The municipal primary market Tuesday saw several new issues price, including triple-A Harvard University, and many deals repriced to lower yields. In the secondary, smaller declines in yield were seen than in the past week as participants approach this market with caution.

Meanwhile,

The secondary market saw AAA benchmark yields fall two or three basis points inside of 10 years and three basis points outside of 10 after a week straight of at least 10-basis-point bumps.

The reason for the smaller bumps on benchmarks compared to the past several sessions of 10 basis point declines is twofold.

“On one side of the fence there are those who are still engaged with decent buyers and thus they think the bumps should be bigger,” said Greg Saulnier, municipal analyst at Refinitiv MMD. On the other side, there are those who aren’t seeing any real inquiry and think the recent rally of the last week has “come a little too far too fast and they think we are due for a bit of a correction as the primary starts to get active again,” he said. “All in all, it appears we are approaching some kind of cautious calm for the time being with equal forces at play on both sides of the market, which is a good thing considering where we were a month ago.”

Several higher education, utilities, healthcare, smaller school districts and general obligations priced as dealers and issuers test municipal yields and participants look for price stability.

In the primary market, in one of the larger $100 million-plus deals, Wells Fargo priced $155 million of system revenue bonds for the Arizona Board of Regents Arizona State University, and saw its saw its levels bumped in a re-pricing by seven to nine basis points.

Goldman later in the afternoon released a pricing wire on $360 million of AAA Harvard University revenue bonds with yields nearly in lockstep with benchmarks.

Secondary market trading showed strong prints on high-grade names, especially on bonds inside of 10 years.

“High-grade spreads have tightened on the belief that all the federal government support will help stabilize balance sheets,” Robert Roffo, managing director of R&C Investment Advisors LLC, said. “High-yield credit spreads are still wide based on the uncertainty of the effect of the coronavirus and offer compelling value if one is careful.”

While bargains exist in both the investment-grade and high-yield markets, he said investors need to be careful because the credit landscape has changed and good credit research is more essential than ever.

“I believe there is good value in the municipal bond market as muni to Treasury ratios are still attractive due to the recent market dislocations, which should drive some crossover buying as additional support for the muni market,” Roffo added.

Other participants warned that both technical and fundamental concerns surrounding credit and supply could present challenges for the market going forward. But, there were welcome signs of stability, said Peter Delahunt, managing director of municipals at Raymond James & Associates.

“A fair amount of the negotiated deals have met with strong over-subscription, resulting in price bumps, and competitive sale balances have cleaned up well,” Delahunt said. “There is cash on the sidelines with an opportunistic appetite.”

He said bid-wanted activity has retreated from the recent elevated levels but remains slightly above the historically upper band of $1 billion for daily par volume.

“The benchmark scales have had more price discovery for establishing levels, and benchmark ratios to Treasuries remain de-coupled,” Delahunt said, adding that credit and coupon spreads versus the benchmark scales are beginning to normalize for the more high-grade, vanilla credits.

Secondary market trading

Secondary market trading showed strong prints, especially on the short end.

New Jersey Educational Facilities Authority 5s of 2021 traded at 0.81%-0.70%. On Thursday, they traded at 1.01%. Wake County, NC GOs, 5s of 2022, 0.87%. Austin Texas ISD 5s of 2023 traded at 0.89%. Portland Oregon waters, 5s of 2024, traded at 0.93%-0.88%. Georgia GOs, 5s of 2027, traded at 0.93%. Last Wednesday and Tuesday, they traded at 1.15%-1.18%. North Carolina GOs, 5s of 2028, traded at 0.96%. On Thursday, 1.10% and 1.18% Wednesday.

Out longer, SoCal Metro waters, 5s of 2040, traded at 1.87%-1.85%. University of Washington, 4s of 2045, traded at 2.38% and 2.60%-2.44% last Wednesday. El Paso, Texas ISD, 4s of 2048, traded at 2.31%-2.25%.

Primary market

Goldman Sachs & Co. priced $360 million of Harvard University revenue bonds for the Massachusetts Development Finance Agency (Aaa/AAA/).

The issue saw yields range from 0.89% in 2025 to 1.13% in 10 years with 5% coupons.

RBC Capital Markets priced $208 million of Hamilton County, Ohio UC Health (A3/A/) revenue bonds. The 10-year with a 5% coupon priced at 2.68%. A 132 million tranche of the long bond, 5s of 2050, yielded 3.55% while $35 million of 4s of 2050 priced to yield 3.78%.

The Arizona Board of Regents Arizona State University system revenue bonds, priced by Wells Fargo, saw its levels bumped in a re-pricing by seven to nine basis points.

