LOS ANGELES — The Metropolitan Water District of Southern California has been restructuring its portfolio through refundings and other methods over the past two years to capture interest rate savings.

But the massive district that spans 5,200 square miles differs from others in that it carries such a strong rating -- triple-A across the board on its general obligation bonds -- that it also was able to refund one of its variable-rate demand obligations to a self-liquidity VRDO with no reserve fund required.

With $4.5 billion in outstanding revenue bond debt, MWD is “always paying attention to opportunities to decrease the cost of that,” said Gary Breaux, MWD’s chief financial officer.

The water district has been in the market regularly with refundings on Securities Industry and Financial Markets Association index mode bonds or revenue refunding bonds.

On July 3, it plans to price $104 million in special variable rate water revenue refunding bonds. Goldman, Sachs & Co. will be the underwriter.

MWD hopes to achieve $7 million annually in debt service costs across the portfolio through its efforts. Some of the savings will be achieved through reductions in letter of credit fees.

“Some of these refundings are to change mode from variable-rate demand obligations to a self-liquidity VRDO; and some are economic refundings where we save money,” said Breaux.

MWD, established in 1928 through a California statute, can levy property taxes within its service area, establish water rates, impose charges for water standby and service availability and incur general obligation bonded indebtedness and issue revenue bonds.

The primary purpose of the water district is to provide a supplemental supply of water at wholesale rates to its member public agencies. As a water wholesaler, Metropolitan serves 26 member agencies; it has no direct retail customers but provides water for almost 19 million people through its member agencies.

Its size and gilt-edged GO ratings from all three major rating agencies give MWD advantages that others might not have including the ability to issue self-liquidity bonds, which are quite uncommon. MWD also wasn’t required to establish a reserve for those bonds because of its high rating.

It holds AA-plus ratings from Standard & Poor’s and Fitch Ratings on its revenue bonds and Aa1 from Moody’s Investors Service

One VRDO it changed to self-liquidity was held by the Spanish Bank, BBVA, which wasn’t trading well due to problems with Spain’s economy, Breaux said.

With the VRDO due to expire, MWD’s financial team decided to make a change. Its credit rating enabled the issuer to refund to a self-liquidity VRDO without a reserve.

“We were finding that investors and rating agencies were saying a debt service reserve was unnecessary because of our rating,” Breaux said.

The water agency’s high rating is attributable to several factors, Breaux said.

Among those are the nature of the organization and its size. It provides 40% to 60% of the water for a 5,200-square-mile region that includes portions of the counties of Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura.

According to a Moody’s Investors Service report June 19 that rated the water district’s expected refunding Aa1/VMIG 1, the district “has soundly managed its self-liquidity and market access bond program.”

Since selling its first long-mode put bond, a SIFMA index mode bond, the district has successfully remarked various series on average three months in advance of the scheduled mandatory tender date, Moody’s analysts said.

“Given the district’s still very large variable rate exposure and swap portfolio, however, above average coverage ratios would be expected to maintain a VMIG 1 short-term rating, and we expect the district to continue to manage its self-liquidity debt program so that its 12-month put exposure remains manageable,” Moody’s analysts said in the report.

The current sale of flexible index mode bonds will be used to refund the district’s 2009 Series A-1 SIFMA index mode bonds, which will leave the district with approximately $432 million in SIFMA index mode obligations. MWD will also have $187 million in self-liquidity VRDOs and $104 million in flexible index mode bonds.

Of these obligations, $337 million are subject to scheduled mandatory tender in the next 12 months, according to Moody’s report. This is well below the district’s amount of available liquidity which was sufficient to provide nearly three times coverage of the obligations due within one year, the report states.

Since very few issuers carry such high ratings, and not many would qualify to issue a self-liquidity VRDO, it’s unusual for an issuer to be able to structure debt this way, according to Matt Fabian, managing director with Westport, Conn.-based Municipal Market Advisors.

“There’s still plenty of demand for floating rate products, in particular for a high grade issuer with a bit more yield like this,” Fabian said. “It is hard to see it having a problem.”

MWD also has an active SIFMA program; and some of those come up every quarter to be remarketed and the rate is reset, Breaux said.

“That has been a very successful program for us,” he added.

Using this structure, issuers sell long-term bonds whose rates are reset periodically, daily, weekly, or monthly. The rates are usually based on some formula, such as percentage of a SIFMA index or a London Interbank Offered Rate.

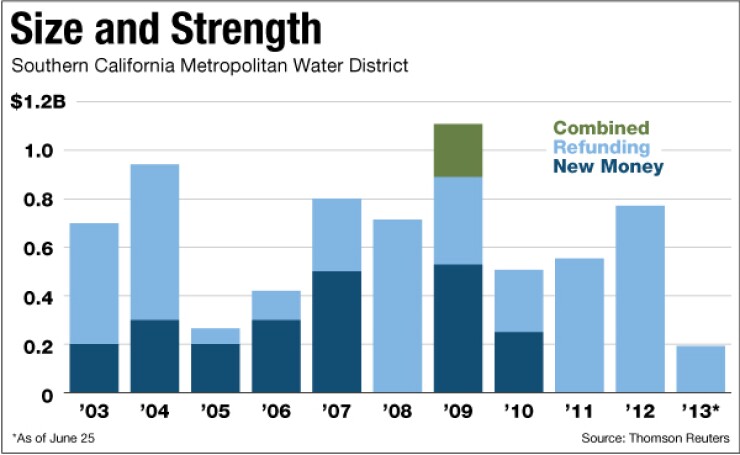

MWD refunded $771.3 million in 2012, some of that through its quarterly SIFMA program, Breaux said. So far this year, through June 25, MWD has refunded $192.3 million.

VRDO issuance fell from $128 billion in 2008 to $30 billion in 2010, according to a March 2011 report from Moody’s Investors Service.

According to that Moody’s report, before the crisis liquidity support was available for 10-25 basis points, but that grew to 50 to 150 basis points by early 2011.

The outstanding balance of VRDBs declined for the third consecutive year in 2012, according to a March 2012 report from Moody’s, to $264 billion, down 12% from $301 billion as of year-end 2011.

Approximately 12.5% by face amount of Moody’s rated portfolio of variable rated debt is currently supported by and rated based on the underlying obligor’s own liquidity, rather than third party support, the rating agency said. Most self-liquidity obligors are in the higher education and health care sectors and have large liquid investment portfolios.

MWD has a variable rate portfolio with close to $1 billion.

“These are variable rates that float with the market,” Breaux said. “So we are earning more interest on one side, while we are paying more on the other side. It evens out.”

Breaux doesn’t anticipate needing to issue new money bonds until 2014, but after that he expects the water district will be issuing $100 million a year for several years to maintain its facilities.

“We have extremely high demand for our bonds and receive one of the lowest interest rates as a result,” Breaux said. “Especially since we have the ability to issue under own name and through self-liquidity. Investors don’t want exposure to any one bank, so we are finding those provide the lowest cost of funds.”

Given MWD’s status as California’s biggest wholesaler of water it is on solid financial ground, said Craig Brothers, a portfolio manager with Los Angeles-based Bel Air Investment Advisors.

“We view these as very high quality credits,” said Brothers, whose company holds both MWD GO and revenue debt. “Our only area of concern would be a severe reduction in MWD’s access to water.”