WASHINGTON - Moody's Investors Service changed its outlook to negative for U.S. airports in a report issued today, one of two new rating agency reports on the sector's credit.

Airline capacity reductions caused by extraordinarily expensive fuel and a troubled economy are now putting some airports in danger of credit problems, Moody's warned in its report.

Standard & Poor's released a report yesterday that put a positive light on large hub airports, saying that they tend to have better credit ratings than small and medium-sized hub airports.

Moody's said in its report that the "unprecedented inflation in the price of jet fuel" has led airlines to announce service cuts this year, and puts airlines at increased danger of bankruptcy because of the difficulty in recovering higher costs through raised ticket prices.

"Moody's believes the creditworthiness of the U.S. airport sector remains strong, but the negative industry trends ... have been more acute than expected," the rating agency said. "The degree to which these changes affect airport credit ratings will depend on the depth and duration of airline financial stress."

The agency gave airports a stable outlook for 2008 in its last report, which was issued in February, but found that during the first half of the year the national economy continued to stagnate, jet fuel prices escalated, and airlines made service cuts that led to a downward trend in air travel after February.

Drops in the number of flights and passengers are a leading indicator of looming airport credit stress "because falling passenger volumes are a precursor to airlines eventually choosing to reduce flight and gate activity or perhaps even pull out of an airport altogether," Moody's said.

The agency has changed its appraisal of some key credit factors. Moody's now has lower expectations for airport financial positions, airline seat capacity, and airline financial health. And although the report shows a stable expectation for federal funding for airports, the agency predicts airfare affordability to drop due to additional fees, inflation, and unfavorable economic conditions, and higher fuel prices.

Airport debt backed by passenger facility charges is "of particular concern" because it depends on passenger traffic, Moody's said.

But the same service cuts that will decrease airport traffic will also "help to alleviate some of the excess capacity that's been in the system the last couple of years, and it should allow the airports to have improved pricing power," Moody's analyst Kurt Krummenacker said in an interview.

Krummenacker added that airport finances have strengthened in recent years, positioning them well to limit credit impacts of a short-term industry downturn.

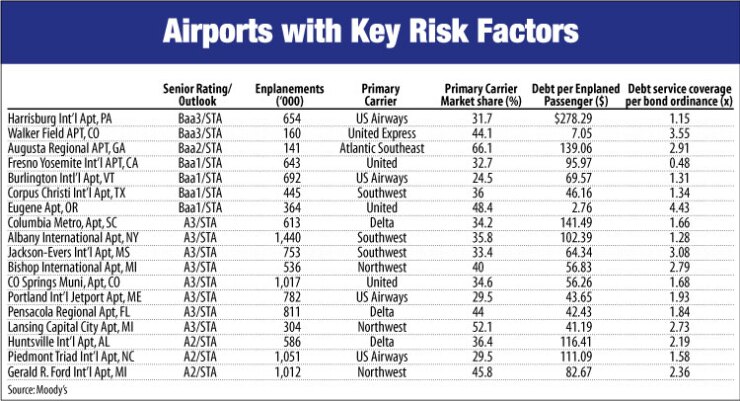

Moody's also pointed to airport size as a factor in long-term credit outlook.

"Smaller airports with limited air service will be most at risk for negative credit impacts, particularly those airports with high leverage or inflexible capital plans that require additional debt," the report said.

The Standard & Poor's report analyzed airports by rating category, hub size, and facility type based on fiscal and calendar 2006 data.

"Generally speaking, based on our analysis of the statistics, we believe that larger airports (based on passenger activity levels) typically have better credit ratings," the report said.

None of the 18 small-hub airports - airports with about 331,000 to 1.65 million annual enplanements - rated by Standard & Poor's had debt in the AA category. Only one of 29 medium-hub airports were in the AA rating category. But 25% of the 28 large-hub airports the agency rated were in the AA category.

But the distribution of hubs within credit categories was almost unchanged from a 2006 report.

Smaller airports may however be less dependent on passenger airline revenues, as opposed to hubs with more connecting flights, Standard & Poor's analyst Joseph J. Pezzimenti said in an interview.

Connector hubs "might be more susceptible or vulnerable because that traffic base is not necessarily built-in demand," he said.

Standard and Poor's analysts emphasized that location and proximity to competing airports, legal provisions in regard to protecting bond holders, and management are some other factors they consider in rating analyses, Pezzimenti said.