BRADENTON, Fla. – Miami-Dade County is worried about its swaps going south if Congress tinkers with the tax exemption on municipal bonds.

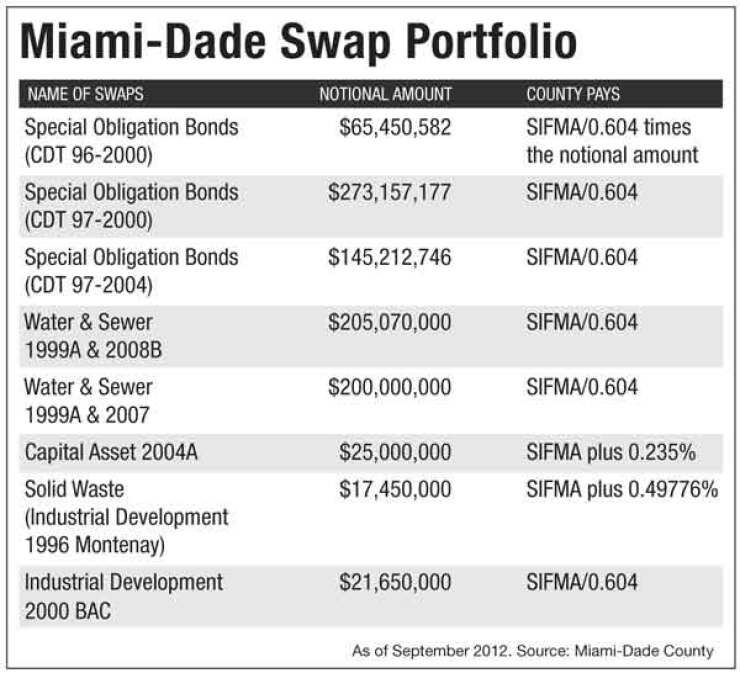

Florida’s most populous county, with 2.6 million residents, had swaps on a notional amount of $953 million in bonds as of September 2012.

The county’s payments to counterparties are based on a Securities Industry and Financial Markets Association index plus a spread. All of the swaps currently are “in-the-money” or in the county’s favor.

The payments from counterparties to the county are based on the Consumer Price Index or the London Interbank Offered Rate plus a spread.

Potential changes in the tax code eliminating or restricting the tax exemption on muni bond interest could be troublesome for issuers with SIFMA-based swaps, which could result in increased payments to counterparties and termination liability, market experts said. The SIFMA index is tied to tax-exempt rates that would presumably rise if the exemption is curtailed.

“This is definitely a problem,” a trader said.

The potential federal tax change is “one of the things keeping me up at night,” Deputy Mayor and Finance Director Ed Marquez said at a County Commission finance committee meeting Tuesday during a review of the county’s bond and swap portfolio.

“I’m fearful as finance director that as the federal government starts to figure out how to address the national deficit that Congress may compromise at some point, and one thing that is low-hanging fruit is limiting tax-exempt benefits that local governments get,” he said. “Should that occur, which is a higher possibility than ever before, that’s going to have an adverse effect on our swaps.”

Marquez said the derivatives have been good tools for the county in the past, but they may not be in future. If Congress changes the tax-exemption provisions “then that will have an adverse financial impact on a number of our swaps,” he said, adding that the situation could worsen if interest rates rise.

When Commissioner Dennis Moss asked what kind of swaps can be troublesome, Marquez said, “Any kind. It’s a tool that can do great things. It’s a tool that can cut off your leg.”

Marquez said he hopes to propose strategies in the next month to mitigate the county’s exposure, including extending the terms some of swaps, negotiating reverse swaps, and possibly termination. “If we do anything, it’s to lessen the risk,” he said.

Citi municipal strategist Mikhail Foux said it makes sense for issuers with floating-rate notes and SIFMA-based swaps to unwind the deals.

“If they are in-the-money, and things go the other way, that’s the simplest thing to do,” said Foux. “Realistically, the main concern would be that something happens to tax exemption, and that would actually push the SIFMA index higher.”

Swaps based on Libor and CPI will not be affected by changes to the tax-exemption, he said, adding that all those paying on floating issues will be affected by higher rates.

“I think, in general, who should be concerned in the current environment are mainly people who did swaps who are paying floating rates and who are paid fixed rates,” Foux said. “They might lose all of their gain.”

In his review of the bond portfolio, Marquez said Miami-Dade has $27.1 billion of principal and interest outstanding through 2049, which includes multiple credits.

Just over $1 billion in general obligation bonds are outstanding, or 8% of the total portfolio. The GOs are rated AA by Fitch Ratings, Aa2 by Moody’s Investors Service, and AA-minus by Standard & Poor’s.

The county has $5.82 billion of aviation revenue bonds outstanding, issued on behalf of Miami International Airport and its $6.5 billion ongoing capital improvement program. The bonds are rated A2 by Moody’s, and A by Fitch and S&P.

The Finance Committee Tuesday approved issuing $900 million of aviation bonds subject to the alternative minimum tax.

The aviation bonds are expected to price and close by September. Proceeds will be used to fund $58.5 million of CIP projects, and the remainder will refund debt issued in 2002 and 2003.

Miami-Dade has $1.8 billion of water and sewer revenue bonds outstanding, and rated Aa2 by Moody’s, and A-plus by Fitch and S&P.

The county is reviewing plans for a new $4 billion of bonds to support a major CIP.

The finance committee Tuesday withdrew three major items relating to the new multi-billion-dollar water and sewer program, and controversial rate increases to support the bonds.

The water and sewer items will now be heard by the full County Commission on May 16, which will include a public hearing.

County officials are being asked to approve a total bonding program of $4.245 billion to rehab and upgrade the aging water and sewer system.

Many of the improvements are related to a federal consent decree and requirements of the Florida Department of Environmental Regulation.

The county is also anticipating that a lawsuit will be filed.

In a separate measure, the commission will be asked to approve the issuance later this year of $350 million in new water and sewer revenue bonds and $170 million of refunding bonds.

The bonding program is tied to rate increases that some commissioners said were not fully vetted in public, though some board members recognized that Miami-Dade’s rates have been kept low over the years at the cost improving the system.

Under the proposal recommended by staff and the county’s engineer, rates would increase by 8% on Oct. 1.

In fiscal years 2014 and 2015, rates would increase another 6% each year, and in each of the following two years rates would rise an additional 5%.

In addition to the bond program, commissioners next week are expected to discuss whether there are additional sources of funding for water and sewer improvements besides rate increases.