empire State taking 12.268% and the Lone Star State taking 10.149%.

Prior week's top FAs

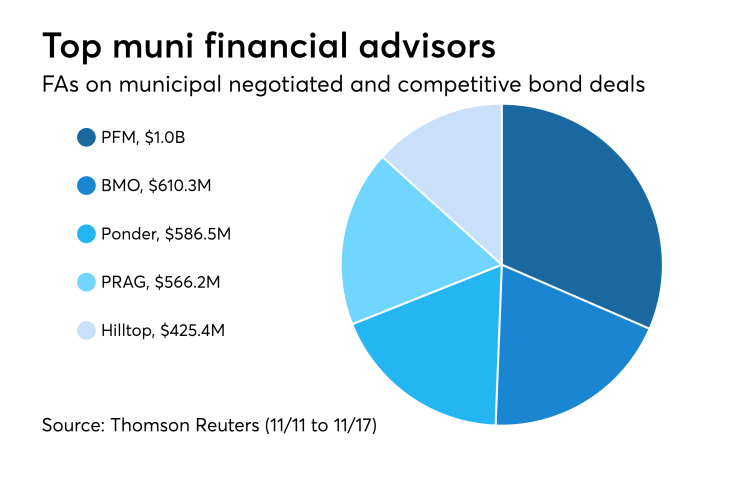

The top municipal financial advisors of last week included PFM Financial Advisors, BMO Capital Markets, Ponder & Co., Public Resources Advisory Group, and Hilltop Securities, according to Thomson Reuters data.

In the week of Nov. 11 to Nov. 17, PFM advised on $1.0 billion, BMO $610.3 million, Ponder $586.5 million, PRAG $566.2 million and Hilltop $425.4 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 90-day and 181-day discount bills were mixed, as the $42 billion of three-months incurred a 2.345% high rate, up from 2.340% the prior week, and the $36 billion of six-months incurred a 2.455% high rate, down from 2.465% the week before.

Coupon equivalents were 2.392% and 2.520%, respectively. The price for the 91s was 99.413750 and that for the 182s was 98.765681.

The median bid on the 90s was 2.315%. The low bid was 2.285%. Tenders at the high rate were allotted 73.95%. The bid-to-cover ratio was 3.06.

The median bid for the 181s was 2.430%. The low bid was 2.400%. Tenders at the high rate were allotted 89.702%. The bid-to-cover ratio was 3.16.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Tuesday. There are currently $25 billion of four-week bills outstanding.

Treasury also said it will sell $30 billion of eight-week bills Tuesday.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.