Citi priced $120 million of Oklahoma State University General revenue refunding bonds for the Board of Regents for the Oklahoma Agricultural and Mechanical Colleges (/AA-/AA-).

Piper Sandler priced $88 million of utility system revenue refunding and improvement bonds for the City of New Baunfels, Texas. The bonds yielded 1.07% with a 5% coupon in 2021, 1.43% with a 5% in 10 years and 2.56% with a 4% in 2050.

In the competitive market, FHN Financial won $40 million of Barrow County, GA School District bonds (Aa1 (Aa2) state aid withholding. The 5s of 2030 yield 1.16% and 3s of 2037 yield 2.08%. A $43 million general obligation bond deal priced by PNC Capital Markets for Pittsburgh (/AA-/AA-) saw its one-year, 3s of 2021, yield 1.24%, 5s of 2030, 1.71% and 4s of 2040, 2.54%.

There were several small deals pricing with many bank-qualified in both the negotiated and competitive markets, which have increased in recent weeks.

However, the stability aside, there are potential concerns going forward, Delahunt said.

“Supply-demand technicals impact the municipal market more so than other markets due to the limited diversity of the demand universe,” he said. “The overhanging supply that has been postponed could widen spreads to clear the market if the deal flow becomes too heavy.”

Delahunt reiterated that credit impacts could also be looming.

“Even with the liquidity that was announced by the Fed for cash strapped municipalities seeking short term, 24-month financing, the fundamental credit scenario will be quite challenging,” he said, noting that the impacts will be more pronounced in sales tax, transit, healthcare, and senior care credits.

The ability of issuers to cover expenditures while revenues have evaporated is one of the potential fundamental obstacles, Delahunt said.

“Even with the various forms of aid, some credits will most likely become subject to downgrades as their financial strength continues to face struggles,” he said, pointing to more expenses, such as unemployment benefits and more Medicaid payments, while pension assets have lost value in the market demise.

The issuers that experience less revenues will be subject to sales and sales tax losses, less income and payroll tax with greater unemployment, and less capital gains taxes, Delahunt said.

“Hospitals are not performing elective surgeries and facing massive costs and overtime from the COVID crisis,” he warned. “The spread for these credits will undoubtedly widen into a ‘new normal’ as we see more downgrades.”

Secondary market data

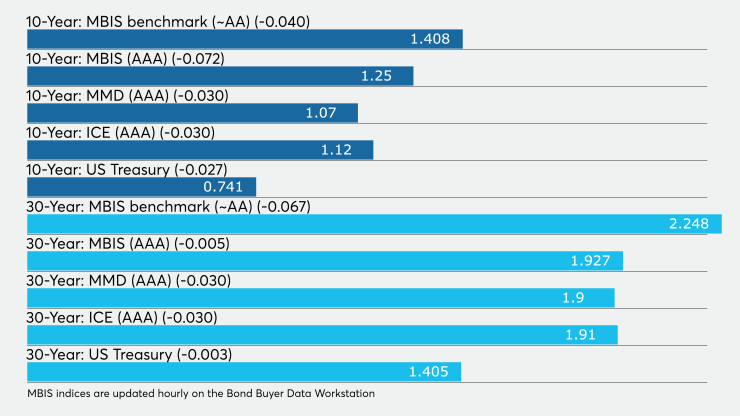

Munis were stronger on the MBIS benchmark scale Monday, with yields falling by four basis points in the 10-year maturity and by six basis points in the 30-year maturities. High-grades were also mixed, with yields on MBIS' AAA scale decreasing by seven basis points in the 10-year and decreasing by five basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO fell three basis points to 1.07% while 30-year decreased three basis points to 1.90%.

The MMD muni to taxable ratio was 141.9% on the 10-year and 134.8% on the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was down three basis points to 1.12% while the 30-year was down three basis points to 1.91%.

The ICE muni to taxable ratio on the 10-year was 155% and the 30-year was 132%.

BVAL saw the 10-year fall three basis points to 1.11% and the 30-year dropping three basis points to 1.91%.

The IHS muni curve saw the 10-year down to 1.13% and the 30-year lowering to 1.88%.

Stocks rallied as Treasury yields were steady.

The Dow Jones Industrial Average rose 2.39%, the S&P 500 index increased 3.06% and the Nasdaq was up 3.95%.

The three-month Treasury was yielding 0.22%, the Treasury two-year was yielding 0.22%, the five-year was yielding 0.42%, the 10-year was yielding 0.75% and the 30-year was yielding 1.40%.

Aaron Weitzman contributed to this report.