Michigan’s COVID-19-caused tax revenue wounds will extend throughout fiscal 2021 but the pain won’t run as deep as previously expected thanks to the federal government’s helping hand and consumer spending habits.

The state is projecting a 4.9% drop in revenue from fiscal 2020 but the picture has brightened since August projections, according to

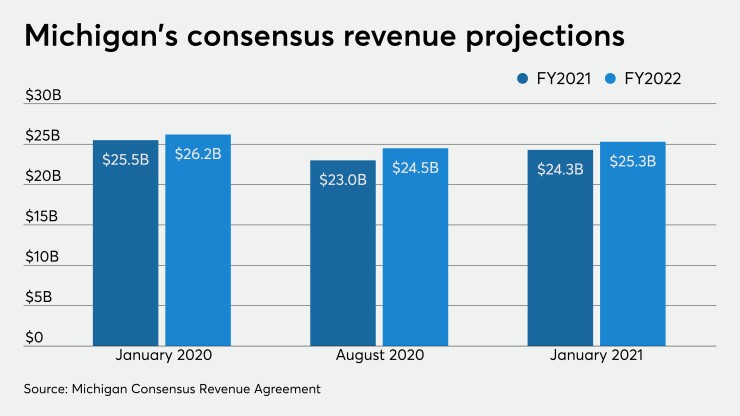

The state now expects to collect $24.27 billion of general and school fund revenues for the current fiscal year, which ends Sept. 30. That’s down $1.24 billion from the January 2020 pre-pandemic forecast of $25.51 billion but better than the $23.04 billion predicted at the last conference in August which was used to finalize the state's fiscal 2021 budget.

Top state and legislative officials at the state’s estimating conference Friday approved revised estimates for the current fiscal year and fiscal year 2022 and laid out its first guesses on fiscal 2023 on general fund revenues and school aid funds.

“While the pandemic has had a dramatic impact on our economy, the state of Michigan has outperformed national averages in a number of areas,” state Treasurer Rachael Eubanks said. “While still down more than $1 billion compared to before the pandemic, today the state’s revenues were raised upwards primarily due to direct and indirect impacts from the federal stimulus.”

The forecast factors in national forecasts and the latest state data on jobs and sector performance such as auto sales, but predictions remain difficult. New federal stimulus being promoted by the incoming Biden administration could help the economy and bolster tax collections while additional federal unemployment benefits would have a direct impact on income tax withholding.

“Our economic recovery this year will continue to depend on the course of the pandemic and the additional economic relief coming from Washington D.C.,” Eubanks said.

The conference group — made up of Eubanks, Budget Director Dave Massaron, Senate Fiscal Agency Director Christopher Harkins and House Fiscal Agency Director Mary Ann Cleary —reached the estimates based on projections from the House and Senate fiscal agencies and Gov. Gretchen Whitmer's administration and after hearing testimony from economic experts at the University of Michigan and IHS Markit.

“This provides one-time revenue to make necessary investments in the pandemic recovery and other one-time needs of the state,” said Massaron, Detroit’s former chief financial officer who recently stepped into the role of state budget director.

The conference also revised the fiscal 2022 prediction setting the total revenue figure at $25.32 billion, down $84 million from the January 2020 forecast of $26.16 billion but better than the $24.45 billion August revision.

The estimate for fiscal 2023 puts revenues at $25.9 billion, including $11.17 billion in general fund revenues and $14.73 billion of school aid revenues.

Officials from the Research Seminar in Quantitative Economics at the University of Michigan cautioned that estimates are especially tricky and noted that the depth of the 2008-2009 Great Recession took a year or two to fully understand.

“COVID remains in the driver seat of the economic recovery,” Gabriel Ehrlich, director at the RSQE, told the conference members.

The state’s seven-day average of new cases was tracking at about 1,000 heading into the holidays and then rose to 7,500. It’s come down and was at about 2,700 last week.

“The biggest reason for optimism these days is that vaccines” are being rolled out, Ehrlich said. The state had administered 233,000 administered doses through Jan. 10.

The state lost more than 1 million jobs from February to April and had recovered about 60% through October although it lost 11,000 in November, the most recent month that is available.

