The muni market is skidding to a halt from a break-neck issuance filled two weeks, as an eerie quiet pervades ahead of the long holiday weekend.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was mixed in trading through Thursday’s midway point.

The 10-year muni benchmark yield was steady at 2.386% from Wednesday’s final read, according to

The MBIS benchmark index, which is comprised of investment-grade municipal securities, is updated hourly on the

Top-rated municipal bonds were mixed on Thursday around midday. The yield on the 10-year benchmark muni general obligation was steady at 2.13% from Wednesday, while the 30-year GO increased by as many as two basis points from 2.73%, according to a read of MMD’s triple-A scale.

U.S. Treasuries were mostly stronger around noon on Thursday. The yield on the two-year Treasury nudged up to 1.87% from 1.86%, the 10-year Treasury yield slipped to 2.48% from 2.50% and the yield on the 30-year Treasury fell to 2.84% from 2.88%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.4% compared with 84.5% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 94.9% versus 94.9%, according to MMD.

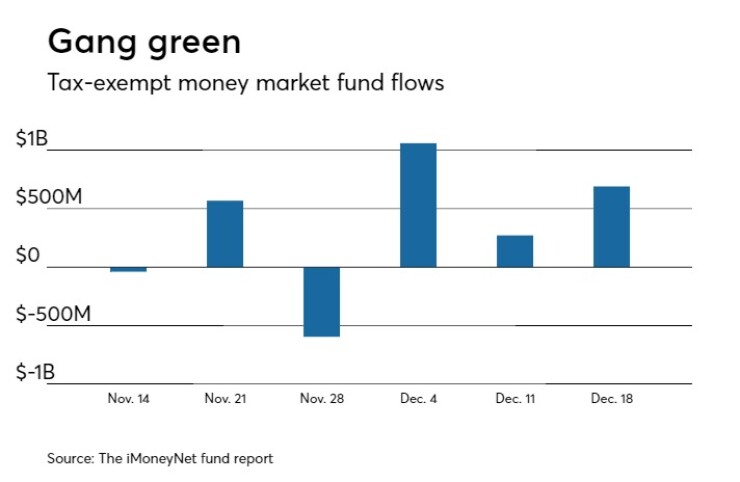

Tax-exempt money market funds saw inflows

Tax-exempt money market funds experienced inflows of $690.4 million, bringing total net assets to $131.19 billion in the week ended Dec. 18, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $271.3 million to $130.50 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds rose to 0.62% from 0.53% in the previous week.

The total net assets of the 827 weekly reporting taxable money funds decreased $22.62 billion to $2.659 trillion in the week ended Dec. 19, after an inflow of $34.30 billion to $2.682 trillion the week before.

The average, seven-day simple yield for the taxable money funds jumped to 0.85% from 0.76% from the prior week.

Overall, the combined total net assets of the 1,026 weekly reporting money funds decreased $21.93 billion to $2.791 trillion in the week ended Dec. 19, after inflows of $34.57 billion to $2.813 trillion in the prior week.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 52,688 trades on Wednesday on volume of $20.193 billion.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.49 billion to $5.18 billion on Thursday. The total is comprised of $879 million of competitive sales and $4.30 billion of negotiated deals.

Primary market

The muni market has all but come to a complete stop, with the long holiday weekend right away the corner. After weeks of fast and furious activity, where issuers rushed to market to beat impending tax legislation changes — a lot of people have decided to start the weekend early, as if often the case before a holiday.

“It has been a harrowing month of hyper-partisanship in Washington that finally led to a bi-cameral (but not bi-partisan) agreement on tax cuts,” said Natalie Cohen, senior analyst and managing director, municipal securities research, Wells Fargo. "Interestingly, the bill may not be signed for a bit, until spending caps can be lifted.”

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.