SAN FRANCISCO - Citing an unprecedented and unexpected 12% forecast downturn in the state's key casino gambling business revenues, Moody's Investors Service Wednesday downgraded Nevada's general obligation bonds to Aa2 from Aa1.

The downturn in gambling, "a sector that was previously believed to be recession-proof," has hammered a state general fund that is heavily dependent on gambling revenue and sales taxes, which are highly correlated with tourism and gambling, Moody's said in a news release. The state is also experiencing high residential foreclosure rates and declining home values.

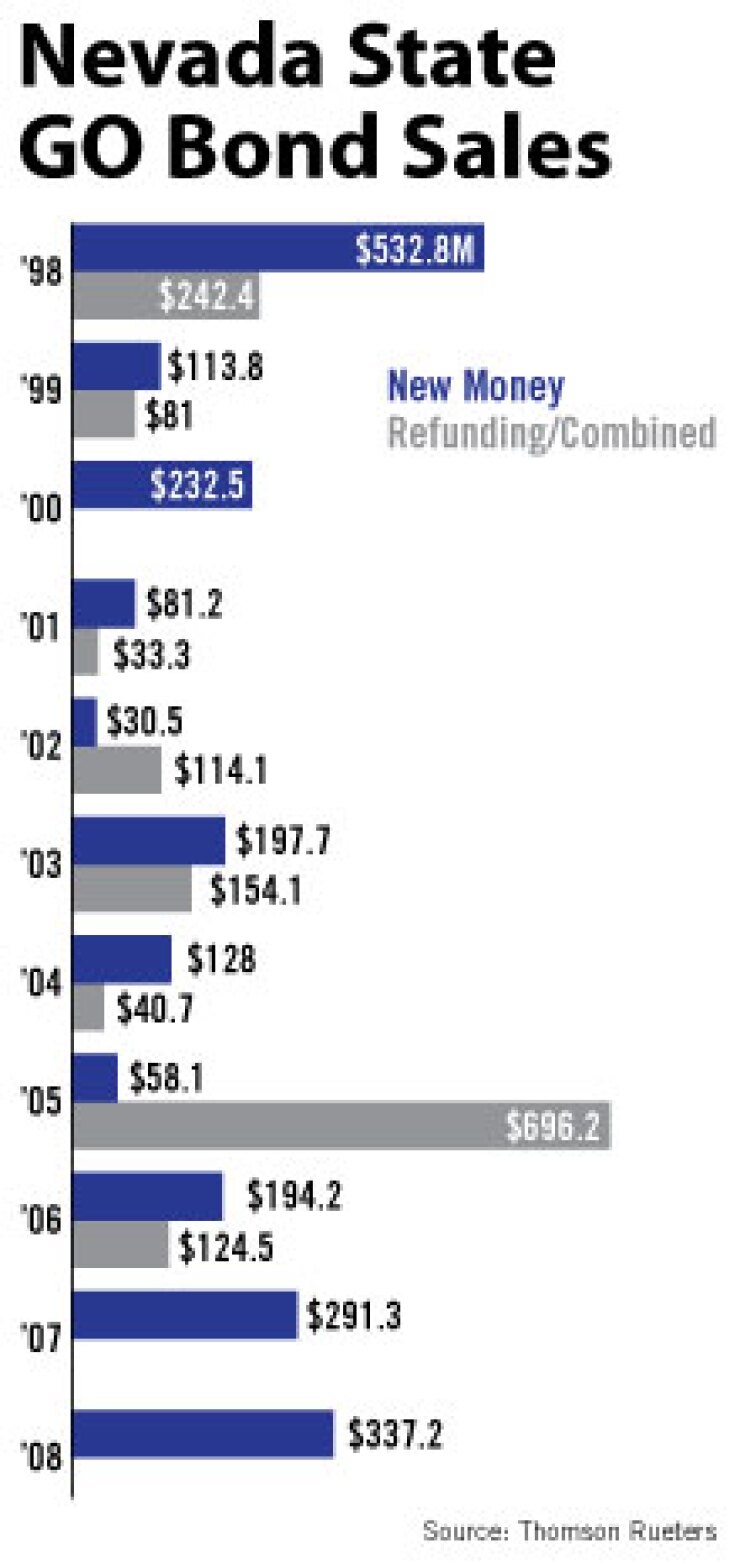

The downgrades apply to $1.4 billion of outstanding GO bonds, and also less than $100 million of lease-revenue bonds linked to the state's creditworthiness, which were dropped to Aa3 from Aa2. Moody's also revised its outlook for the state to stable from negative.

"We have worked very hard to maintain the state's high credit rating, but the financial picture in Nevada has caused Moody's to adjust the state's rating in the short term," Treasurer Kate Marshall said in a statement. "The good news is Nevada has maintained a relatively high rating throughout one of the worst financial crisis in our nation's history, testimony to the state's prudent financial practices."

The economic crash has led to a series of downward revisions to projected budget revenue, and Moody's credits state leaders for responding quickly with cuts and adjustments.

"With the rainy-day fund depleted, many funds swept of additional cash, and an unwillingness to raise revenues, however, the state's financial and budgetary flexibility has decreased," Moody's said yesterday.

Lawmakers are currently working in Carson City on a two-year budget of roughly $6 billion. They are currently negotiating on a package that would impose about $780 million in tax increases to restore some of the cuts proposed in Gov. Jim Gibbons' budget, according to published reports. They would need two-thirds majorities to override his veto threat.

Lawmakers are also hashing out the capital budget that is financed with Nevada GOs. Those bonds are repaid with a state property tax levy. Though the numbers aren't finalized, officials expected to have less capacity for new GO issuance in the 2011 biennium than the current one, according to Lori Chatwood, deputy treasurer for debt management.

As rating positives, Moody's cited conservative financial management practices and a relatively light debt burden compared to 50-state medians.

Standard & Poor's assigns Nevada GOs its AA-plus rating and a stable outlook, while Fitch Ratings assigns its AA-plus rating and a negative outlook.