CHICAGO - Minnesota hits the market next week with $468 million of state general fund appropriation bonds for the Minnesota Vikings' new $975 million football stadium.

After years of contentious debate amid fears the National Football League team would move to Los Angeles or somewhere else, state lawmakers in 2012 authorized bonds with up to $498 million of net proceeds to cover the state's $350 million share of the stadium's cost and Minneapolis' $150 million commitment. The team is responsible for the remainder.

The result is next week's deal, offering two series of bonds including a $397.7 million tax-exempt tranche and a $70.3 million taxable tranche. The state will take retail orders on the tax-exempt piece and indications on the taxable series on Monday with the institutional pricing for both set for Tuesday.

The tax-exempt piece matures through 2043 with principal repayment beginning in 2015. The tentative structure on the tax-exempt securities calls for term bonds of $89 million in 2038 and $114 million in 2043. Term bonds in 2034 for $12.6 million and in 2043 for $32.6 million are planned. The tax-exempt piece features a 10-year call and the taxable a 10-year make-whole call.

RBC Capital Markets will run the books with JPMorgan and Wells Fargo Securities serving as co-senior managers. Another five firms — Piper Jaffray & Co., Morgan Stanley, Citi, Cronin & Co. Inc., and Loop Capital Markets LLC — are co-managers. Public Financial Management Inc. is financial advisor and Kutak Rock is bond counsel.

The state has carved a series of revenue sources to repay the bonds but earmarked revenues have proven tenuous and the state is stressing with investors that no specific revenue stream is pledged to the bonds but instead a sturdier general fund appropriation pledge.

"The appropriations from the general fund constitute a continuing appropriation that does not require any further action by the Legislature for payments to be made in future years," Kristin Hanson, assistant commissioner of treasury for Minnesota Management and Budget said on an investor roadshow posted with the deal's offering statement.

"Given that debt service will be paid from the state's general fund, the performance of these offsetting revenues is not a rating factor," Fitch Ratings said in its report on the sale.

The state carries general obligation ratings in the high-double-A category from all three rating agencies and appropriation-backed ratings of AA from Fitch and Standard & Poor's. Fitch affirmed the rating Wednesday. The state's only other appropriation backed deal was a tobacco refunding sold last year.

Like most appropriation pledges, the legislature could vote to alter it and the governor has un-allotment powers when state revenues are faltering. The state stresses that governors have never unalloted debt service funds.

"Fitch would expect an issuer of the strong credit quality of Minnesota to continue to protect its debt service obligations," analysts wrote.

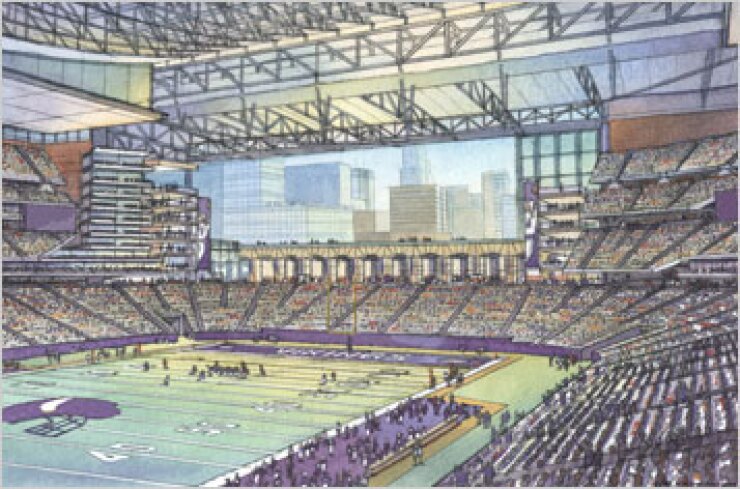

The 65,000-seat stadium is expected to open for the 2016 season. It's being built adjacent to the team's current home, the 31-year-old Hubert H. Humphrey Metrodome.

The sale will cover all of the public costs of the stadium, Hanson said. The taxable piece will finance the state's costs for the team's locker room and other facilities and corporate suites with a heavier private use. The state opted for a 30-year term on the bonds to match the term of the lease.

The state is promoting the deal with retail investors by offering $1,000 denominations as an opportunity to invest in what's been dubbed by Gov. Mark Dayton as "the people's stadium."

The state originally intended to repay its share of the borrowing through an expansion of charitable gambling. Revenues have fallen sharply short of expectations, so state lawmakers last year approved a backup plan that set aside funds from a cigarette tax increase and corporate tax changes approved earlier in the year.

Minneapolis will repay its share beginning in 2021 by redirecting a portion of its existing 0.5% convention sales taxes and hospitality taxes.

The bond sale was originally expected last summer but it was put off as the public agency overseeing the construction process - the Minnesota Sports Facilities Authority - finalized various construction agreements with the Vikings, who signed a 30 year lease. A groundbreaking was held last month.

The roadshow provides investors with an overview of the state's financial condition which was bolstered over the last year by both an improving economy and tax increases. The state's $38.3 billion two-year budget signed last year included an income tax on higher earners, a cigarette tax hike, and corporate income tax changes.

The November forecast showed gambling revenues are still falling far short of expectations and debt service requirements for the stadium, but that's primarily a political issue now given the appropriation pledge behind the bonds. The forecast estimated gambling tax receipts at $88 million in the next biennium, down $64 million from prior estimates.

The Vikings also underperformed, finishing 2013 with a 5-10-1 record.

The forecast projected that all of the $20 million redirected from various corporate sales taxes annually beginning in fiscal 2014 under the backup plan will be needed over the next few years for stadium purposes.

A special stadium reserve fund bolstered by an infusion of $26.5 million with one-time cigarette floor stocks tax receipts as part of the backup plan is expected to hold $36 million at the end of fiscal 2014, an increase of $9 million from previous estimates. The reserve balance will drop to $18 million at the end of fiscal 2015, and to zero by fiscal 2016.