The Massachusetts Bay Transportation Authority faces a $165 million deficit for fiscal 2010, which begins July 1, as debt service costs for the transit agency will increase by $77 million to $445 million.

Principal and interest payments tend to make up approximately 30% of the MBTA's operating budget as it has $5.2 billion of outstanding debt. However, next year, while debt service costs increase by $77 million, the authority will receive the same level of financial support from the state as in fiscal 2009 - $767 million of sales tax and general fund revenues, according to chief financial officer Jonathan Davis.

Since the state projects total sales tax collections to decrease in fiscal 2010 from the current year, the authority will receive the same allocation next year as it did in fiscal 2009.

"That's part of what's driving the deficit," Davis said. "There's no growth in the sales tax, and in fact year-over-year sales tax revenues have been in decline most recently, and anytime there's a decline year-over-year of sales tax, there's no increase to the guaranteed amount, and that's what we're faced with in 2010. So, that's approximately $23 million in revenue that we were expecting that we will not be getting in 2010."

The MBTA receives a dedicated portion of the state's 5% sales tax. To help augment sluggish sales-tax receipts, Massachusetts will take $86 million from the fiscal 2010 general fund to meet the $767 million allocation to the transit authority. In the past three years, the commonwealth has used general fund revenues to help support its annual payment to the MBTA.

In addition to the sales-tax revenues, the authority receives dedicated assessment revenues, which are fees that cities and towns pay to the state and then pass on to the MBTA. In fiscal 2009, the authority expects to receive $146 million of such revenue. The agency has the ability to cross collateralize between the two revenue streams so that the MBTA can use assessment revenue to meet debt service requirements on sales tax bonds and vice versa.

The authority closed a $75 million budget shortfall for fiscal 2009 through use of rainy-day funds and restructuring debt. This year, it may look towards a fare increase or additional revenue from the state in the form of a gas tax or some other revenue.

Gov. Deval Patrick this week is set to release his proposal to reform the way Massachusetts funds its transportation systems. That proposal could include an increase in the state's gas tax and/or toll hikes.

Without additional state support, the MBTA will need to evaluate a fare increase or other measures to bring revenues in line with expenditures. It last raised fares by 25% in January 2007.

"There are some discussions going on within the administration and at the legislature as it relates to funding transportation," Davis said. "Should there be no additional new revenues, I think, we would have to take a look at fare increases and service reductions."

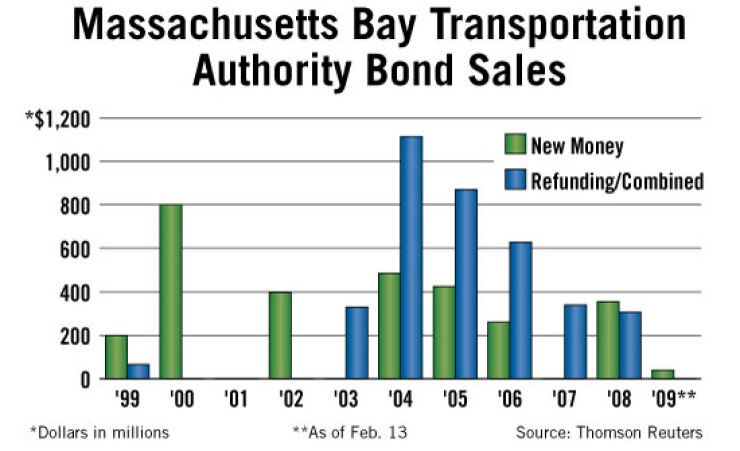

The MBTA is in the midst of issuing senior sales tax bonds, and today will sell $79.6 million of 20-year, variable-rate demand bonds. The bonds will help support capital projects and will also match a forward starting floating-to-fixed-rate swap with Bear Stearns Financial Products Inc. In that swap agreement, the authority pays a fixed rate of 5.61% and receives a floating rate based off of the SIFMA swap index.

On Feb. 12, the authority sold $39.3 million of fixed-rate refunding bonds, with two split maturities. Of the debt maturing in 2017, $3 million priced with 3% coupon to yield 2.58% while another $16.1 million priced with a 5% coupon to yield 2.58% yield. Of the debt maturing in 2018, $4 million priced with a 4% coupon to yield 2.82% while $16.1 million priced with a 5% coupon to yield 2.82%. All bonds carrying a 5% coupon priced 23 basis points above that day's Municipal Market Data triple-A yield curve. Citi and Ramirez & Co. are co-senior managers on the transactions. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo PC is bond counsel.

The MBTA is the oldest and fifth-largest transit system in the U.S. The authority oversees a system of buses, commuter lines, subways, and trolleys throughout eastern Massachusetts, providing an estimated 1.1 million passenger trips every business day.