Consumer spending on services took a deep hit but spending on goods and income tax withholding has helped offset the hits.

The current estimates leave the state’s budget stabilization fund intact with no pay-ins or payouts anticipated through fiscal 2023.

“It should be noted that the deposits to or withdrawals from the BSF are not automatic, and that they require an appropriation. Pay-ins and pay-outs from the BSF are based on growth in real adjusted personal income,” according to the conference summary.

The latest figures will influence state pandemic spending, economic initiatives and planning for the next budget between Whitmer, a Democrat, and Republicans who hold a legislative majority.

The two sides have butted heads over Whitmer’s economic restrictions to combat spread of the coronavirus. GOP leaders attributed the improved picture to federal funding they called unsustainable and have threatened to withhold action on relief distribution without further easing of restrictions.

“After a year of unimaginable challenges, we must continue to be wise and guarded with state spending and ensure our fiscal plans are crafted with the future in mind,” Senate Appropriations Chair Jim Stamas, R-Midland, said in a statement. “Federal relief is not a sustainable revenue source and we still do not know what the future may bring for our state’s economy.”

“There won’t be a real economic recovery — and the state budget won’t be truly healthy — until our economy is reopened,” said Michigan House Appropriations Chair Thomas Albert, R-Lowell.

The picture looked grimmer earlier in the pandemic but by August coffers were doing better than predicted and that paved an easier road to balance the fiscal 2021 budget. The state is operating on budget bills that make up the nearly $63 billion all-fund budget package.

The budget was balanced after $250 million in spending cuts. It included $45 billion for general operations and $17.7 billion for education. The budget included small increases in kindergarten through 12th grade funding and allocated more for Medicaid while holding higher education and local government shared revenue mostly steady.

In an October report, Moody’s Investors Service called the budget agreement a positive for local governments and schools. “The spending plan is credit positive for Michigan local governments because it preserves their state funding amid coronavirus-induced revenue difficulties” as “preliminary state budget estimates had signaled local government funding cuts,” Moody’s said.

Moody’s rates Michigan Aa1 with a stable outlook.

The state’s May revenue estimating conference projected revenues would tumble by $3 billion in the current year and $5 billion more in the next two fiscal years as the pandemic socked the state’s economy.

The state tapped federal CARES Act funds to cover eligible expenses, moved to cut spending and used $350 million in reserves to restore balance in the current year, leaving about $850 million in the rainy day fund. The state’s CARES allocation totaled $3.9 billion including $3.1 billion for the state and $900 for eligible local governments.

The estimating conference met again in August and announced better

The ability to carry over the fiscal 2020 fund balances into the next fiscal year along with the lower projected gap and a drop in Medicaid caseloads provided the “crux of how we were able to piece 2021 together,” said Kurt Weiss, spokesman for Budget Director Chris Kolb.

S&P Global Ratings last year moved its outlook on Michigan’s AA rating to negative from stable. "Our negative outlook also reflects difficult fiscal decisions ahead for Michigan as it deliberates the fiscal 2021 budget and beyond," said S&P analyst Ladunni Okolo in the report.

Fitch Ratings rates the state AA with a stable outlook. Moody’s rates it Aa1 with a stable outlook.

On Tuesday, Whitmer rolled out $5.6 billion package dubbed the “Michigan COVID Economic Recovery Plan” that taps $575 million in state revenues available based on the Friday revisions.

The remainder of initiatives would be paid for from various federal program relief programs already in place. It would bolster efforts on vaccine distribution and testing, food and rental assistance programs, and small business aid. Schools would receive $1.7 billion in federal funds and $300 million in state funds. It makes permanent the extension of unemployment benefits to 36 weeks from 20 weeks.

The measures will be sent lawmakers Wednesday. Whitmer sought to raise pressure on lawmakers to put aside threats to hold off on authorizing new relief until pandemic restrictions end.

"I know that the Republican legislature would never want to stand in the way of making sure that these federal dollars get to our kids' schools or to our ability to build up our apparatus to get people vaccinated…or for aid for businesses that are struggling right now,” Whitmer said.