CHICAGO — The Michigan Strategic Fund will enter the market next week with $122 million of revenue bonds to refund debt issued seven years ago to acquire and renovate a downtown Detroit landmark.

The refunding will transfer ownership of the massive Cadillac Place office building to the Michigan Strategic Fund from the development group that took over the facility in 1999 from General Motors Corp. Cadillac Place was GM’s world headquarters from 1923 until 2000, before the company moved to the Renaissance Center, also in downtown Detroit.

In 2004, the state floated certificates of participation and used the proceeds to acquire the building and finance one of the nation’s largest historic renovation projects. The building now houses dozens of state agencies, including the Michigan Supreme Court and state appellate court, the state attorney general’s office, the Michigan State Police, and other agencies.

A total of 1,600 employees work there, and the state intends to bring more in. The building’s vacancy rate is now at 20%, according to Moody’s Investors Service.

The essential nature of the building’s role for the state significantly boosts bondholder security, Moody’s said.

Citi is the senior manager on the deal, with five additional firms rounding out the underwriting team. Miller, Canfield, Paddock and Stone PLC is bond counsel.

The bonds will be issued in two series, including $121 million of tax-exempt lease rental bonds and $755,000 of federally taxable lease-rental bonds. They will be payable solely from lease payments by the state, with annual payments equal to annual debt service payments.

The issue is a mix of serial and term bonds. The serials have a final maturity of 2026 and the terms feature a final maturity of 2031, according to bond documents.

There are some risks for bondholders due to the appropriation process and the possibility of lease termination, though Moody’s views the risks as remote. The state could terminate the lease, for example, if the Michigan Strategic Fund violates one of several laws, many of them tied to labor relations.

Based on the appropriation risk, the bonds are rated A1 by Moody’s, two notches below the state’s general obligation rating. Standard & Poor’s rates the debt A-plus.

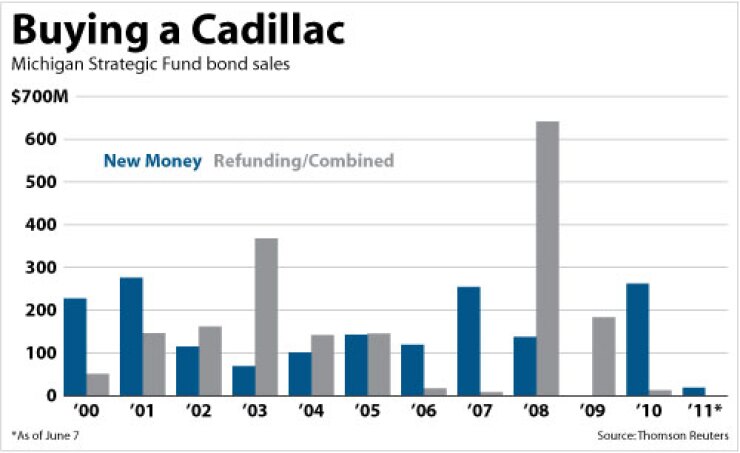

The Michigan Strategic Fund finances both private and public projects. Next week’s deal marks the fund’s second lease-backed debt sale, as it typically issues debt for nonprofit projects, pollution control, and wastewater projects.